SunTrust 2015 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

148

NOTE 19 – CONTINGENCIES

Litigation and Regulatory Matters

In the ordinary course of business, the Company and its

subsidiaries are parties to numerous civil claims and lawsuits

and subject to regulatory examinations, investigations, and

requests for information. Some of these matters involve claims

for substantial amounts. The Company’s experience has shown

that the damages alleged by plaintiffs or claimants are often

overstated, based on unsubstantiated legal theories, unsupported

by facts, and/or bear no relation to the ultimate award that a court

might grant. Additionally, the outcome of litigation and

regulatory matters and the timing of ultimate resolution are

inherently difficult to predict. These factors make it difficult for

the Company to provide a meaningful estimate of the range of

reasonably possible outcomes of claims in the aggregate or by

individual claim. However, on a case-by-case basis, reserves are

established for those legal claims in which it is probable that a

loss will be incurred and the amount of such loss can be

reasonably estimated. The Company's financial statements at

December 31, 2015 reflect the Company's current best estimate

of probable losses associated with these matters, including costs

to comply with various settlement agreements, where applicable.

The actual costs of resolving these claims may be substantially

higher or lower than the amounts reserved.

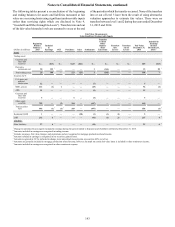

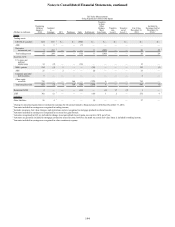

For a limited number of legal matters in which the Company

is involved, the Company is able to estimate a range of reasonably

possible losses in excess of related reserves, if any. Management

currently estimates these losses to range from $0 to

approximately $170 million. This estimated range of reasonably

possible losses represents the estimated possible losses over the

life of such legal matters, which may span a currently

indeterminable number of years, and is based on information

available at December 31, 2015. The matters underlying the

estimated range will change from time to time, and actual results

may vary significantly from this estimate. Those matters for

which an estimate is not possible are not included within this

estimated range; therefore, this estimated range does not

represent the Company’s maximum loss exposure. Based on

current knowledge, it is the opinion of management that

liabilities arising from legal claims in excess of the amounts

currently reserved, if any, will not have a material impact on the

Company’s financial condition, results of operations, or cash

flows. However, in light of the significant uncertainties involved

in these matters and the large or indeterminate damages sought

in some of these matters, an adverse outcome in one or more of

these matters could be material to the Company’s financial

condition, results of operations, or cash flows for any given

reporting period.

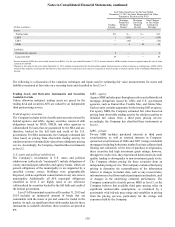

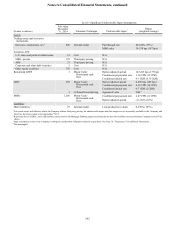

The following is a description of certain litigation and regulatory

matters:

Card Association Antitrust Litigation

The Company is a defendant, along with Visa and MasterCard,

as well as several other banks, in several antitrust lawsuits

challenging their practices. For a discussion regarding the

Company’s involvement in this litigation matter, see Note 16,

“Guarantees.”

Lehman Brothers Holdings, Inc. Litigation

Beginning in October 2008, STRH, along with other

underwriters and individuals, were named as defendants in

several individual and putative class action complaints filed in

the U.S. District Court for the Southern District of New York

and state and federal courts in Arkansas, California, Texas, and

Washington. Plaintiffs alleged violations of Sections 11 and 12

of the Securities Act of 1933 and/or state law for allegedly false

and misleading disclosures in connection with various debt and

preferred stock offerings of Lehman Brothers Holdings, Inc.

("Lehman Brothers") and sought unspecified damages. All cases

were transferred for coordination to the multi-district litigation

captioned In re Lehman Brothers Equity/Debt Securities

Litigation pending in the U.S. District Court for the Southern

District of New York. Defendants filed a motion to dismiss all

claims asserted in the class action. On July 27, 2011, the District

Court granted in part and denied in part the motion to dismiss

the claims against STRH and the other underwriter defendants

in the class action. A settlement with the class plaintiffs was

approved by the Court and the class settlement approval process

was completed. A number of individual lawsuits and smaller

putative class actions remained following the class settlement.

STRH settled two such individual actions. The other individual

lawsuits were dismissed. In two of such dismissed individual

actions, the plaintiffs were unable to appeal the dismissals of

their claims until their claims against a third party were resolved.

In one of these individual actions, the plaintiffs have filed a notice

of appeal to the Second Circuit Court of Appeals. Oral argument

in that appeal is expected to occur in 2016. In the other individual

action, no appeal has been filed.

Bickerstaff v. SunTrust Bank

This case was filed in the Fulton County State Court on July 12,

2010, and an amended complaint was filed on August 9, 2010.

Plaintiff asserts that all overdraft fees charged to his account

which related to debit card and ATM transactions are actually

interest charges and therefore subject to the usury laws of

Georgia. Plaintiff has brought claims for violations of civil and

criminal usury laws, conversion, and money had and received,

and purports to bring the action on behalf of all Georgia citizens

who incurred such overdraft fees within the four years before

the complaint was filed where the overdraft fee resulted in an

interest rate being charged in excess of the usury rate. The Bank

filed a motion to compel arbitration and on March 16, 2012, the

Court entered an order holding that the Bank's arbitration

provision is enforceable but that the named plaintiff in the case

had opted out of that provision pursuant to its terms. The Court

explicitly stated that it was not ruling at that time on the question

of whether the named plaintiff could have opted out for the

putative class members. The Bank filed an appeal of this

decision, but this appeal was dismissed based on a finding that

the appeal was prematurely granted. On April 8, 2013, the

plaintiff filed a motion for class certification and that motion was

denied on February 19, 2014. Plaintiff appealed the denial of

class certification and on September 8, 2015, the Georgia

Supreme Court agreed to hear the appeal.