SunTrust 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

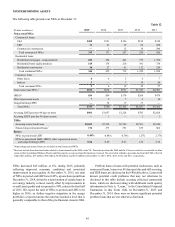

The securities AFS portfolio had an effective duration of

4.5 years at December 31, 2015 compared to 3.6 years at

December 31, 2014. Effective duration is a measure of price

sensitivity of a bond portfolio to an immediate change in market

interest rates, taking into consideration embedded options. An

effective duration of 4.5 years suggests an expected price change

of approximately 4.5% for a 100 basis point instantaneous and

parallel change in market interest rates.

The credit quality and liquidity profile of the securities AFS

portfolio remained strong at December 31, 2015 and

consequently, we believe that we have the flexibility to respond

to changes in the economic environment and take actions as

opportunities arise to manage our interest rate risk profile and

balance liquidity risk against investment returns. Over the longer

term, the size and composition of the securities AFS portfolio

will reflect balance sheet trends, our overall liquidity position,

and interest rate risk management objectives. Accordingly, the

size and composition of the securities AFS portfolio could

change over time.

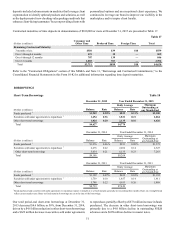

Federal Home Loan Bank and Federal Reserve Bank Stock

We previously acquired capital stock in the FHLB of Atlanta as

a precondition for becoming a member of that institution. As a

member, we are able to take advantage of competitively priced

advances as a wholesale funding source and to access grants and

low-cost loans for affordable housing and community

development projects, among other benefits. At December 31,

2015, we held a total of $32 million of capital stock in the FHLB,

a decrease of $344 million compared to December 31, 2014. This

decrease in our holdings of FHLB capital stock was due to our

redemption of stock related to a decline in FHLB borrowings

over the same period. For the years ended December 31, 2015,

2014, and 2013, we recognized dividends related to FHLB

capital stock of $11 million, $13 million, and $8 million,

respectively.

Similarly, to remain a member of the Federal Reserve

System, we are required to hold a certain amount of capital stock,

determined as either a percentage of the Bank’s capital or as a

percentage of total deposit liabilities. At December 31, 2015, we

held $402 million of Federal Reserve Bank of Atlanta stock,

unchanged from December 31, 2014. For each of the years ended

December 31, 2015, 2014, and 2013, we recognized dividends

related to Federal Reserve Bank of Atlanta stock of $24 million.

In December 2015, the U.S. Congress passed legislation that

changes the dividend rate on our statutory investment in Federal

Reserve Bank of Atlanta stock from 6% to the lower of 6% or

the 10-year Treasury note rate, beginning in 2016.

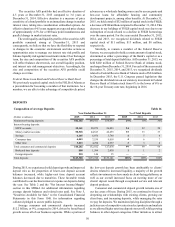

DEPOSITS

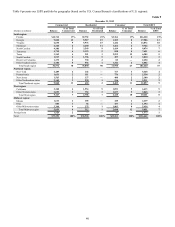

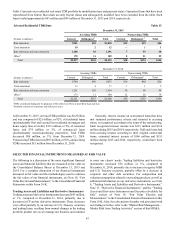

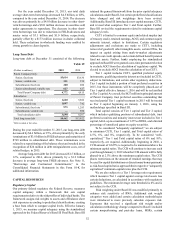

Composition of Average Deposits Table 16

Year Ended December 31 % of Total Deposits

(Dollars in millions) 2015 2014 2013 2015 2014 2013

Noninterest-bearing deposits $42,102 $40,411 $38,643 29% 30% 30%

Interest-bearing deposits:

NOW accounts 35,161 28,879 26,083 24 22 20

Money market accounts 50,518 44,813 42,655 35 33 33

Savings 6,165 6,076 5,740 45 4

Consumer time 6,443 7,539 9,018 46 7

Other time 3,813 4,294 4,937 33 4

Total consumer and commercial deposits 144,202 132,012 127,076 99 99 98

Brokered time deposits 888 1,584 2,030 11 2

Foreign deposits 218 146 35 —— —

Total deposits $145,308 $133,742 $129,141 100% 100% 100%

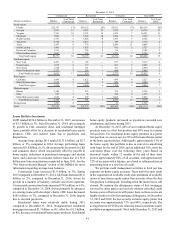

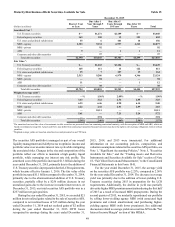

During 2015, we experienced solid deposit growth and improved

deposit mix as the proportion of lower-cost deposit account

balances increased, while higher-cost time deposit account

balances decreased due to maturities. These favorable trends

contributed to our decline in interest expense on deposits during

the year. See Table 2 and the "Net Interest Income/Margin"

section in this MD&A for additional information regarding

average deposit balances and related rates paid. See Note 5,

"Securities Available for Sale," to the Consolidated Financial

Statements in this Form 10-K for information regarding

collateral pledged to secure public deposits.

Average consumer and commercial deposits increased

$12.2 billion, or 9%, compared to 2014, driven by broad-based

growth across all of our business segments. While a portion of

the low-cost deposit growth has been attributable to clients’

desires related to increased liquidity, a majority of the growth

reflects investments we have made in client-facing platforms, as

well as our overall increased focus on meeting more of our

clients' deposit needs through exceptional service and relevant

deposit products.

Consumer and commercial deposit growth remains one of

our key areas of focus. During 2015, we continued to focus on

deepening our relationships with existing clients, growing our

client base, and increasing deposits, while managing the rates

we pay for deposits. We maintained pricing discipline through a

judicious use of competitive rates in select products and markets

as we allowed higher rate time deposits to run-off, while growing

balances in other deposit categories. Other initiatives to attract