SunTrust 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

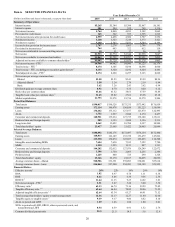

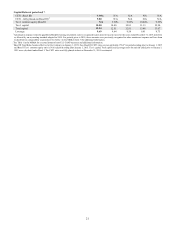

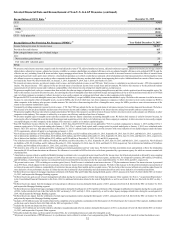

Business Segments Highlights

Consumer Banking and Private Wealth Management

Consumer Banking and Private Wealth Management net income

increased 8% compared to 2014, due to strong deposit growth,

our balance sheet optimization efforts, and further improvements

in credit quality. Loan balances declined 3% in 2015, due to loan

sales and securitizations, partially offset by a 5% increase in

consumer loan production. Noninterest income declined 1%

compared to 2014, largely due to declines in wealth

management-related revenue during 2015, as well as continued

declines in service charges. While current market conditions

have made growing wealth management revenue more

challenging, meeting more of our clients’ wealth and investment

needs continues to be a strategic priority. Expenses have been

well-controlled, as we have been using efficiency gains to invest

in client-facing talent and technology. We continue to generate

solid returns from our digital investments and expect this to

increase as mobile adoption rates and digital sales trend upwards.

Looking forward, we remain optimistic about the long-term

trajectory of this business as we execute against our strategic

priorities, and as the value of our strong deposit growth is more

fully realized in a normal interest rate environment.

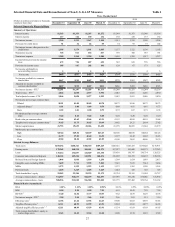

Wholesale Banking

Wholesale Banking net income increased 9%, driven by broad-

based revenue growth, partially offset by energy-related reserve

increases in 2015. Net interest income was up 6%, driven by 8%

loan growth and 16% growth in deposits. The loan growth was

broad-based across each line of business and most industry

verticals, partially offset by intentional reductions in lower-

return areas. The strong deposit momentum within this business

also continued, evidence of the success our liquidity specialists

have had and the enhancements we have made to our treasury

and payment product offerings. Noninterest income increased

10% compared to 2014, primarily as a result of the 14% growth

in investment banking income where we had record years in

equity originations, mergers and acquisitions, syndicated and

leveraged finance, and investment grade bond originations. This

breadth of growth in investment banking income reflects the

investments we have made to expand our capabilities and

become more of a strategic advisor to our clients. Our efficiency

also improved as we drove further operating leverage, while also

investing in revenue generating initiatives. While market

conditions can be inconsistent from quarter to quarter, we are

encouraged by our differentiated business model and remain

focused on expanding our client base, meeting more of their

complex corporate finance and advisory needs, and continuing

to grow this business.

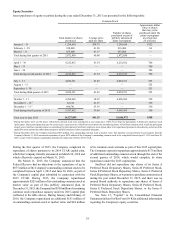

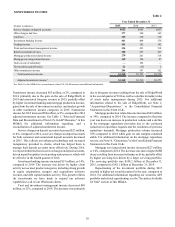

Mortgage Banking

Mortgage Banking net income increased considerably compared

to the prior year, primarily due to the improved credit quality of

the loan portfolio, both as a result of the improving housing

market and our proactive actions to reduce risk. This

improvement was partially offset by a decline in net interest

income resulting from loan sales in 2014 and lower loan spreads

in 2015. Production volume increased by 38% in 2015, due

primarily to higher refinancing activity. New purchase volume

also improved in 2015, a sign of the continued improvement of

the economies in our markets. We also grew our servicing

portfolio by approximately 5%, as a result of portfolio

acquisitions. In both production and servicing, we achieved our

objectives of targeted market share growth. Overall, we benefited

from improving asset quality and good expense discipline, which

have allowed this business to become a more consistent

contributor to the bottom line performance of the overall

Company.

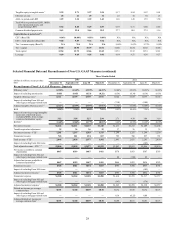

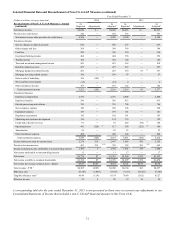

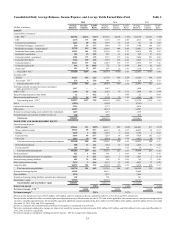

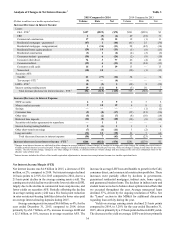

Additional information related to our business segments can be

found in Note 20, "Business Segment Reporting," to the

Consolidated Financial Statements in this Form 10-K, and

further discussion of our business segment results for 2015 and

2014 can be found in the "Business Segment Results" section of

this MD&A.