SunTrust 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

103

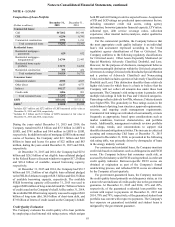

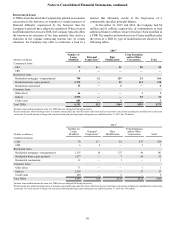

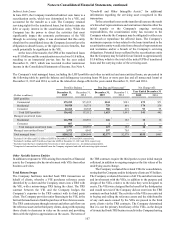

December 31, 2014

Commercial Residential Consumer Total

(Dollars in millions)

Carrying

Value ALLL

Carrying

Value ALLL

Carrying

Value ALLL

Carrying

Value ALLL

Individually evaluated $92 $11 $2,563 $300 $126 $8 $2,781 $319

Collectively evaluated 73,300 975 35,940 477 20,819 166 130,059 1,618

Total evaluated 73,392 986 38,503 777 20,945 174 132,840 1,937

LHFI at fair value — — 272 — — — 272 —

Total LHFI $73,392 $986 $38,775 $777 $20,945 $174 $133,112 $1,937

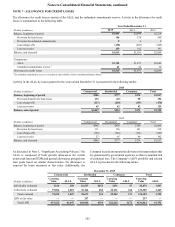

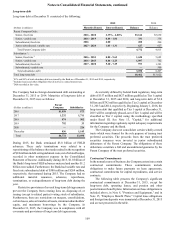

NOTE 8 - PREMISES AND EQUIPMENT

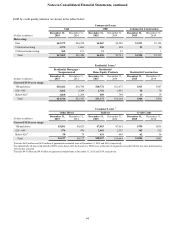

Premises and equipment at December 31 consisted of the

following:

(Dollars in millions)

Useful Life

(in years) 2015 2014

Land Indefinite $330 $334

Buildings and improvements 1 - 40 1,073 1,051

Leasehold improvements 1 - 30 636 628

Furniture and equipment 1 - 20 1,463 1,426

Construction in progress 249 201

Total premises and equipment 3,751 3,640

Less: Accumulated depreciation and amortization 2,249 2,132

Premises and equipment, net $1,502 $1,508

None of the Company's premises and equipment was subject to

mortgage indebtedness (included in long-term debt) at

December 31, 2015. At December 31, 2014, premises and

equipment subject to mortgage indebtedness was immaterial.

Net premises and equipment included $3 million and $4 million

related to net capital leases at December 31, 2015 and 2014,

respectively. Aggregate rent expense (principally for offices),

including contingent rent expense and sublease income, totaled

$200 million, $206 million, and $220 million for the years ended

December 31, 2015, 2014, and 2013, respectively. Depreciation

and amortization expense for the years ended December 31,

2015, 2014, and 2013 totaled $175 million, $176 million, and

$185 million, respectively.

The Company previously completed sale leaseback

transactions consisting of branch properties and various

individual office buildings. Upon completion of these

transactions, the Company recognized a portion of the resulting

gains and deferred the remainder to be recognized ratably over

the expected term of the lease, predominantly 10 years, as an

offset to net occupancy expense. To the extent that terms on these

leases are extended, the remaining deferred gain would be

amortized over the new lease term. Amortization of deferred

gains on sale leaseback transactions was $54 million, $53

million, and $58 million for the years ended December 31, 2015,

2014, and 2013, respectively. At December 31, 2015 and 2014,

the remaining deferred gain associated with sale leaseback

transactions was $108 million and $162 million, respectively.

The Company has various obligations under capital leases

and noncancelable operating leases for premises and equipment.

The leases predominantly expire over the next 10 years, with the

longest expiring in 2081. Many of these leases provide for

periodic adjustment of rentals based on changes in various

economic indicators, while others also include a renewal option.

The following table presents future minimum payments

under noncancelable operating leases, net of sublease rentals,

with initial terms in excess of one year at December 31, 2015.

Capital leases were immaterial at December 31, 2015.

(Dollars in millions) Operating Leases

2016 $207

2017 192

2018 122

2019 103

2020 81

Thereafter 307

Total minimum lease payments $1,012

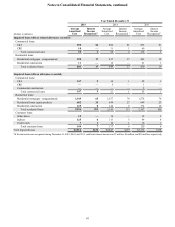

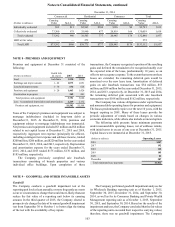

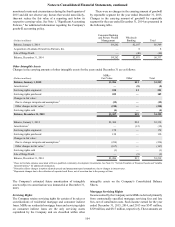

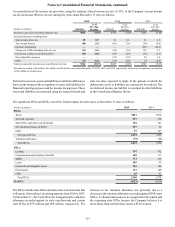

NOTE 9 – GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

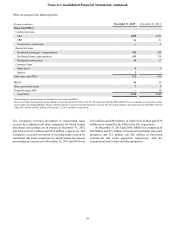

The Company conducts a goodwill impairment test at the

reporting unit level at least annually, or more frequently as events

occur or circumstances change that would more-likely-than-not

reduce the fair value of a reporting unit below its carrying

amount. In the third quarter of 2015, the Company elected to

prospectively change the date of its annual goodwill impairment

test from September 30 to October 1 to better align the timing

of the test with the availability of key inputs.

The Company performed goodwill impairment analyses for

its Wholesale Banking reporting unit as of October 1, 2015,

September 30, 2015, December 31, 2014, and September 30,

2014, as well as for its Consumer Banking and Private Wealth

Management reporting unit as of October 1, 2015, September

30, 2015, and September 30, 2014. Based on the results of the

impairment analyses, the Company concluded that the fair values

of the reporting units exceeded their respective carrying values;

therefore, there was no goodwill impairment. The Company