SunTrust 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9

Management” and "Net Interest Income/Margin" sections of the

MD&A in this Form 10-K.

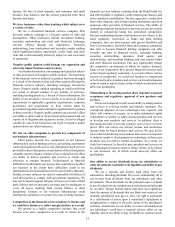

Our earnings may be affected by volatility in mortgage

production and servicing revenues, and by changes in

carrying values of our MSRs and mortgages held for sale due

to changes in interest rates.

We earn revenue from originating mortgage loans and fees

for servicing mortgage loans. When rates rise, the demand for

mortgage loans usually tends to fall, reducing the revenue we

receive from loan originations (mortgage production revenue).

Changes in interest rates can affect prepayment assumptions

and thus the fair value of our MSRs. An MSR is the right to

service a mortgage loan-collect principal, interest and escrow

amounts-for a fee. When interest rates fall, borrowers are usually

more likely to prepay their mortgage loans by refinancing them

at a lower rate. As the likelihood of prepayment increases, the

fair value of our MSRs can decrease. Each day we evaluate the

fair value of our MSRs and any related hedges, and any net

decrease in the fair value reduces the fair value of the MSR asset

and related hedge instruments, which in turn reduce earnings in

the period in which the decrease occurs.

Similarly, we measure at fair value mortgages held for sale

for which an active secondary market and readily available

market prices exist. Similar to other interest-bearing securities,

the value of these mortgages held for sale may be adversely

affected by changes in interest rates. For example, if market

interest rates increase relative to the yield on these mortgages

held for sale and other interests, their fair value may fall. We may

not hedge this risk, and even if we do hedge the risk with

derivatives and other instruments, we may still incur significant

losses from changes in the value of these mortgages held for sale

and other interests or from changes in the value of the hedging

instruments. For additional information, see “Enterprise Risk

Management-Other Market Risk” and “Critical Accounting

Policies” in the MD&A, and Note 9, “Goodwill and Other

Intangible Assets,” to the Consolidated Financial Statements in

this Form 10-K.

We use derivatives to hedge the risk of changes in the fair

value of the MSR, exclusive of decay. The hedge may not be

effective and may cause volatility, or losses, in our mortgage

servicing income. Also, we typically use derivatives and other

instruments to hedge our mortgage banking interest rate risk. We

generally do not hedge all of our risk, and we may not be

successful in hedging any of the risk. Hedging is a complex

process, requiring sophisticated models and constant monitoring

and re-balancing. We may use hedging instruments tied to U.S.

Treasury rates, LIBOR or Eurodollars that may not perfectly

correlate with the value or income being hedged. We could incur

significant losses from our hedging activities. There may be

periods where we elect not to use derivatives and other

instruments to hedge mortgage banking interest rate risk. For

additional information, see Note 17, “Derivative Financial

Instruments,” to the Consolidated Financial Statements in this

Form 10-K.

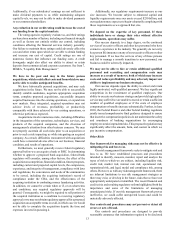

Disruptions in our ability to access global capital markets

may adversely affect our capital resources and liquidity.

In managing our consolidated balance sheet, we depend on

access to global capital markets to provide us with sufficient

capital resources and liquidity to meet our commitments and

business needs, and to accommodate the transaction and cash

management needs of our clients. Other sources of contingent

funding available to us include inter-bank borrowings,

repurchase agreements, FHLB capacity, and borrowings from

the Federal Reserve discount window. Any occurrence that may

limit our access to the capital markets, such as a decline in the

confidence of debt investors, our depositors or counterparties

participating in the capital markets, or a downgrade of our debt

rating, may adversely affect our funding costs and our ability to

raise funding and, in turn, our liquidity.

Credit Risks

We are subject to credit risk.

When we lend money, commit to lend money or enter into

a letter of credit or other contract with a counterparty, we incur

credit risk, which is the risk of losses if our borrowers do not

repay their loans or if our counterparties fail to perform according

to the terms of their contracts. A number of our products expose

us to credit risk, including loans, leveraged loans, leases and

lending commitments, derivatives, trading assets, insurance

arrangements with respect to such products, and assets held for

sale. The credit quality of our portfolio can have a significant

impact on our earnings. We estimate and establish reserves for

credit risks and credit losses inherent in our credit exposure

(including unfunded credit commitments). This process, which

is critical to our financial results and condition, requires difficult,

subjective, and complex judgments, including about how

economic conditions might impair the ability of our borrowers

to repay their loans. As is the case with any such assessments,

there is always the chance that we will fail to identify the proper

factors or that we will fail to accurately estimate the impacts of

factors that we do identify.

We might underestimate the credit losses inherent in our

loan portfolio and have credit losses in excess of the amount

reserved. We might increase the allowance because of changing

economic conditions, including falling real estate or commodity

prices and higher unemployment, or other factors such as

changes in borrower behavior. As an example, borrowers may

discontinue making payments on their real estate-secured loans

if the value of the real estate is less than what they owe, even if

they are still financially able to make the payments.

Also, to the extent we increase our consumer credit portfolio,

we may be subject to greater risk than we have experienced in

the past since such loans typically are unsecured and may be

subject to greater fraud risk to the extent such loans are originated

online.

While we believe that our allowance for credit losses was

adequate at December 31, 2015, there is no assurance that it will

be sufficient to cover all incurred credit losses, especially if

economic conditions worsen. In the event of significant

deterioration in economic conditions, we may be required to

increase reserves in future periods, which would reduce our

earnings and potentially capital. For additional information, see

the “Risk Management-Credit Risk Management” and “Critical

Accounting Policies-Allowance for Credit Losses” sections of

the MD&A in this Form 10-K.