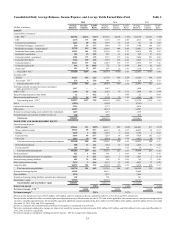

SunTrust 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

policies and processes are critical to how we report our financial

condition and results of operation, and they require management

to make estimates about matters that are uncertain; depressed

market values for our stock and adverse economic conditions

sustained over a period of time may require us to write down

some portion of our goodwill; our financial instruments

measured at fair value expose us to certain market risks; our stock

price can be volatile; we might not pay dividends on our stock;

and certain banking laws and certain provisions of our articles

of incorporation may have an anti-takeover effect.

INTRODUCTION

We are a leading provider of financial services with our

headquarters located in Atlanta, Georgia. Our principal banking

subsidiary, SunTrust Bank, offers a full line of financial services

for consumers, businesses, corporations, and institutions, both

through its branches (located primarily in Florida, Georgia,

Maryland, North Carolina, South Carolina, Tennessee, Virginia,

and the District of Columbia) and through other national delivery

channels. We operate three business segments: Consumer

Banking and Private Wealth Management, Wholesale Banking,

and Mortgage Banking, with our functional activities included

in Corporate Other. See Note 20, "Business Segment Reporting,"

to the Consolidated Financial Statements in this Form 10-K for

a description of our business segments. In addition to deposit,

credit, mortgage banking, and trust and investment services

offered by the Bank, our other subsidiaries provide asset and

wealth management, securities brokerage, and capital markets

services.

This MD&A is intended to assist readers in their analysis of

the accompanying Consolidated Financial Statements and

supplemental financial information. It should be read in

conjunction with the Consolidated Financial Statements and

Notes to the Consolidated Financial Statements in Item 8 of this

Form 10-K, as well as other information contained in this

document. When we refer to “SunTrust,” “the Company,” “we,”

“our,” and “us” in this narrative, we mean SunTrust Banks, Inc.

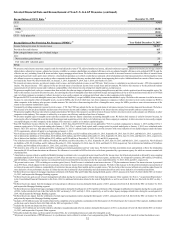

and subsidiaries (consolidated). In the MD&A, net interest

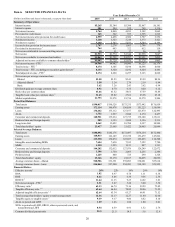

income, net interest margin, total revenue, and efficiency ratios

are presented on an FTE basis. The FTE basis adjusts for the tax-

favored status of net interest income from certain loans and

investments. We believe this measure to be the preferred industry

measurement of net interest income and it enhances

comparability of net interest income arising from taxable and

tax-exempt sources. Additionally, we present other non-U.S.

GAAP metrics to assist investors in understanding

management’s view of particular financial measures, as well as

to align presentation of these financial measures with peers in

the industry who may also provide a similar presentation.

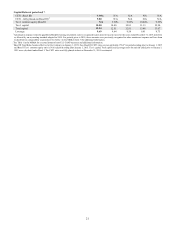

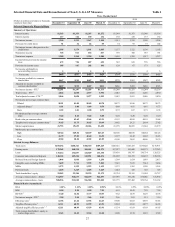

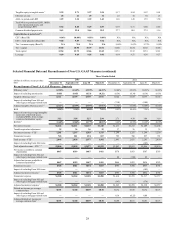

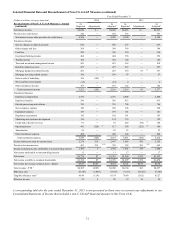

Reconcilements for all non-U.S. GAAP measures are provided

in Table 1.