SunTrust 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

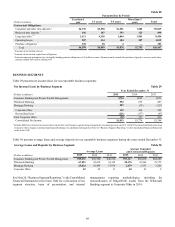

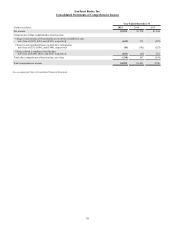

75

SunTrust Banks, Inc.

Consolidated Statements of Income

Year Ended December 31

(Dollars in millions and shares in thousands, except per share data) 2015 2014 2013

Interest Income

Interest and fees on loans $4,506 $4,617 $4,633

Interest and fees on loans held for sale 82 78 107

Interest and dividends on securities available for sale 593 613 579

Trading account interest and other 84 76 69

Total interest income 5,265 5,384 5,388

Interest Expense

Interest on deposits 219 235 291

Interest on long-term debt 252 270 210

Interest on other borrowings 30 39 34

Total interest expense 501 544 535

Net interest income 4,764 4,840 4,853

Provision for credit losses 165 342 553

Net interest income after provision for credit losses 4,599 4,498 4,300

Noninterest Income

Service charges on deposit accounts 622 645 657

Other charges and fees 377 368 369

Card fees 329 320 310

Investment banking income 461 404 356

Trading income 181 182 182

Trust and investment management income 334 423 518

Retail investment services 300 297 267

Mortgage production related income 270 201 314

Mortgage servicing related income 169 196 87

Gain on sale of subsidiary —105 —

Net securities gains/(losses) 21 (15) 2

Other noninterest income 204 197 152

Total noninterest income 3,268 3,323 3,214

Noninterest Expense

Employee compensation 2,576 2,576 2,488

Employee benefits 366 386 413

Outside processing and software 815 741 746

Net occupancy expense 341 340 348

Equipment expense 164 169 181

Marketing and customer development 151 134 135

Regulatory assessments 139 142 181

Credit and collection services 71 91 264

Operating losses 56 441 503

Amortization 40 25 23

Other noninterest expense 1441 498 549

Total noninterest expense 5,160 5,543 5,831

Income before provision for income taxes 2,707 2,278 1,683

Provision for income taxes 1764 493 322

Net income including income attributable to noncontrolling interest 1,943 1,785 1,361

Net income attributable to noncontrolling interest 10 11 17

Net income $1,933 $1,774 $1,344

Net income available to common shareholders $1,863 $1,722 $1,297

Net income per average common share:

Diluted $3.58 $3.23 $2.41

Basic 3.62 3.26 2.43

Dividends declared per common share 0.92 0.70 0.35

Average common shares - diluted 520,586 533,391 539,093

Average common shares - basic 514,844 527,500 534,283

1 Amortization expense related to qualified affordable housing investment costs is recognized in provision for income taxes for each of the periods presented as allowed by an

accounting standard adopted in 2014. Accordingly, $49 million of related amortization expense for the year ended December 31, 2013 was reclassified from other noninterest

expense to provision for income taxes.

See accompanying Notes to Consolidated Financial Statements.