SunTrust 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

111

price and number of shares to be issued upon exercise to be

proportionately adjusted. The amount of such adjustment is

determined by a formula and depends in part on the extent to

which the Company raises its dividend. The formulas are

contained in the warrant agreements which were filed as exhibits

to Form 8-K filed on September 23, 2011.

Substantially all of the Company’s retained earnings are

undistributed earnings of the Bank, which are restricted by

various regulations administered by federal and state bank

regulatory authorities. At December 31, 2015 and 2014, retained

earnings of the Bank available for payment of cash dividends to

the Parent Company under these regulations totaled

approximately $2.7 billion and $2.9 billion, respectively.

Additionally, the Federal Reserve requires the Company to

maintain cash reserves. At December 31, 2015 and 2014, these

reserve requirements totaled $1.0 billion and $1.5 billion,

respectively, and were fulfilled with a combination of cash on

hand and deposits at the Federal Reserve.

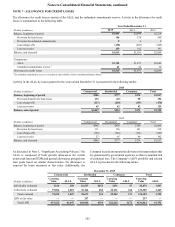

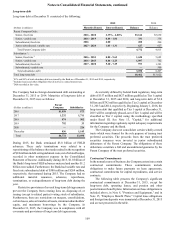

Regulatory Capital

The Company is subject to various regulatory capital

requirements that involve quantitative measures of the

Company’s assets. The following table presents regulatory

capital metrics for SunTrust and the Bank at December 31:

Under Basel III 1 Under Basel I 1

2015 2014

(Dollars in millions) Amount Ratio Amount Ratio

SunTrust Banks, Inc.

CET1 $16,421 9.96% N/A N/A

Tier 1 common equity N/A N/A $15,594 9.60%

Tier 1 capital $17,804 10.80% 17,554 10.80

Total capital 20,668 12.54 20,338 12.51

Leverage 9.69 9.64

SunTrust Bank

CET1 $17,859 11.02% N/A N/A

Tier 1 capital 17,908 11.05 $17,036 10.67%

Total capital 20,101 12.40 19,619 12.29

Leverage 9.96 9.57

1 Basel III Final Rules became effective on January 1, 2015; thus, CET1 is not

applicable ("N/A") in periods ending prior to January 1, 2015 and Basel I Tier 1

common equity is N/A in periods ending after January 1, 2015. Tier 1 capital, Total

capital, and Leverage ratio for periods ended prior to January 1, 2015 were calculated

under Basel I.

On October 11, 2013, the Federal Reserve published final rules

in the Federal Register implementing Basel III. These rules,

which became effective for the Company and the Bank on

January 1, 2015, include the following minimum capital

requirements: CET1 ratio of 4.5%; Tier 1 capital ratio of 6%;

Total capital ratio of 8%; Leverage ratio of 4%; and a capital

conservation buffer of 2.5% of RWA. The capital conservation

buffer is applicable beginning on January 1, 2016 and will be

phased-in through December 31, 2018.

At December 31, 2015, the Company had $627 million in

principal amount of trust preferred securities outstanding. The

Basel III rules require the phase-out of non-qualifying Tier 1

capital instruments such as trust preferred securities.

Accordingly, on January 1, 2015, the Company began phasing-

out of Tier 1 capital its trust preferred and other hybrid capital

securities, and instead began treating them as qualifying Tier 2

capital. Beginning January 1, 2016, these securities will be

completely phased-out of Tier 1 capital and will be classified as

Tier 2 capital, using the methodology specified under Basel III.

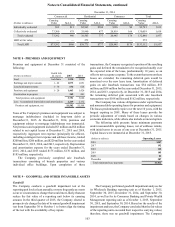

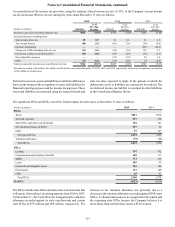

Preferred Stock

Preferred stock at December 31 consisted of the following:

(Dollars in millions) 2015 2014 2013

Series A (1,725 shares outstanding) $172 $172 $172

Series B (1,025 shares outstanding) 103 103 103

Series E (4,500 shares outstanding) 450 450 450

Series F (5,000 shares outstanding) 500 500 —

Total preferred stock $1,225 $1,225 $725

In September 2006, the Company authorized and issued

depositary shares representing ownership interests in 5,000

shares of Perpetual Preferred Stock, Series A, no par value and

$100,000 liquidation preference per share (the Series A Preferred

Stock). The Series A Preferred Stock has no stated maturity and

will not be subject to any sinking fund or other obligation of the

Company. Dividends on the Series A Preferred Stock, if declared,

will accrue and be payable quarterly at a rate per annum equal

to the greater of three-month LIBOR plus 0.53%, or 4.00%.

Dividends on the shares are noncumulative. Shares of the Series

A Preferred Stock have priority over the Company’s common

stock with regard to the payment of dividends and, as such, the

Company may not pay dividends on or repurchase, redeem, or

otherwise acquire for consideration shares of its common stock

unless dividends for the Series A Preferred Stock have been

declared for that period and sufficient funds have been set aside

to make payment. During 2009, the Company repurchased 3,275

shares of the Series A Preferred Stock. In September 2011, the

Series A Preferred Stock became redeemable at the Company’s

option at a redemption price equal to $100,000 per share, plus

any declared and unpaid dividends. Except in certain limited

circumstances, the Series A Preferred Stock does not have any

voting rights.

In December 2011, the Company authorized 5,010 shares

and issued 1,025 shares of Perpetual Preferred Stock, Series B,

no par value and $100,000 liquidation preference per share (the

Series B Preferred Stock). The Series B Preferred Stock has no

stated maturity and will not be subject to any sinking fund or

other obligation of the Company. Dividends on the shares are

noncumulative and, if declared, will accrue and be payable

quarterly at a rate per annum equal to the greater of three-month

LIBOR plus 0.65%, or 4.00%. Shares of the Series B Preferred

Stock have priority over the Company's common stock with

regard to the payment of dividends and, as such, the Company

may not pay dividends on or repurchase, redeem, or otherwise

acquire for consideration shares of its common stock unless

dividends for the Series B Preferred Stock have been declared

for that period and sufficient funds have been set aside to make

payment. The Series B Preferred Stock was immediately

redeemable upon issuance at the Company's option at a

redemption price equal to $100,000 per share, plus any declared

and unpaid dividends. Except in certain limited circumstances,

the Series B Preferred Stock does not have any voting rights.