SunTrust 2015 Annual Report Download - page 134

Download and view the complete annual report

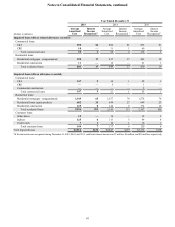

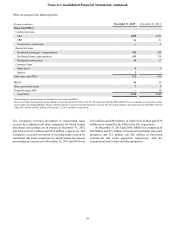

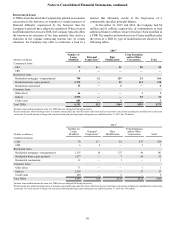

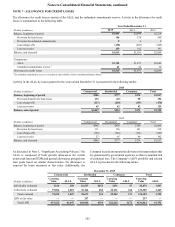

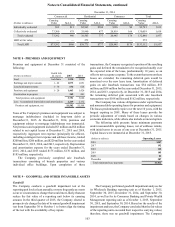

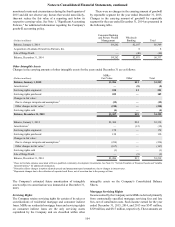

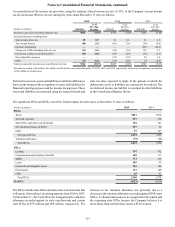

Please find page 134 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

106

(i) the transferred assets are legally isolated, (ii) the transferee

has the right to pledge or exchange the transferred assets, and

(iii) the Company has relinquished effective control of the

transferred assets. If all three conditions are met, then the transfer

is accounted for as a sale.

Except as specifically noted herein, the Company is not

required to provide additional financial support to any of the

entities to which the Company has transferred financial assets,

nor has the Company provided any support it was not otherwise

obligated to provide. No events occurred during the year ended

December 31, 2015 that changed the Company’s previous

conclusions regarding whether it is the primary beneficiary of

the VIEs described herein. Furthermore, no events occurred

during the year ended December 31, 2015 that changed the

Company’s sale conclusion with regards to previously

transferred residential mortgage loans, indirect auto loans,

student loans, or commercial and corporate loans.

Transfers of Financial Assets

The following discussion summarizes transfers of financial

assets to VIEs for which the Company has retained some level

of continuing involvement.

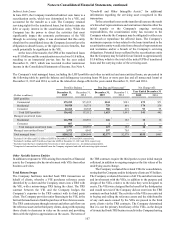

Residential Mortgage Loans

The Company typically transfers first lien residential mortgage

loans in conjunction with Ginnie Mae, Fannie Mae, and Freddie

Mac securitization transactions, whereby the loans are

exchanged for cash or securities that are readily redeemable for

cash, and servicing rights are retained.

The Company sold residential mortgage loans to the

aforementioned GSEs, which resulted in pre-tax net gains of

$232 million, $224 million, and $186 million for the years ended

December 31, 2015, 2014, and 2013, respectively. The Company

has made certain representations and warranties with respect to

the transfer of these loans. See Note 16, “Guarantees,” for

additional information regarding representations and warranties.

In a limited number of securitizations, the Company has

received securities in addition to cash in exchange for the

transferred loans, while also retaining servicing rights. The

securities received are measured at fair value and classified as

securities AFS. At December 31, 2015 and 2014, the fair value

of securities received totaled $38 million and $55 million,

respectively.

The Company evaluated its VI securitization entities for

potential consolidation under the VIE consolidation model.

Notwithstanding the Company's role as servicer, the Company

typically does not have power over the securitization entities as

a result of rights held by the master servicer. However, in certain

transactions, the Company does have power as the servicer, but

does not have an obligation to absorb losses, or the right to receive

benefits, that could potentially be significant. In all such cases,

the Company does not consolidate the securitization entity. Total

assets at December 31, 2015 and 2014, of the unconsolidated

entities in which the Company has a VI were $241 million and

$288 million, respectively.

The Company’s maximum exposure to loss related to these

unconsolidated residential mortgage loan securitizations is

comprised of the loss of value of any interests it retains, which

are immaterial, and any repurchase obligations or other losses it

incurs as a result of any guarantees related to these

securitizations, discussed further in Note 16, “Guarantees.”

Commercial and Corporate Loans

The Company holds securities issued by CLO entities that own

commercial leveraged loans and bonds, certain of which were

transferred to the entities by the Company. The Company has

determined that the CLO entities are VIEs and that it is not the

primary beneficiary of these entities because it does not possess

the power to direct the activities that most significantly impact

the economic performance of the entities. The Company

previously acted as collateral manager for one of these CLO

entities that it consolidated; however, upon the sale of

RidgeWorth in May 2014, the Company was no longer the

collateral manager or primary beneficiary of this CLO and the

CLO was deconsolidated. At December 31, 2015 and 2014, the

Company's unconsolidated VIEs had estimated assets of $525

million and $704 million and estimated liabilities of $482 million

and $654 million, respectively. At December 31, 2015 and 2014,

the Company's holdings included a preference share exposure

valued at $2 million and $3 million, and a senior debt exposure

valued at $8 million and $18 million, respectively.

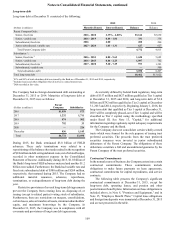

Consumer Loans

Guaranteed Student Loans

The Company has securitized government-guaranteed student

loans through a transfer of loans to a securitization entity and

retained the residual interest in the entity. The Company

concluded that this entity should be consolidated because the

Company has (i) the power to direct the activities that most

significantly impact the economic performance of the VIE and

(ii) the obligation to absorb losses, and the right to receive

benefits, that could potentially be significant. At December 31,

2015 and 2014, the Company’s Consolidated Balance Sheets

reflected $262 million and $306 million of assets held by the

securitization entity and $259 million and $302 million of debt

issued by the entity, respectively.

To the extent that the securitization entity incurs losses on

its assets, the securitization entity has recourse to the guarantor

of the underlying loan, which is backed by the Department of

Education up to a maximum guarantee of 100%. When the

maximum government guarantee is not realized, losses reduce

the amount of available cash payable to the Company as the

owner of the residual interest. To the extent that losses result

from a breach of servicing responsibilities, the securitization

entity has recourse to the Company, which functions as the

master servicer, whereby the Company may be required to

repurchase the defaulting loan(s) at par value. If the breach was

caused by the subservicer, the Company would seek

reimbursement from the subservicer up to the guaranteed

amount. The Company’s maximum exposure to loss related to

the securitization entity would arise from a breach of its servicing

responsibilities. To date, loss claims filed with the guarantor that

have been denied due to servicing errors have either been, or are

in the process of, being cured, or reimbursement has been

provided to the Company by the subservicer, or in limited cases,

absorbed by the Company.