SunTrust 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

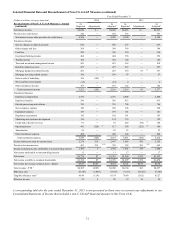

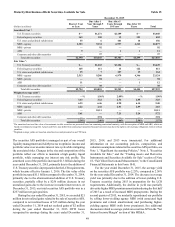

41

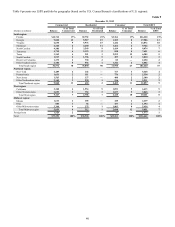

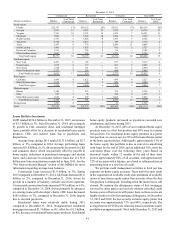

December 31, 2014

Commercial Residential Consumer Total LHFI

(Dollars in millions) Balance % of Total

Commercial Balance % of Total

Residential Balance % of Total

Consumer Balance % of Total

LHFI

South region:

Florida $12,333 17% $10,152 26% $3,651 17% $26,136 20%

Georgia 9,221 13 5,955 15 1,579 8 16,755 13

Virginia 7,191 10 5,721 15 1,479 7 14,391 11

Maryland 3,903 5 3,952 10 1,304 6 9,159 7

North Carolina 3,733 5 3,623 9 1,366 7 8,722 7

Tennessee 4,728 6 2,237 6 749 4 7,714 6

Texas 3,247 4 372 1 2,386 11 6,005 5

South Carolina 1,441 2 1,855 5 431 2 3,727 3

District of Columbia 1,313 2 703 2 92 — 2,108 2

Other Southern states 3,663 5 565 1 1,475 7 5,703 4

Total South region 50,773 69 35,135 91 14,512 69 100,420 75

Northeast region:

New York 4,291 6 145 — 677 3 5,113 4

Pennsylvania 1,675 2 117 — 691 3 2,483 2

New Jersey 1,528 2 141 — 361 2 2,030 2

Other Northeastern states 2,327 3 236 1 444 2 3,007 2

Total Northeast region 9,821 13 639 2 2,173 10 12,633 9

West region:

California 3,006 4 1,622 4 899 4 5,527 4

Other Western states 2,332 3 798 2 899 4 4,029 3

Total West region 5,338 7 2,420 6 1,798 9 9,556 7

Midwest region:

Illinois 2,180 3 233 1 352 2 2,765 2

Ohio 935 1 56 — 388 2 1,379 1

Other Midwestern states 3,054 4 292 1 1,686 8 5,032 4

Total Midwest region 6,169 8 581 1 2,426 12 9,176 7

Foreign loans 1,291 2 — — 36 — 1,327 1

Total $73,392 100% $38,775 100% $20,945 100% $133,112 100%

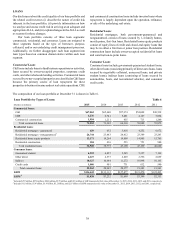

Loans Held for Investment

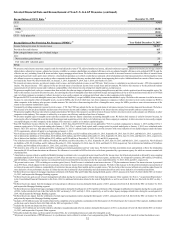

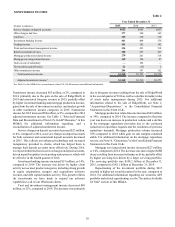

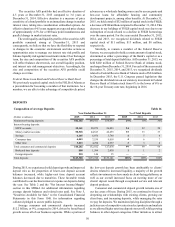

LHFI totaled $136.4 billion at December 31, 2015, an increase

of $3.3 billion, or 3%, from December 31, 2014, driven largely

by growth in C&I, consumer direct, and residential mortgage

loans, partially offset by a decrease in residential home equity

products, CRE, and indirect loans due to paydowns and

dispositions.

Average loans during 2015 totaled $133.6 billion, up $2.7

billion, or 2%, compared to 2014. Average performing loans

increased $3.0 billion, or 2%, driven primarily by growth in C&I

and consumer direct, which was partially offset by payoffs in

home equity, reductions in guaranteed mortgages and student

loans, and a decrease in consumer indirect loans due to a $1.0

billion auto loan securitization completed in June 2015. See the

"Net Interest Income/Margin" section of this MD&A for more

information regarding average loan balances.

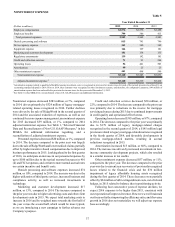

Commercial loans increased $1.9 billion, or 3%, during

2015 compared to December 31, 2014. C&I loans increased $1.6

billion, or 2%, compared to December 31, 2014, driven by

growth in a number of industry verticals and client segments.

Commercial construction loans increased $743 million, or 61%,

compared to December 31, 2014, driven primarily by advances

on existing loans with developer clients. CRE loans decreased

$505 million, or 7%, compared to December 31, 2014, largely

due to elevated paydowns.

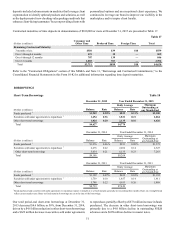

Residential loans were relatively stable during 2015

compared to December 31, 2014. Nonguaranteed residential

mortgages increased $1.3 billion, or 6%, offset by a $1.1 billion,

or 8%, decrease in residential home equity products. Residential

home equity products decreased as paydowns exceeded new

originations and draws during 2015.

At December 31, 2015, 40% of our residential home equity

products were in a first lien position and 60% were in a junior

lien position. For residential home equity products in a junior

lien position, we own or service 30% of the loans that are senior

to the home equity product. Additionally, approximately 13% of

the home equity line portfolio is due to convert to amortizing

term loans by the end of 2016 and an additional 30% enter the

conversion phase over the following three years. Based on

historical trends, within 12 months of the end of their draw

period, approximately 82% of all accounts, and approximately

72% of accounts with a balance, are closed or refinanced into an

amortizing loan or a new line of credit.

We perform credit management activities to limit our loss

exposure on home equity accounts. These activities may result

in the suspension of available credit and curtailment of available

draws of most home equity junior lien accounts when the first

lien position is delinquent, including when the junior lien is still

current. We monitor the delinquency status of first mortgages

serviced by other parties and actively monitor refreshed credit

bureau scores of borrowers with junior liens, as these scores are

highly sensitive to first lien mortgage delinquency. At December

31, 2015 and 2014, the loss severity on home equity junior lien

accounts was approximately 75% and 80%, respectively. The

average borrower FICO score related to loans in our home equity

portfolio was approximately 760 at both December 31, 2015 and