SunTrust 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

108

no substantive power to direct the significant activities of the

VIEs, and therefore, the VIEs are not consolidated.

The outstanding notional amounts of the VIE-facing TRS

contracts and the Company's related senior financing

outstanding to VIEs were $2.2 billion and $2.3 billion at

December 31, 2015 and 2014, respectively. These financings

were classified within trading assets and derivative instruments

on the Consolidated Balance Sheets and were measured at fair

value. The Company entered into client-facing TRS contracts of

the same outstanding notional amounts. The notional amounts

of the TRS contracts with VIEs represent the Company’s

maximum exposure to loss, although this exposure has been

mitigated via the TRS contracts with third parties. For additional

information on the Company’s TRS contracts and its

involvement with these VIEs, see Note 17, “Derivative Financial

Instruments.”

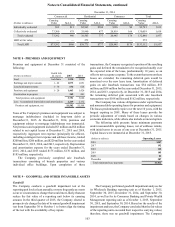

Community Development Investments

As part of its community reinvestment initiatives, the Company

invests in multi-family affordable housing developments and

other community development entities as a limited and/or

general partner and/or a debt provider. The Company receives

tax credits for its limited partner investments. The Company has

determined that the vast majority of the related partnerships are

VIEs.

In limited circumstances, the Company owns both the

limited partner and general partner interests, in which case the

related partnerships are not considered VIEs and are

consolidated by the Company. The Company sold properties

with a carrying value of $72 million for gains of $19 million

during the year ended December 31, 2015, and the remaining

properties held for sale at December 31, 2015 were immaterial.

One property was sold during the year ended December 31, 2014

for an immaterial gain. During 2013, the Company sold

properties resulting in an aggregate gain of $17 million.

The Company has concluded that it is not the primary

beneficiary of affordable housing partnerships when it invests

as a limited partner and there is a third party general partner. The

investments are accounted for in accordance with the accounting

guidance for investments in affordable housing projects. The

general partner, or an affiliate of the general partner, often

provides guarantees to the limited partner, which protects the

Company from construction and operating losses and tax credit

allocation deficits. Assets of $1.6 billion and $1.4 billion in these

and other community development partnerships were not

included in the Consolidated Balance Sheets at December 31,

2015 and 2014, respectively. The Company's limited partner

interests had carrying values of $672 million and $363 million

at December 31, 2015 and 2014, respectively, and are recorded

in other assets on the Company’s Consolidated Balance Sheets.

The Company’s maximum exposure to loss for these investments

totaled $1.1 billion and $776 million at December 31, 2015 and

2014, respectively. The Company’s maximum exposure to loss

would result from the loss of its limited partner investments along

with $268 million and $278 million of loans, interest-rate swap

fair value exposures, or letters of credit issued by the Company

to the entities at December 31, 2015 and 2014, respectively. The

remaining exposure to loss is primarily attributable to unfunded

equity commitments that the Company is required to fund if

certain conditions are met.

The Company also owns noncontrolling interests in funds

whose purpose is to invest in community developments. At

December 31, 2015 and 2014, the Company's investment in these

funds totaled $132 million and $113 million, respectively, and

the Company's maximum exposure to loss on its equity

investments, which is comprised of its investments in the funds

plus any additional unfunded equity commitments, was $321

million and $236 million, respectively.

During the year ended December 31, 2015, 2014, and 2013,

the Company recognized $68 million, $66 million, and $64

million of tax credits for qualified affordable housing projects,

and $66 million, $61 million, and $49 million of amortization

on qualified affordable housing projects in the provision for

income taxes, respectively.

During the year ended December 31, 2015, the Company

recorded $35 million of expense related to community

development investments not within the scope of the accounting

guidance for investments in qualified affordable housing

projects. During the year ended December 31, 2014, the

Company recorded $19 million of amortization related to these

non-qualified investments ($5 million of which was recorded

within other noninterest expense and $14 million was recorded

within amortization expense in the Company's Consolidated

Statements of Income). No amortization was recorded for these

non-qualified investments during the year ended December 31,

2013.

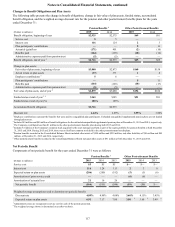

NOTE 11 - BORROWINGS AND CONTRACTUAL COMMITMENTS

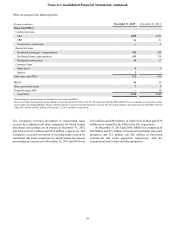

Other short-term borrowings

Other short-term borrowings at December 31 were as follows:

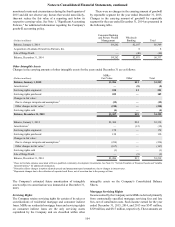

2015 2014

(Dollars in millions) Balance Interest Rate Balance Interest Rate

FHLB advances $— —% $4,000 0.23%

Master notes 582 0.20 1,280 0.15

Dealer collateral 442 0.20 354 0.13

Total other short-term borrowings $1,024 $5,634