SunTrust 2015 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

146

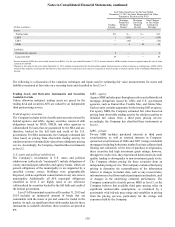

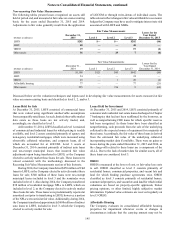

recoverable. Impairment is recognized if the carrying amount of

the property exceeds its fair value. During the year ended

December 31, 2015, the Company did not recognize impairment

or increased estimated net realizable values on any of its

affordable housing properties.

During the first quarter of 2014, the Company decided to

actively market for sale certain consolidated affordable housing

properties, and accordingly, recognized an initial impairment

charge of $36 million to adjust the carrying values of these

properties to their estimated net realizable values, which were

obtained from a third party broker opinion and were considered

level 3. Subsequently during 2014, the Company recognized

recoveries of $15 million on these affordable housing properties

as a result of increased estimated net realizable values.

Additionally, the Company recognized gains of $19 million

during the year ended December 31, 2015 on the sale of these

affordable housing investments.

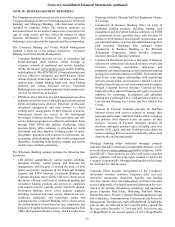

Other Assets

Other assets consists of other repossessed assets, assets under

operating leases where the Company is the lessor, land held for

sale, and equity method investments.

Other repossessed assets comprises repossessed personal

property that is measured at fair value less cost to sell. These

assets are considered level 3 as their fair value is determined

based on a variety of subjective, unobservable factors. There

were no losses recognized by the Company on other repossessed

assets during the years ended December 31, 2015 and 2014, as

the impairment charges on repossessed personal property were

a component of the ALLL.

The Company monitors the fair value of assets under

operating leases where the Company is the lessor and recognizes

impairment on the leased asset to the extent the carrying value

is not recoverable and the fair value is less than its carrying value.

Fair value is determined using collateral specific pricing digests,

external appraisals, broker opinions, recent sales data from

industry equipment dealers, and the discounted cash flows

derived from the underlying lease agreement. As market data for

similar assets and lease arrangements is available and used in

the valuation, these assets are considered level 2. During the

years ended December 31, 2015 and 2014, the Company

recognized impairment charges of $6 million and $59 million,

respectively, attributable to the fair value of various personal

property under operating leases.

Land held for sale is recorded at the lesser of carrying value

or fair value less cost to sell. Land held for sale is considered

level 2 as its fair value is determined based on market

comparables and broker opinions. Impairment charges the

Company recognized on land held for sale was immaterial and

$5 million during the years ended December 31, 2015 and 2014,

respectively.

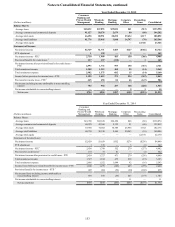

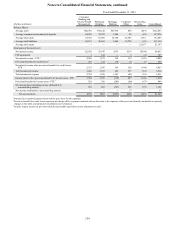

Fair Value of Financial Instruments

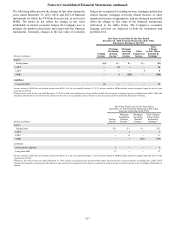

The measured amounts and fair values of the Company’s financial instruments are as follows:

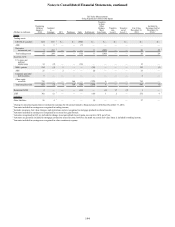

December 31, 2015 Fair Value Measurements

(Dollars in millions)

Measured

Amount

Fair

Value Level 1 Level 2 Level 3

Financial assets:

Cash and cash equivalents $5,599 $5,599 $5,599 $— $— (a)

Trading assets and derivative instruments 6,119 6,119 866 5,143 110 (b)

Securities AFS 27,825 27,825 3,542 23,727 556 (b)

LHFS 1,838 1,842 — 1,803 39 (c)

LHFI, net 134,690 131,178 — 397 130,781 (d)

Financial liabilities:

Deposits 149,830 149,889 — 149,889 — (e)

Short-term borrowings 4,627 4,627 — 4,627 — (f)

Long-term debt 8,462 8,374 — 7,772 602 (f)

Trading liabilities and derivative instruments 1,263 1,263 664 593 6 (b)