SunTrust 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

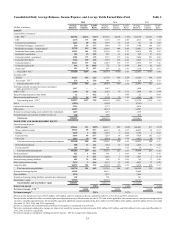

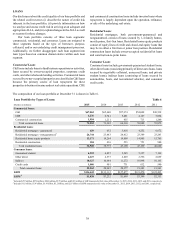

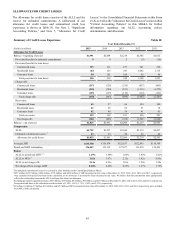

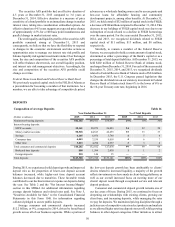

2014, and the average outstanding loan size was approximately

$46,000 at both December 31, 2015 and 2014.

Consumer loans increased $1.3 billion, or 6%, during 2015

compared to December 31, 2014. The increase was attributable

to a $1.6 billion, or 34%, increase in consumer direct loans given

continued growth in our online origination channels and

partnerships, and a $185 million, or 21%, increase in credit cards,

partially offset by a $517 million, or 5%, decrease in indirect

loans. The decrease in consumer indirect loans was due to our

securitization of $1.0 billion in consumer indirect auto loans

during 2015, partially offset by new originations. Going forward,

we may periodically conduct additional auto loan securitization

transactions, as they allow us to more efficiently use the balance

sheet and diversify our funding sources, while still being an

active loan originator and partner to our auto dealership clients.

Loans Held for Sale

LHFS decreased $1.4 billion, or 43%, during 2015, largely due

to loan sales and transfers out of LHFS exceeding the flow of

mortgage production into LHFS. Loan transfers from LHFS to

LHFI totaled $741 million during 2015, comprised primarily of

indirect auto and C&I loans that were previously transferred to

LHFS during 2014 in anticipation of being sold, but no longer

met the criteria for sale.

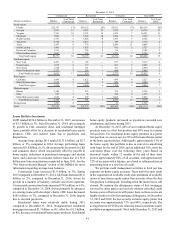

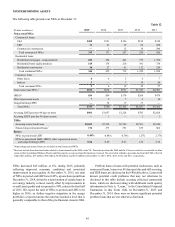

Asset Quality

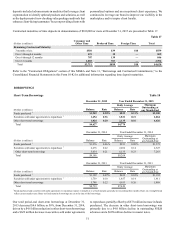

Our asset quality remained favorable during 2015, driven by

improved residential housing markets, resolution of NPAs, and

lower levels of new NPLs in most loan classes except C&I, which

increased primarily due to deterioration in our energy-related

exposure. While our asset quality performance can be attributed,

in part, to the proactive actions we have taken over the past

several years to de-risk, diversify, and improve the quality of our

loan portfolio, we also recognize that our strong asset quality

will eventually normalize.

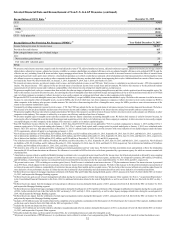

NPAs decreased $45 million, or 6%, compared to

December 31, 2014. At December 31, 2015, the percentage of

NPLs to total LHFI was 0.49%, an increase of one basis point

compared to December 31, 2014 due to the aforementioned

energy NPLs. Higher NPLs were offset by a decline in OREO

and nonperforming LHFS.

Net charge-offs were $341 million during 2015, compared

to $445 million during 2014, a decrease of $104 million, or 23%.

During 2015, the net charge-off ratio declined to 0.26%,

compared to 0.34% during 2014. For 2016, we expect NPLs and

net charge-offs to increase primarily as a result of further stress

amongst our energy clients, but also due to a normalization from

the low levels experienced in 2015. However, we expect our

overall net charge-off ratio to be between 30 and 40 basis points

in 2016, which is below our long-term expectation of 40 to 70

basis points.

Total early stage delinquencies increased six basis points

from December 31, 2014 to 0.70% of total loans at December 31,

2015. Early stage delinquencies, excluding government-

guaranteed loans, were 0.30% at both December 31, 2015 and

2014.

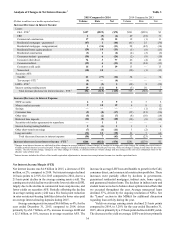

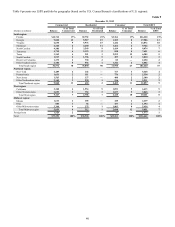

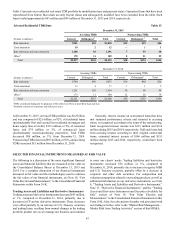

Energy-related Loan Exposure

We believe that our LHFI portfolio is well diversified by product,

client, and geography. However, the LHFI portfolio may be

exposed to concentrations of credit risk which exist in relation

to individual borrowers or groups of borrowers, types of

collateral, certain industries, certain loan products, or regions of

the country.

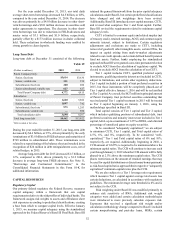

The energy industry vertical is a component of our CIB

business. Outstanding loans in the energy portfolio totaled $3.1

billion at December 31, 2015, and represented 2% of the total

loan portfolio. Total exposure, which includes funded and

unfunded commitments, was $9.3 billion at December 31, 2015,

and represented 4% of our total funded and unfunded

commitments. We anticipate our total exposure to remain

relatively stable; however, as energy clients evaluate their cash

flow needs it is possible that outstanding loans could increase as

clients draw against their unfunded commitments. Loans in the

energy portfolio that were in a second lien position were

immaterial.

Exposures to the two most adversely impacted sectors,

namely oil field services and exploration & production,

represented 15% and 23%, respectively, of our energy loan

portfolio at December 31, 2015. The remaining energy loan

portfolio relates to borrowers in the midstream (i.e., pipeline &

transportation) and downstream (i.e., refining & distribution)

energy sectors, which have not been as meaningfully impacted

by commodity price volatility.

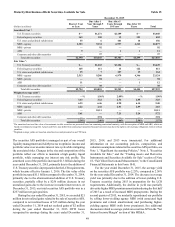

At December 31, 2015, 6% of our total energy loans were

nonperforming and 19% were criticized (which includes

nonperforming loans and criticized accruing loans). At

December 31, 2015, 86% of our nonperforming energy loans

were current with respect to payments, however, they were

classified as nonperforming as discussed in the "Critical

Accounting Policies" section of this MD&A and in Note 1,

"Significant Accounting Policies," to the Consolidated Financial

Statements in this Form 10-K.

We believe that we have taken a vigilant approach to

managing our energy exposure and accounting for increased

probable loss content in our reserve estimation process. At

December 31, 2015, reserves associated with the energy

portfolio represented 4.6% of total outstanding energy loans. The

decline in oil prices during the first quarter of 2016 will likely

result in further asset quality deterioration of loans in the energy

industry vertical, which will increase NPLs and criticized

accruing loans, and potentially result in higher energy-related

reserves and net charge-offs. These trends and other relevant

inputs are incorporated into our total first quarter 2016 provision

for loan losses estimate of between $80 million and $110 million,

as discussed in the "Allowance for Credit Losses" section of this

MD&A. We believe that our energy-related risk is manageable,

especially in the context of the overall Company, and we will

continue to carefully monitor and manage our energy exposures.

See Note 6, “Loans,” to the Consolidated Financial Statements

in this Form 10-K for more information on our LHFI portfolio.