Sallie Mae 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

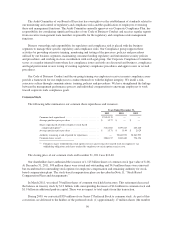

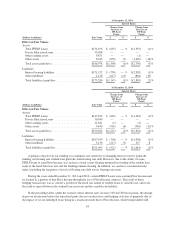

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Interest Rate Sensitivity Analysis

Our interest rate risk management seeks to limit the impact of short-term movements in interest rates on our

results of operations and financial position. The following tables summarize the potential effect on earnings over

the next 12 months and the potential effect on fair values of balance sheet assets and liabilities at December 31,

2011 and 2010, based upon a sensitivity analysis performed by management assuming a hypothetical increase in

market interest rates of 100 basis points and 300 basis points while funding spreads remain constant.

Additionally, as it relates to the effect on earnings, a sensitivity analysis was performed assuming the funding

index increases 25 basis points while holding the asset index constant, if the funding index is different than the

asset index. The earnings sensitivity is applied only to financial assets and liabilities, including hedging

instruments, that existed at the balance sheet date and does not take into account new assets, liabilities or hedging

instruments that may arise in 2012.

As of December 31, 2011

Impact on Annual Earnings If:

As of December 31, 2010

Impact on Annual Earnings If:

Interest Rates:

Funding

Spreads Interest Rates:

Funding

Spreads

(Dollars in millions, except per share amounts)

Increase

100 Basis

Points

Increase

300 Basis

Points

Increase

25 Basis

Points(1)

Increase

100 Basis

Points

Increase

300 Basis

Points

Increase

25 Basis

Points(1)

Effect on Earnings

Change in pre-tax net income before unrealized

gains (losses) on derivative and hedging

activities ................................ $ 3 $ 61 $(419) $(129) $ (140) $ (368)

Unrealized gains (losses) on derivative and hedging

activities ................................ 493 814 (16) 131 82 (28)

Increase in net income before taxes ............. $496 $ 875 $(435) $ 2 $ (58) $ (396)

Increase in diluted earnings per common share .... $.965 $1.702 $(.846) $.004 $(0.110) $(.746)

(1) If an asset is not funded with the same index/frequency reset of the asset then it is assumed the funding index increases 25 basis points

while holding the asset index constant.

92