SunTrust 2015 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

145

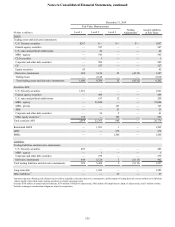

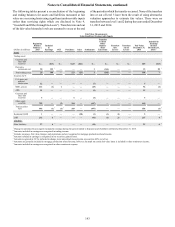

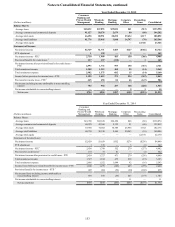

Non-recurring Fair Value Measurements

The following tables present losses recognized on assets still

held at period end, and measured at fair value on a non-recurring

basis, for the years ended December 31, 2015 and 2014.

Adjustments to fair value generally result from the application

of LOCOM or through write-downs of individual assets. The

tables do not reflect changes in fair value attributable to economic

hedges the Company may have used to mitigate interest rate risk

associated with LHFS and MSRs.

Fair Value Measurements Losses for the

Year Ended

December 31, 2015

(Dollars in millions)

December 31,

2015 Level 1 Level 2 Level 3

LHFS $202 $— $— $202 ($6)

LHFI 48 — — 48 —

OREO 19 — — 19 (4)

Other assets 36 — 29 7 (6)

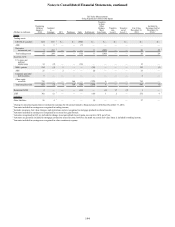

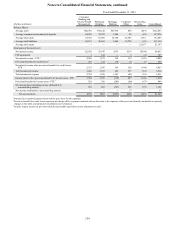

Fair Value Measurements Losses for the

Year Ended

December 31, 2014

(Dollars in millions)

December 31,

2014 Level 1 Level 2 Level 3

LHFS $1,108 $121 $45 $942 ($6)

LHFI 24 — — 24 —

OREO 29 — 1 28 (6)

Affordable housing 77 — — 77 (21)

Other assets 225 — 216 9 (64)

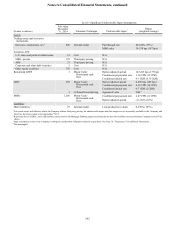

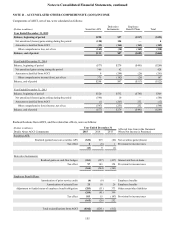

Discussed below are the valuation techniques and inputs used in developing fair value measurements for assets measured at fair

value on a non-recurring basis and classified as level 1, 2, and/or 3.

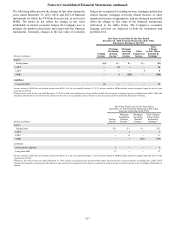

Loans Held for Sale

At December 31, 2015, LHFS consisted of commercial loans

that were valued using significant unobservable assumptions

from comparably rated loans. As such, limited observable market

data exists as these loans are not actively traded, and,

accordingly, are classified as level 3.

At December 31, 2014, LHFS classified as level 1 consisted

of commercial and industrial loans for which pricing is readily

available, and level 2 assets consisted primarily of agency and

non-agency residential mortgages, which were measured using

observable collateral valuations, and corporate loans, all of

which are accounted for at LOCOM. Level 3 assets at

December 31, 2014 consisted primarily of indirect auto loans

and tax-exempt municipal leases that incurred fair value

adjustments upon being transferred to LHFS, as the Company

elected to actively market these loans for sale. These loans were

valued consistent with the methodology discussed in the

Recurring Fair Value Measurements section of this footnote.

During 2014, the Company transferred $470 million of C&I

loans to LHFS, as the Company elected to actively market these

loans for sale; $340 million of these loans were tax-exempt

municipal leases included in level 3 and the remainder were

included in level 1. Also during 2014, the Company transferred

$38 million of residential mortgage NPLs to LHFS, which are

included in level 2, as the Company elected to actively market

these loans for sale. These loans were predominantly reported at

amortized cost prior to transferring to LHFS, however, a portion

of the NPLs were carried at fair value. Additionally, during 2014,

the Company transferred approximately $600 million of indirect

auto loans to LHFS, included in level 3, which the Company

elected to actively market for sale.

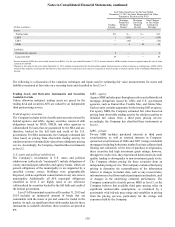

Loans Held for Investment

At December 31, 2015 and 2014, LHFI consisted primarily of

consumer and residential real estate loans discharged in Chapter

7 bankruptcy that had not been reaffirmed by the borrower, as

well as nonperforming CRE loans for which specific reserves

had been recognized. As these loans have been classified as

nonperforming, cash proceeds from the sale of the underlying

collateral is the expected source of repayment for a majority of

these loans. Accordingly, the fair value of these loans is derived

from the estimated fair value of the underlying collateral,

incorporating market data if available. There were no gains or

losses during the years ended December 31, 2015 and 2014, as

the charge-offs related to these loans are a component of the

ALLL. Due to the lack of market data for similar assets, all of

these loans are considered level 3.

OREO

OREO is measured at the lower of cost, or fair value less costs

to sell. OREO classified as level 2 consists primarily of

residential homes, commercial properties, and vacant lots and

land for which binding purchase agreements exist. OREO

classified as level 3 consists primarily of residential homes,

commercial properties, and vacant lots and land for which initial

valuations are based on property-specific appraisals, broker

pricing opinions, or other limited, highly subjective market

information. Updated value estimates are received regularly on

level 3 OREO.

Affordable Housing

The Company evaluates its consolidated affordable housing

properties for impairment whenever events or changes in

circumstances indicate that the carrying amount may not be