SunTrust 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

Other Market Risk

Other sources of market risk include the risk associated with

holding residential and commercial loans, other loans and

securities designated for sale into the secondary market,

mortgage loan commitments that will be sold into the secondary

market, and our investment in MSRs. We manage the risks

associated with the residential mortgage LHFS (i.e., the

warehouse) and our IRLCs on residential loans intended for sale.

The warehouses and IRLCs consist primarily of fixed and

adjustable rate single family residential loans. The risk

associated with the warehouses and IRLCs is the potential

change in interest rates between the time the customer locks the

rate on the anticipated loan and the time the loan is sold on the

secondary market, which is typically 60-150 days.

We manage interest rate risk predominantly with interest

rate swaps, futures, and forward sale agreements, where the

changes in value of the instruments substantially offset the

changes in value of the warehouse and the IRLCs. The IRLCs

on residential mortgage loans intended for sale are classified as

derivative instruments and are not designated for hedge

accounting purposes.

MSRs are measured at the present value of future net cash

flows that are expected to be received from the mortgage

servicing portfolio. The value of MSRs is highly dependent upon

the assumed prepayment speed of the mortgage servicing

portfolio, which is driven by the level of certain key interest rates,

primarily the current 30-year mortgage rate. Future expected net

cash flows from servicing a loan in the mortgage servicing

portfolio would not be realized if the loan pays off earlier than

anticipated.

MSRs are measured at fair value with a balance of $1.3

billion and $1.2 billion at December 31, 2015 and 2014,

respectively, and are managed within established risk limits and

monitored as part of an established governance process.

We originated MSRs with fair values at the time of

origination of $238 million and $178 million during 2015 and

2014, respectively. Additionally, we purchased MSRs with fair

values of approximately $109 million and $130 million during

2015 and 2014, respectively.

We recognized mark-to-market decreases in the fair value

of the MSR portfolio of $242 million and $401 million during

2015 and 2014, respectively. Changes in fair value include the

decay resulting from the realization of expected monthly net

servicing cash flows. We recognized net losses related to MSRs,

inclusive of decay and related hedges, of $172 million and $134

million during 2015 and 2014, respectively. Compared to the

prior year, the increase in net losses related to MSRs was driven

by higher decay in the current periods, resulting from increased

prepayments due to higher refinance activity given the low

interest rate environment.

We held a total net book value of approximately $30 million

and $9 million of non-public equity exposures (direct

investments) and other equity-related investments at

December 31, 2015 and 2014, respectively. We generally hold

these investments as long-term investments. If conditions in the

market deteriorate, these long-term investments and other assets

could incur impairment charges, including, but not limited to,

goodwill and other intangible assets.

OFF-BALANCE SHEET ARRANGEMENTS

In the ordinary course of business we engage in certain activities

that are not reflected in our Consolidated Balance Sheets,

generally referred to as "off-balance sheet arrangements." These

activities involve transactions with unconsolidated VIEs as well

as other arrangements, such as commitments and guarantees, to

meet the financing needs of our customers and to support ongoing

operations. Additional information regarding these types of

activities is included in the “Liquidity Risk Management”

section of this MD&A, as well as Note 10, “Certain Transfers of

Financial Assets and Variable Interest Entities,” Note 11,

“Borrowings and Contractual Commitments,” and Note 16,

“Guarantees,” to the Consolidated Financial Statements in this

Form 10-K.

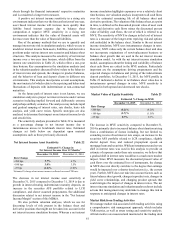

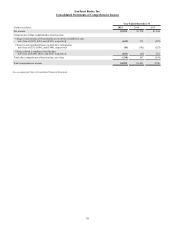

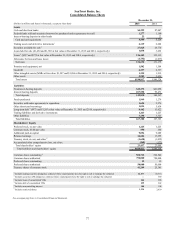

Contractual Obligations

In the normal course of business, we enter into certain contractual

obligations, including obligations to make future payments on

debt and lease arrangements, contractual commitments for

capital expenditures, and service contracts. Table 28 presents our

significant contractual obligations at December 31, 2015, except

for UTBs (discussed below), unfunded lending commitments

(presented in Table 27 within the "Liquidity Risk Management"

section of this MD&A), short-term borrowings (presented in the

"Borrowings" section of this MD&A), and pension and other

postretirement benefit plans, disclosed in Note 15, "Employee

Benefit Plans," to the Consolidated Financial Statements in this

Form 10-K. Capital lease obligations and foreign time deposits

were immaterial at December 31, 2015 and are not reflected in

the table below. For additional information regarding our time

deposits, operating leases, and long-term debt, refer to the

"Deposits" section of this MD&A, as well as Note 8, "Premises

and Equipment," and Note 11, "Borrowings and Contractual

Commitments," to the Consolidated Financial Statements in this

Form 10-K.

At December 31, 2015, we had UTBs of $100 million, which

represent a reserve for tax positions that we have taken or expect

to be taken in our tax returns, and which ultimately may not be

sustained upon examination by taxing authorities. Since the

ultimate amount and timing of any future tax settlements are

uncertain, UTBs have been excluded from Table 28. See

additional discussion in Note 14, "Income Taxes," to the

Consolidated Financial Statements in this Form 10-K.