SunTrust 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

probability of loss and amount of such loss, if any, in preparing

our financial statements.

We evaluate the likelihood of a potential loss from legal or

regulatory proceedings to which we are a party. We record a

liability for such claims only when a loss is considered probable

and the amount can be reasonably estimated. The liability is

recorded in other liabilities in the Consolidated Balance Sheets

and the related expense is recorded in the applicable category of

noninterest expense, depending on the nature of the legal matter,

in the Consolidated Statements of Income. Significant judgment

may be required in determining both probability of loss and

whether an exposure is reasonably estimable. Our estimates are

subjective based on the status of the legal or regulatory

proceedings, the merits of our defenses, and consultation with

in-house and outside legal counsel. In many such proceedings,

it is not possible to determine whether a liability has been

incurred or to estimate the ultimate or minimum amount of that

liability until the matter is close to resolution. As additional

information becomes available, we reassess the potential liability

related to pending claims and may revise our estimates.

Due to the inherent uncertainties of the legal and regulatory

processes in the multiple jurisdictions in which we operate, our

estimates may be materially different than the actual outcomes,

which could have material effects on our business, financial

condition, and results of operations. See Note 19,

“Contingencies,” to the Consolidated Financial Statements in

this Form 10-K for further discussion.

Estimates of Fair Value

The objective of a fair value measurement is to use market-based

inputs or assumptions, when available, to estimate the price that

would be received to sell an asset or paid to transfer a liability

in an orderly transaction between market participants at the

measurement date. When observable market prices from

transactions for identical assets or liabilities are not available,

we evaluate pricing for similar assets or liabilities. If observable

market prices for such assets or liabilities are unavailable or

impracticable to obtain, we look to other techniques for

estimating fair value (for example, obtaining third party price

quotes or using modeling techniques such as discounted cash

flows). The resulting valuation may include significant

judgments particularly when the market for an asset or liability

is not active.

Fair value measurements for assets and liabilities that

include significant inputs that are not observable in the market

are required to be classified as level 3 in the fair value hierarchy.

We have instituted various processes and controls surrounding

these measurements to ensure appropriate methodologies are

utilized. We continue to maintain a cross-functional approach

when estimating the fair value of these difficult to value financial

instruments. This includes input from not only the related line

of business, but also from risk management and finance, to

ultimately arrive at an appropriate estimate of the instrument's

fair value. This process involves the gathering of multiple

sources of information, including broker quotes, values provided

by pricing services, trading activity in other similar instruments,

market indices, and pricing matrices.

Modeling techniques incorporate our assessments regarding

assumptions that market participants would use in pricing the

asset or the liability, including assumptions about the risks

inherent in a particular valuation technique. These assessments

are inherently subjective; the use of different assumptions could

result in material changes to these fair value measurements. We

employed significant unobservable inputs when estimating fair

value for certain trading assets, securities AFS, portfolio loans

accounted for at fair value, IRLCs, LHFS, MSRs, and certain

derivatives.

We record all MSRs at fair value on a recurring basis. The

fair value of MSRs is based on discounted cash flow analyses

and can be highly variable quarter to quarter as market conditions

and projected interest rates change. We provide disclosure of the

key economic assumptions used to measure MSRs and residual

interests and a sensitivity analysis to adverse changes to these

assumptions in Note 9, “Goodwill and Other Intangible Assets,”

to the Consolidated Financial Statements in this Form 10-K. This

sensitivity analysis does not take into account hedging activities

discussed in the “Other Market Risk” section of this MD&A.

Overall, the financial impact of the level 3 financial

instruments did not have a material impact on our liquidity or

capital. Our holdings of level 3 financial instruments continues

to decline due to paydowns, sales, and settlements of these

instruments. Table 21 discloses assets and liabilities measured

at fair value on a recurring basis that are classified as level 3

measurements.

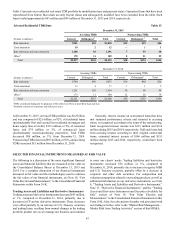

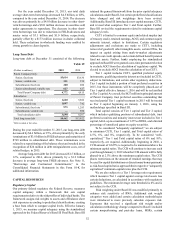

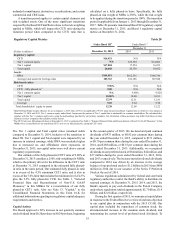

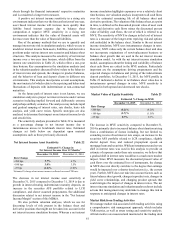

Level 3 Assets and Liabilities Table 21

December 31

(Dollars in millions) 2015 2014

Trading assets and derivatives 1$110 $25

Securities AFS 556 946

LHFS 51

LHFI 257 272

MSRs 1,307 1,206

Total level 3 assets $2,235 $2,450

Total assets $190,817 $190,328

Total assets measured at fair value on a

recurring basis 37,002 36,342

Level 3 assets as a % of total assets 1.2%1.3%

Level 3 assets as a % of total assets

measured at fair value on a recurring basis 6.0%6.7%

Trading liabilities and derivative instruments $6 $5

Other liabilities 23 27

Total level 3 liabilities $29 $32

Total liabilities $167,380 $167,323

Total liabilities measured at fair value on a

recurring basis 2,259 2,537

Level 3 liabilities as a % of total liabilities —%—%

Level 3 liabilities as a % of total liabilities

measured at fair value on a recurring basis 1.3%1.3%

1 Includes IRLCs.

Level 3 trading assets and derivatives increased by $85 million

during the year ended December 31, 2015, primarily due to the

addition of bonds that are not actively traded in the market; as

such, observable market data for these instruments is limited.

Level 3 securities AFS decreased by $390 million during the year

ended December 31, 2015 due primarily to the redemption of

FHLB stock as well as continued paydowns and sales on

securities AFS. During the year ended December 31, 2015, we