SunTrust 2015 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

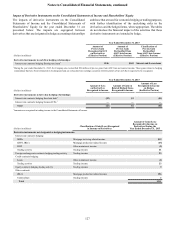

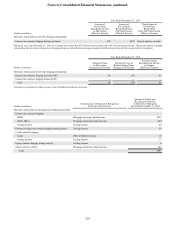

Notes to Consolidated Financial Statements, continued

134

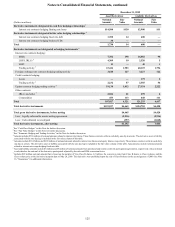

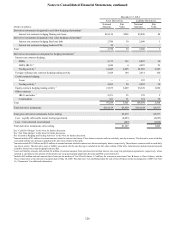

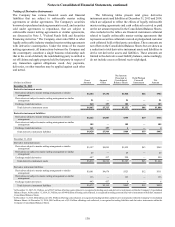

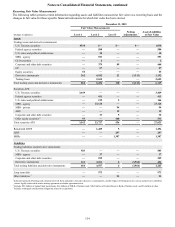

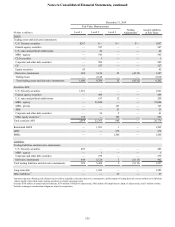

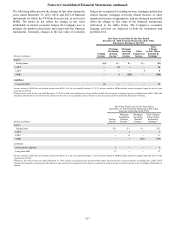

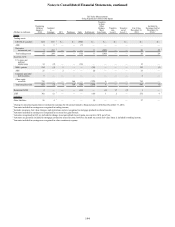

Recurring Fair Value Measurements

The following tables present certain information regarding assets and liabilities measured at fair value on a recurring basis and the

changes in fair value for those specific financial instruments for which fair value has been elected.

December 31, 2015

Fair Value Measurements

(Dollars in millions) Level 1 Level 2 Level 3

Netting

Adjustments 1Assets/Liabilities

at Fair Value

Assets

Trading assets and derivative instruments:

U.S. Treasury securities $538 $— $— $— $538

Federal agency securities — 588 — — 588

U.S. states and political subdivisions — 30 — — 30

MBS - agency — 553 — — 553

CLO securities — 2 — — 2

Corporate and other debt securities — 379 89 — 468

CP — 67 — — 67

Equity securities 66 — — — 66

Derivative instruments 262 4,182 21 (3,313) 1,152

Trading loans — 2,655 — — 2,655

Total trading assets and derivative instruments 866 8,456 110 (3,313) 6,119

Securities AFS:

U.S. Treasury securities 3,449 — — — 3,449

Federal agency securities — 411 — — 411

U.S. states and political subdivisions — 159 5 — 164

MBS - agency — 23,124 — — 23,124

MBS - private — — 94 — 94

ABS — — 12 — 12

Corporate and other debt securities — 33 5 — 38

Other equity securities 293 — 440 — 533

Total securities AFS 3,542 23,727 556 — 27,825

Residential LHFS — 1,489 5 — 1,494

LHFI — — 257 — 257

MSRs — — 1,307 — 1,307

Liabilities

Trading liabilities and derivative instruments:

U.S. Treasury securities 503 — — — 503

MBS - agency — 37 — — 37

Corporate and other debt securities — 259 — — 259

Derivative instruments 161 4,261 6 (3,964) 464

Total trading liabilities and derivative instruments 664 4,557 6 (3,964) 1,263

Long-term debt — 973 — — 973

Other liabilities 3— — 23 — 23

1 Amounts represent offsetting cash collateral received from, and paid to, the same derivative counterparties, and the impact of netting derivative assets and derivative liabilities

when a legally enforceable master netting agreement or similar agreement exists.

2 Includes $93 million of mutual fund investments, $32 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank of Atlanta stock, and $6 million of other.

3 Includes contingent consideration obligations related to acquisitions.