SunTrust 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

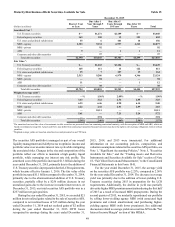

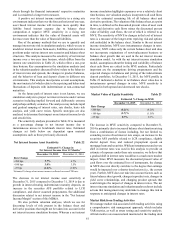

entire commercial loan portfolio were increased by 10%, the

ALLL for the commercial portfolio would increase by

approximately $102 million at December 31, 2015.

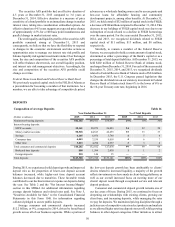

Recently, a number of downgrades were made to borrowers

in certain sectors of our energy-related commercial loan

portfolio. While certain of these loans may be current with

respect to their contractual debt service agreements, the decline

in oil prices and projected slowdown in global economic growth,

combined with facts and circumstances associated with these

specific loan arrangements, raises uncertainty regarding the full

collectability of principal. Therefore, we prudently stopped

accruing interest on these loans in the fourth quarter of 2015 and

classified the loans as NPLs. We believe that we have taken a

vigilant approach to managing our energy exposure and

accounting for increased probable loss content in our reserve

estimation process. See the “Loans” section in this MD&A for

additional information regarding our energy-related loan

exposure.

The allowance for residential and consumer loans is also

sensitive to changes in estimated loss severity rates. If the

estimated loss severity rates for these loans increased by 10%,

the total ALLL for the residential and consumer portfolios would

increase by approximately $45 million at December 31, 2015.

These sensitivity analyses are intended to provide insights into

the impact of adverse changes in risk rating and estimated loss

severity rates and do not imply any expectation of future

deterioration in the risk ratings or loss rates. Given current

processes employed, management believes the risk ratings and

inherent loss rates currently assigned are appropriate. It is

possible that others, given the same information, could reach

different conclusions that could be material to our financial

statements.

In addition to the ALLL, we estimate probable losses related

to unfunded lending commitments, such as letters of credit and

binding unfunded loan commitments. Unfunded lending

commitments are analyzed and segregated by risk using our

internal risk rating scale. These risk classifications, in

combination with probability of commitment usage, and any

other pertinent information, result in the estimation of the reserve

for unfunded lending commitments.

Our financial results are affected by the changes in the

allowance for credit losses. This process involves our analysis

of complex internal and external variables, and it requires that

we exercise judgment to estimate an appropriate allowance for

credit losses. Changes in the financial condition of individual

borrowers, economic conditions, or the condition of various

markets in which collateral may be sold could require us to

significantly decrease or increase the level of the allowance for

credit losses. Such an adjustment could materially affect net

income. For additional discussion of the ALLL see the

“Allowance for Credit Losses” and “Nonperforming Assets”

sections in this MD&A as well as Note 6, “Loans,” and Note 7,

“Allowance for Credit Losses,” to the Consolidated Financial

Statements in this Form 10-K.

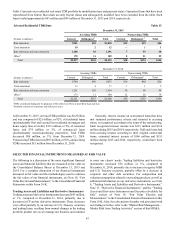

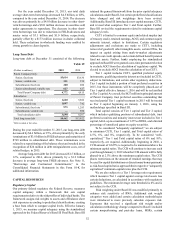

Mortgage Repurchase Reserve

We sell residential mortgage loans to investors through whole

loan sales in the normal course of our business. The investors

are primarily GSEs; however, $30 billion, or approximately

10%, of the population of total loans sold between January 1,

2005 and December 31, 2015 were sold to non-agency investors,

some in the form of securitizations. In association with these

transactions, we provide representations and warranties to the

third party investors that these loans meet certain requirements

as agreed to in investor guidelines. We have experienced

significantly fewer repurchase claims and losses related to loans

sold since 2009 as a result of stronger credit performance, more

stringent credit guidelines, and underwriting process

improvements.

During the third quarter of 2013, we reached agreements

with Freddie Mac and Fannie Mae under which they released us

from certain existing and future repurchase obligations for loans

sold to Freddie Mac between 2000 and 2008 and Fannie Mae

between 2000 and 2012.

Our current estimated liability for contingent losses related

to loans sold (i.e., our mortgage repurchase reserve) was $57

million at December 31, 2015. The liability is recorded in other

liabilities in the Consolidated Balance Sheets, and the related

repurchase provision is recognized in mortgage production

related income in the Consolidated Statements of Income. The

current reserves are deemed to be sufficient to cover probable

estimated losses related to certain defects (MI related, excessive

seller contribution, ineligible property, and other charter

violations) as outlined in the settlement contract, GSE owned

loans serviced by third party servicers, loans sold to private

investors, and indemnifications.

Various factors could potentially impact the accuracy of the

assumptions underlying our mortgage repurchase reserve

estimate. As discussed previously, the level of repurchase

requests we receive is dependent upon the actions of third parties

and could differ from the assumptions that we have made.

Delinquency levels, delinquency roll rates, and our loss severity

assumptions are all highly dependent upon economic factors,

including changes in real estate values and unemployment levels

which are, by nature, difficult to predict. Loss severity

assumptions could also be impacted negatively by delays in the

foreclosure process, which is a heightened risk in some of the

states where our loans sold were originated. Moreover, the 2013

agreements with Fannie Mae and Freddie Mac settling certain

aspects of our repurchase obligations preserve their right to

require repurchases arising from certain types of events, and that

preservation of rights can impact our future losses. While the

repurchase reserve includes the estimated cost of settling claims

related to required repurchases, our estimate of losses depends

on our assumptions regarding GSE and other counterparty

behavior, loan performance, home prices, and other factors.

While we use the best information available in estimating the

mortgage repurchase reserve liability, these, and other factors,

along with the discovery of additional information in the future,

could result in changes in our assumptions which could

materially impact our results of operations.

See Note 16, “Guarantees” to the Consolidated Financial

Statements in this Form 10-K for further discussion.

Legal and Regulatory Matters

We are parties to numerous claims and lawsuits arising in the

course of our normal business activities, some of which involve

claims for substantial amounts, and the outcomes of which are

not within our complete control or may not be known for

prolonged periods of time. Management is required to assess the