SunTrust 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

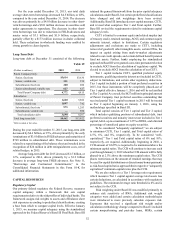

recognized $140 million in net gains through earnings related to

trading and derivative assets and liabilities classified as level 3,

primarily due to $153 million in IRLC related gains offset by

$13 million in net losses from trading securities. See Note 18,

“Fair Value Election and Measurement,” to the Consolidated

Financial Statements in this Form 10-K for a detailed discussion

regarding level 2 and 3 securities and valuation methodologies

for each class of securities.

Goodwill

At December 31, 2015, our reporting units with goodwill

balances were Consumer Banking/ Private Wealth Management

and Wholesale Banking. See Note 20, "Business Segment

Reporting," to the Consolidated Financial Statements in this

Form 10-K for further discussion of our reportable segments. We

conduct a goodwill impairment test at the reporting unit level at

least annually or more frequently as events occur or

circumstances change that would more-likely-than-not reduce

the fair value of a reporting unit below its carrying amount. In

the third quarter of 2015, we elected to prospectively change the

date of our annual goodwill impairment test from September 30

to October 1 to better align the timing of the assessment with the

availability of key inputs. We performed an impairment analysis

as of September 30, 2015, noting that the inputs utilized in the

September 30 analysis were the same inputs that were utilized

in the analysis as of October 1. Based on our annual goodwill

impairment test at October 1, 2015, September 30, 2014, and

September 30, 2013, we determined that each of our reporting

units' fair values were in excess of their respective carrying

values; therefore, no goodwill impairment was recognized. We

also performed an interim goodwill analysis for the Wholesale

reporting unit as of December 31, 2014, noting no goodwill

impairment. Our analysis as of October 1, 2015 indicates that

Wholesale Banking’s fair value in excess of its carrying value

increased modestly relative to December 31, 2014.

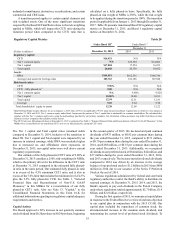

In the analysis as of October 1, 2015, the carrying value of

equity of the reporting units, as well as Corporate Other, was

determined by allocating our total equity to each reporting unit

based on RWA using our actual Tier 1 capital ratio as of the

measurement date. Tier 1 capital was utilized as it most closely

aligns with equity as reported under U.S. GAAP. Appropriate

adjustments were made to each reporting unit’s allocation using

Tier 1 capital to conform with U.S. GAAP equity, namely for

equity tied to goodwill and other intangible assets. Prior to 2015,

the reporting units’ carrying values were based on an equal

weighting of regulatory capital and tangible equity relative to

tangible assets. We moved to an approach based solely on

regulatory capital as we view that approach to be a more objective

measurement of the equity that a market participant would

require to operate the reporting units.

The goodwill impairment analysis estimates the fair value

of equity using discounted cash flow analyses. The inputs and

assumptions specific to each reporting unit are incorporated in

the valuations, including projections of future cash flows,

discount rates, and an estimated long-term growth rate. We assess

the reasonableness of the estimated fair value of the reporting

units by comparing implied valuation multiples with valuation

multiples from guideline companies and by comparing the

aggregate estimated fair value of the reporting units to our market

capitalization over a reasonable period of time. Significant and

sustained declines in our market capitalization could be an

indication of potential goodwill impairment.

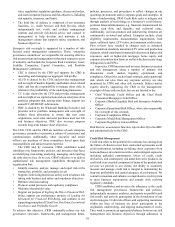

Multi-year financial forecasts are developed for each

reporting unit by considering several key business drivers such

as new business initiatives, client service and retention standards,

market share changes, anticipated loan and deposit growth,

forward interest rates, historical performance, and industry and

economic trends, among other considerations that a market

participant would consider in valuing the reporting units.

Discount rates are estimated based on the Capital Asset Pricing

Model, which considers the risk-free interest rate, market risk

premium, beta, size premiums, and idiosyncratic risk

adjustments specific to a particular reporting unit. The discount

rates are also calibrated based on risks related to the projected

cash flows of each reporting unit.

The estimated fair values of the reporting units are highly

sensitive to changes in these estimates and assumptions;

therefore, in some instances, changes in these assumptions could

impact whether the fair value of a reporting unit is greater than

its carrying value. We perform sensitivity analyses around these

assumptions in order to assess the reasonableness of the

assumptions, and the resulting estimated fair values. Ultimately,

future potential changes in these assumptions may impact the

estimated fair value of a reporting unit and cause the fair value

of the reporting unit to be below its carrying value. Additionally,

the carrying value of a reporting unit's equity could change based

on market conditions, asset growth, preferred stock issuances,

or the risk profile of those reporting units, which could impact

whether or not the fair value of a reporting unit is less than

carrying value.

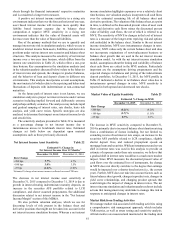

Income Taxes

We are subject to the income tax laws of the U.S., its states and

municipalities where we conduct business. We estimate income

tax expense based on amounts expected to be owed to these

various tax jurisdictions. The estimated income tax expense or

benefit is reported in the Consolidated Statements of Income.

Accrued taxes represent the net estimated amount due to or

to be received from tax jurisdictions either currently or in the

future and are reported in other liabilities on the Consolidated

Balance Sheets. In estimating accrued taxes, we assess the

appropriate tax treatment of transactions and filing positions

after considering statutes, regulations, judicial precedent, and

other pertinent information. The income tax laws are complex

and subject to different interpretations by the taxpayer and the

relevant government taxing authorities. Significant judgment is

required in determining the tax accruals and in evaluating our

tax positions, including evaluating uncertain tax positions.

Changes in the estimate of accrued taxes occur periodically due

to changes in tax rates, interpretations of tax laws, the status of

examinations by the tax authorities, and newly enacted statutory,

judicial, and regulatory guidance that could impact the relative

merits and risks of tax positions. These changes, when they occur,

impact tax expense and can materially affect our operating

results. We review our tax positions quarterly and make

adjustments to accrued taxes as new information becomes

available.

Deferred income tax assets represent amounts available to

reduce income taxes payable in future years. Such assets arise

due to temporary differences between the financial reporting and