SunTrust 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

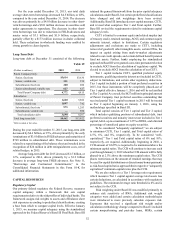

deposits included advancements in analytics that leverage client

segmentation to identify optimal products and solutions, as well

as the deployment of new checking value packages and tools that

enhance client-facing teammates’ focus on providing clients with

personalized options and an exceptional client experience. We

continued to leverage our brand to improve our visibility in the

marketplace and to inspire client loyalty.

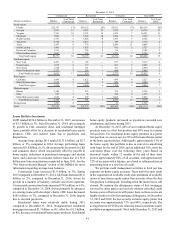

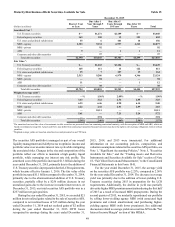

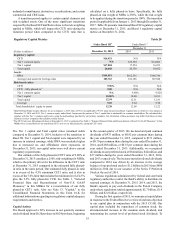

Contractual maturities of time deposits in denominations of $100,000 or more at December 31, 2015 are presented in Table 17.

Table 17

(Dollars in millions)

Consumer and

Other Time Brokered Time Foreign Time Total

Remaining Contractual Maturity:

3 months or less $510 $39 $10 $559

Over 3 through 6 months 491 18 — 509

Over 6 through 12 months 707 139 — 846

Over 12 months 2,003 703 — 2,706

Total $3,711 $899 $10 $4,620

Refer to the "Contractual Obligations" section of this MD&A and Note 11, "Borrowings and Contractual Commitments," to the

Consolidated Financial Statements in this Form 10-K for additional information regarding time deposit maturities.

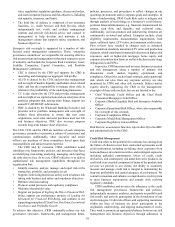

BORROWINGS

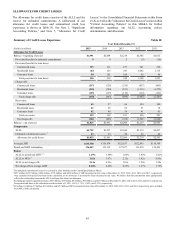

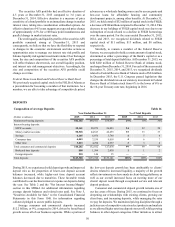

Short-Term Borrowings Table 18

December 31, 2015 Year Ended December 31, 2015

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$1,949 0.20% $822 0.11% $2,180

Securities sold under agreements to repurchase 11,654 0.36 1,821 0.21 2,064

Other short-term borrowings 1,024 0.20 2,135 0.16 4,426

Total $4,627 $4,778

December 31, 2014 Year Ended December 31, 2014

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$1,276 0.06 % $931 0.09 % $1,375

Securities sold under agreements to repurchase 12,276 0.22 2,202 0.14 2,323

Other short-term borrowings 5,634 0.21 6,135 0.23 7,283

Total $9,186 $9,268

December 31, 2013 Year Ended December 31, 2013

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$1,192 0.07% $639 0.10% $1,192

Securities sold under agreements to repurchase 11,759 0.10 1,857 0.14 1,911

Other short-term borrowings 5,788 0.22 4,953 0.26 5,868

Total $8,739 $7,449

1 Funds purchased and securities sold under agreements to repurchase mature overnight or at a fixed maturity generally not exceeding three months. Rates on overnight funds

reflect current market rates. Rates on fixed maturity borrowings are set at the time of the borrowings.

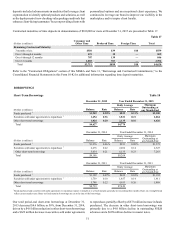

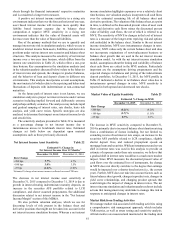

Our total period-end short-term borrowings at December 31,

2015 decreased $4.6 billion, or 50%, from December 31, 2014,

driven by a $4.6 billion reduction in other short-term borrowings

and a $622 million decrease in securities sold under agreements

to repurchase, partially offset by a $673 million increase in funds

purchased. The decrease in other short-term borrowings was

primarily due to a $4.0 billion decline in outstanding FHLB

advances and a $698 million decline in master notes.