SunTrust 2015 Annual Report Download - page 86

Download and view the complete annual report

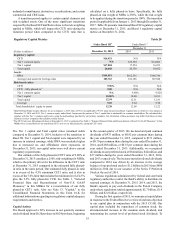

Please find page 86 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

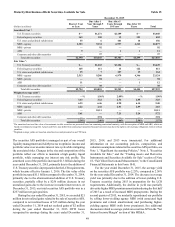

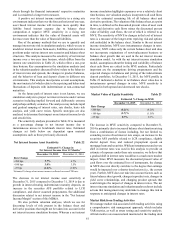

the tax bases of assets and liabilities, as well as from NOL and

tax credit carryforwards. We regularly evaluate the realizability

of DTAs. A valuation allowance is recognized for a DTA if, based

on the weight of available evidence, it is more-likely-than-not

that some portion or all of the DTA will not be realized. In

determining whether a valuation allowance is necessary, we

consider the level of taxable income in prior years to the extent

that carrybacks are permitted under current tax laws, as well as

estimates of future pre-tax and taxable income and tax planning

strategies that would, if necessary, be implemented. We currently

maintain a valuation allowance for certain state carryforwards

and certain other state DTAs. Since we expect to realize our

remaining federal and state DTAs, no valuation allowance is

deemed necessary against these DTAs at December 31, 2015.

For additional information, refer to Note 14, “Income Taxes,” to

the Consolidated Financial Statements in this Form 10-K.

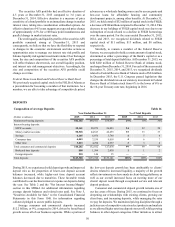

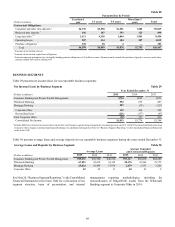

Employee Benefit Plans

We maintain various pension and other postretirement benefit

plans for employees who meet certain requirements. Continued

changes in the size and characteristics of the workforce could

result in a partial settlement of the pension plan. If lump sum

payments were to exceed the total of interest cost and service

cost for the year, settlement accounting would require immediate

recognition through earnings of any net actuarial gain or loss

recorded in AOCI based on the fair value of plan assets and plan

obligations prior to settlement, and recognition of any related

settlement costs. We estimate the financial impact of a partial

settlement in 2016 would be the recognition of approximately

$40 million in additional benefit costs.

On December 31, 2015, we refined the calculation of the

service and interest cost components of net periodic benefit

expense for pension and other postretirement benefit

plans. Previously, we estimated service and interest cost

components utilizing a single weighted-average discount rate

derived from the yield curve used to measure the benefit

obligation at the beginning of the period. Under the refined

method, we utilized a full yield curve approach to estimate these

components by applying specific spot rates along the yield curve

used in the determination of the benefit obligation to the relevant

projected cash flows. This change was made to more closely

match the projected benefit cash flows and the corresponding

yield curve spot rates, and to provide a more precise

measurement of service and interest costs. This change had no

impact on the measurement of our total benefit obligations

recorded at December 31, 2015 or any other prior period. We

accounted for this service and interest cost methodology

refinement as a change in estimate that is inseparable from a

change in accounting principle, and, accordingly, will recognize

its effect prospectively beginning in 2016, which will not

materially impact the total 2016 net periodic pension benefit. For

additional information on our pension and other postretirement

benefit plans see Note 15, “Employee Benefit Plans,” to the

Consolidated Financial Statements in this Form 10-K.

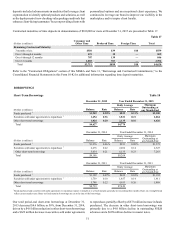

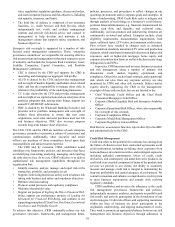

ENTERPRISE RISK MANAGEMENT

In the normal course of business, we are exposed to various risks.

We have established an enterprise risk governance framework

to identify and manage these risks and support key business

objectives. Underlying this framework are limits, policies,

metrics, processes, and procedures designed to effectively

identify, monitor, and manage risk within the confines of our

overall risk appetite.

The Board is responsible for oversight of enterprise risk

governance. The BRC assists the Board in executing this

responsibility. Administration of the framework and governance

process is the responsibility of the CRO, who executes this

responsibility through the CRM organization. The CRO reports

to the CEO, and provides overall vision, direction, and leadership

regarding our enterprise risk management framework and risk

culture. Additionally, the CRO provides regular risk assessments

to Executive Management, the BRC, other Board committees,

and the full Board, as appropriate, and provides other information

to Executive Management and the Board, as requested.

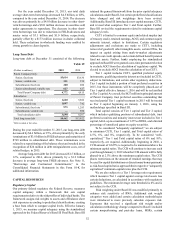

Our enterprise risk governance structure and processes are

founded upon a three line of defense organizational and business

model, which is critical to ensuring that risk in all activities is

properly identified, assessed, and managed. The three lines of

defense model requires effective teamwork and communication,

combined with individual accountability within defined roles.

The enterprise risk governance framework and the three lines of

defense are foundational to our risk culture, which is based upon

strong risk leadership; risk ownership and accountability;

comprehensive risk governance structure and strategy; a well-

articulated risk appetite and associated limits; robust interaction

and communication; effective challenge at all levels of the

organization; talent management, supported by appropriate

training; incorporation of risk considerations in performance,

compensation, and consequence management; and sound

technology and reporting.

• The first line of defense is comprised of all teammates within

our business segments, as well as those within Functional

units executing select activities. The first line of defense

owns and is accountable for the development and execution

of business strategies that are aligned with the risk appetite,

measures, and limits established by the Board, as well as the

associated processes and controls. It is also responsible for

accurate and timely identification, management, and

reporting/escalation of existing and emerging risks.

• The second line of defense is comprised of corporate

functions, including CRM and risk stewards; these groups

are responsible for independent governance and oversight

of the first line of defense relative to specific risks. Risk

stewards represent areas of subject matter expertise relative

to certain risks, including, but not limited to: Technology

Risk and Compliance, which among other things,

encompasses information and cyber-security, Finance Risk

Management, Human Resources, Third-Party Risk

Management, Model Risk Management, and Anti-Money

Laundering/Bank Secrecy Act. In the first quarter of 2016,

FRB Regulation W Oversight and Enterprise Data Oversight

will be added as risk stewards. The second line of defense

is responsible for developing appropriate risk management

frameworks/programs that facilitate first line of defense

identification, reporting, assessment, control, mitigation,

and communication of risk. It also monitors first line of

defense execution of these responsibilities. Second line of

defense frameworks/ programs conform to applicable laws,