SunTrust 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

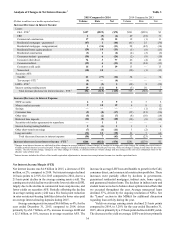

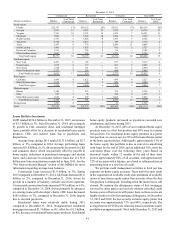

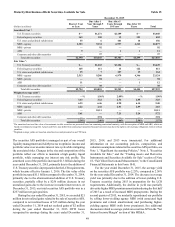

Provision for Credit Losses

The total provision for credit losses includes the provision/

(benefit) for loan losses and the provision/(benefit) for unfunded

commitments. The provision for loan losses is the result of a

detailed analysis performed to estimate an appropriate and

adequate ALLL. During 2015, the total provision for loan losses

decreased $182 million, or 54%, compared to 2014. This decline

in the overall provision for loan losses was driven primarily by

the further improvement in asset quality and lower net charge-

offs in our residential loan portfolio. Partially offsetting this

decline was an increase in our commercial loan loss provision,

primarily reflecting risk rating downgrades of certain energy

clients during 2015. The provision for unfunded commitments

increased during 2015 in response to the downgrade of a specific

unfunded exposure that was individually evaluated for loss

content, and an overall increase in the level of binding unused

commitments.

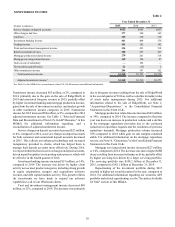

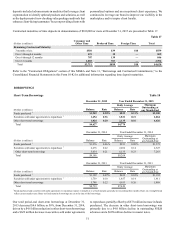

For the first quarter of 2016, we expect the provision for

loan losses to be between $80 million and $110 million, which

is higher than the fourth quarter of 2015, given the abatement of

asset quality improvements and continued loan growth.

However, the ultimate level of reserves and provision will be

determined by our rigorous, quarterly review processes, which

are informed by trends in our LHFI portfolio (including historical

loss experience, expected loss calculations, delinquencies,

performing status, size and composition of the loan portfolio,

and concentrations within the portfolio) combined with a view

on economic conditions. In addition to internal credit quality

metrics, the ALLL estimate is impacted by other indicators of

credit risk associated with the portfolio, such as geopolitical and

economic risks, and the increasing availability of credit and

resultant higher levels of leverage for consumers and commercial

borrowers.

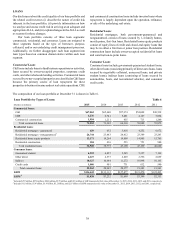

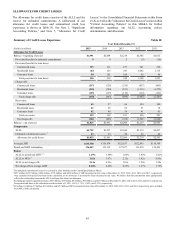

Allowance for Loan and Lease Losses

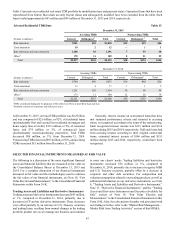

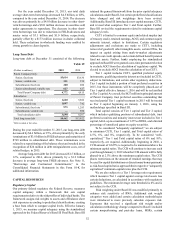

ALLL by Loan Segment Table 11

At December 31

(Dollars in millions) 2015 2014 2013 2012 2011

ALLL:

Commercial loans $1,047 $986 $946 $902 $964

Residential loans 534 777 930 1,131 1,354

Consumer loans 171 174 168 141 139

Total $1,752 $1,937 $2,044 $2,174 $2,457

Segment ALLL as a % of total ALLL:

Commercial loans 60% 51% 46% 41% 39%

Residential loans 30 40 46 52 55

Consumer loans 10 9876

Total 100% 100% 100% 100% 100%

Segment LHFI as a % of total LHFI:

Commercial loans 55% 55% 50% 48% 46%

Residential loans 29 29 34 36 38

Consumer loans 16 16 16 16 16

Total 100% 100% 100% 100% 100%

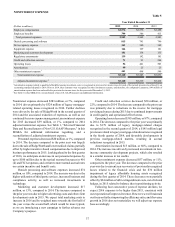

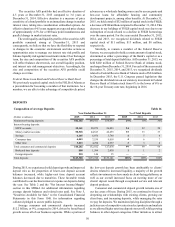

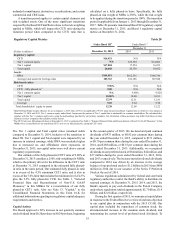

The ALLL decreased $185 million, or 10%, from December 31,

2014, to $1.8 billion at December 31, 2015. The decrease reflects

further improvement in asset quality experienced in 2015. The

ALLL to period-end LHFI ratio decreased 17 basis points from

December 31, 2014, to 1.29% at December 31, 2015, excluding

loans measured at fair value from period-end LHFI in the

calculation. Trends in the ALLL to period-end LHFI ratio will

depend on economic and asset quality conditions (as discussed

above), however, we would expect the ratio to remain generally

stable in 2016. The ratio of the ALLL to total NPLs decreased

to 2.62x at December 31, 2015, compared to 3.07x at

December 31, 2014, resulting from an increase in NPLs due

largely to the increase in specific energy-related NPLs during

2015 and the decrease in ALLL.