SunTrust 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

91

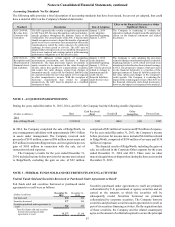

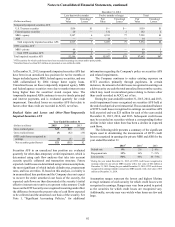

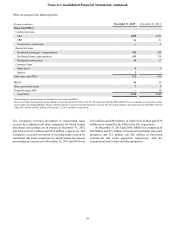

The following table presents the amortized cost, fair value, and weighted average yield of investments in debt securities AFS at

December 31, 2015, by remaining contractual maturity, with the exception of MBS and ABS, which are based on estimated average

life. Receipt of cash flows may differ from contractual maturities because borrowers may have the right to call or prepay obligations

with or without penalties.

Distribution of Remaining Maturities

(Dollars in millions)

Due in 1 Year

or Less

Due After 1

Year through 5

Years

Due After 5

Years through

10 Years

Due After 10

Years Total

Amortized Cost:

U.S. Treasury securities $— $1,271 $2,189 $— $3,460

Federal agency securities 163 105 13 121 402

U.S. states and political subdivisions 35 6 101 14 156

MBS - agency 2,383 9,134 6,997 4,363 22,877

MBS - private —92——92

ABS 9 — 1 1 11

Corporate and other debt securities —37——37

Total debt securities AFS $2,590 $10,645 $9,301 $4,499 $27,035

Fair Value:

U.S. Treasury securities $— $1,265 $2,184 $— $3,449

Federal agency securities 165 111 13 122 411

U.S. states and political subdivisions 35 7 107 15 164

MBS - agency 2,513 9,286 6,979 4,346 23,124

MBS - private —94——94

ABS 11 — — 1 12

Corporate and other debt securities —38——38

Total debt securities AFS $2,724 $10,801 $9,283 $4,484 $27,292

Weighted average yield 12.38% 2.40% 2.66% 2.90% 2.57%

1 Weighted average yields are based on amortized cost and are presented on an FTE basis.

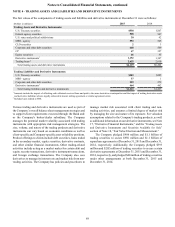

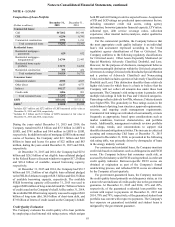

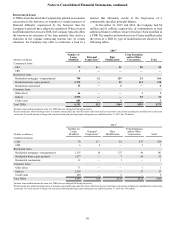

Securities AFS in an Unrealized Loss Position

The Company held certain investment securities AFS where

amortized cost exceeded fair value, resulting in unrealized loss

positions. Market changes in interest rates and credit spreads

may result in temporary unrealized losses as the market prices

of securities fluctuate. At December 31, 2015, the Company did

not intend to sell these securities nor was it more-likely-than-not

that the Company would be required to sell these securities before

their anticipated recovery or maturity. The Company reviewed

its portfolio for OTTI in accordance with the accounting policies

described in Note 1, "Significant Accounting Policies."

Securities AFS in an unrealized loss position at period end are presented in the following tables.

December 31, 2015

Less than twelve months Twelve months or longer Total

(Dollars in millions)

Fair

Value

Unrealized

Losses 2Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses 2

Temporarily impaired securities AFS:

U.S. Treasury securities $2,169 $14 $— $— $2,169 $14

Federal agency securities 75 — 34 1 109 1

MBS - agency 11,434 114 958 36 12,392 150

ABS — — 7 1 7 1

Other equity securities 3 1 — — 3 1

Total temporarily impaired securities AFS 13,681 129 999 38 14,680 167

OTTI securities AFS 1:

ABS 1 — — — 1 —

Total OTTI securities AFS 1 — — — 1 —

Total impaired securities AFS $13,682 $129 $999 $38 $14,681 $167