Sallie Mae 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

this facility can be put to ED at the conclusion of the program thus eliminating a call on our liquidity, we intend

to refinance these assets in the term ABS market prior to the facility’s expiration. In addition, capacity is

maintained in our FFELP ABCP Facility and our FHLB-DM Facility to finance a portion of this collateral should

term financing not be achieved or available.

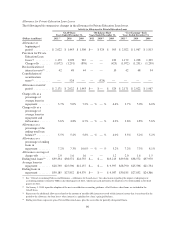

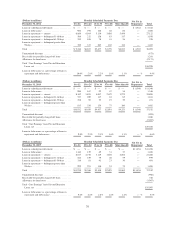

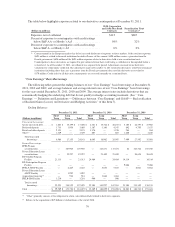

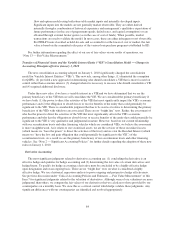

Sources of Liquidity and Available Capacity

The following tables detail our main sources of primary liquidity and our main sources of secondary

liquidity (unused secured credit facilities contingent upon obtaining eligible collateral).

(Dollars in millions) December 31, 2011 December 31, 2010

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Cash and cash equivalents .................. $ 2,794 $ 4,342

Investments ............................. 71 85

Total unrestricted cash and liquid investments(1) . . $ 2,865 $ 4,427

Unencumbered FFELP Loans ................. $ 994 $ 1,441

Sources of secondary liquidity contingent on

obtaining eligible collateral:

Unused secured credit facilities: FFELP ABCP

Facilities and FHLB-DM Facility(2) ............ $11,312 $12,601

(1) At December 31, 2011 and 2010, ending balances include $1.5 billion and $2.0 billion, respectively, of cash and liquid

investments at the Bank. This cash will be used primarily to originate or acquire student loans at the Bank. Our ability to pay

dividends from the Bank is subject to capital and liquidity requirements applicable to the Bank.

(2) Current borrowing capacity under the FFELP ABCP Facilities and FHLB-DM Facility is determined based on qualifying

collateral from the unencumbered FFELP Loans reported in primary liquidity above. Additional borrowing capacity would

primarily be used to fund FFELP Loan portfolio acquisitions and to refinance FFELP Loans used as collateral in the ED

Conduit Program Facility. The total amount we can borrow is contingent upon obtaining eligible collateral. If we use our

unencumbered FFELP Loans as collateral to borrow against these facilities, the remaining amount we could borrow is

reduced accordingly.

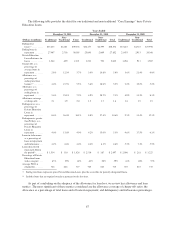

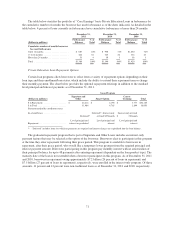

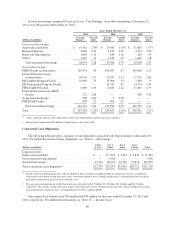

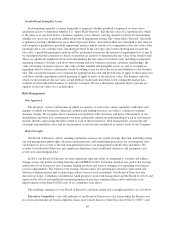

Average Balances

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Cash and cash equivalents .............................. $ 3,623 $ 6,078 $5,713

Investments .......................................... 95 94 145

Total unrestricted cash and liquid investments(1) ............... $ 3,718 $ 6,172 $5,858

Unused bank lines of credit ............................... $ — $ 2,069 $4,014

Unencumbered FFELP Loans ............................. $ 1,399 $ 1,897 $3,507

Sources of secondary liquidity contingent on obtaining eligible

collateral:

Unused secured credit facilities: FFELP ABCP Facilities and

FHLB-DM Facility(2) .................................. $11,356 $12,947 $1,802

(1) For the years ended December 31, 2011, 2010 and 2009, average balances include $1.2 billion, $2.3 billion and $2.0 billion,

respectively, of cash and liquid investments at the Bank. This cash will be used primarily to originate or acquire student loans at the

Bank. Our ability to pay dividends from the Bank is subject to capital and liquidity requirements applicable to the Bank.

(2) Current borrowing capacity under the FFELP ABCP Facilities and FHLB-DM Facility is determined based on qualifying collateral

from the unencumbered FFELP Loans reported in primary liquidity above. Additional borrowing capacity would primarily be used

to fund FFELP Loan portfolio acquisitions and to refinance FFELP Loans used as collateral in the ED Conduit Program Facility.

The total amount we can borrow is contingent upon obtaining eligible collateral. If we use our unencumbered FFELP Loans as

collateral to borrow against these facilities, the remaining amount we could borrow is reduced accordingly.

76