Sallie Mae 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

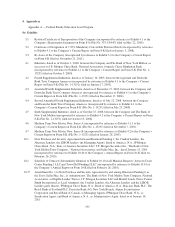

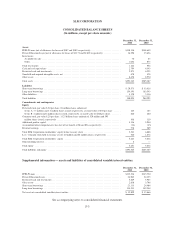

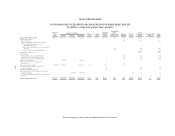

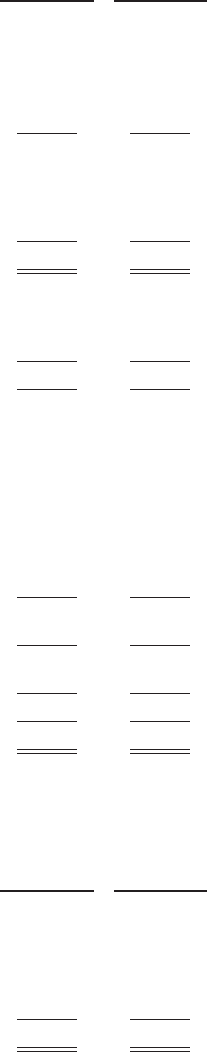

SLM CORPORATION

CONSOLIDATED BALANCE SHEETS

(In millions, except per share amounts)

December 31,

2011

December 31,

2010

Assets

FFELP Loans (net of allowance for losses of $187 and $189, respectively) .......................... $138,130 $148,649

Private Education Loans (net of allowance for losses of $2,171 and $2,022 respectively) ............... 36,290 35,656

Investments

Available-for-sale ..................................................................... 70 83

Other ............................................................................... 1,052 873

Total investments ....................................................................... 1,122 956

Cash and cash equivalents ................................................................ 2,794 4,343

Restricted cash and investments ............................................................ 5,873 6,255

Goodwill and acquired intangible assets, net .................................................. 478 478

Other assets ........................................................................... 8,658 8,970

Total assets ............................................................................ $193,345 $205,307

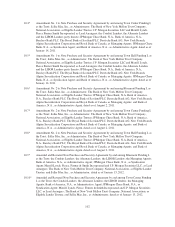

Liabilities

Short-term borrowings ................................................................... $ 29,573 $ 33,616

Long-term borrowings ................................................................... 154,393 163,543

Other liabilities ......................................................................... 4,128 3,136

Total liabilities ......................................................................... 188,094 200,295

Commitments and contingencies

Equity

Preferred stock, par value $.20 per share, 20 million shares authorized

Series A: 3.3 million and 3.3 million shares issued, respectively, at stated value of $50 per share ...... 165 165

Series B: 4 million and 4 million shares issued, respectively, at stated value of $100 per share ......... 400 400

Common stock, par value $.20 per share, 1.125 billion shares authorized: 529 million and 595

million shares issued, respectively ........................................................ 106 119

Additional paid-in capital ................................................................. 4,136 5,940

Accumulated other comprehensive loss (net of tax benefit of $8 and $26, respectively) ................ (14) (45)

Retained earnings ....................................................................... 770 309

Total SLM Corporation stockholders’ equity before treasury stock ................................ 5,563 6,888

Less: Common stock held in treasury at cost: 20 million and 68 million shares, respectively ............ 320 1,876

Total SLM Corporation stockholders’ equity ................................................. 5,243 5,012

Noncontrolling interest ................................................................... 8 —

Total equity ........................................................................... 5,251 5,012

Total liabilities and equity ................................................................ $193,345 $205,307

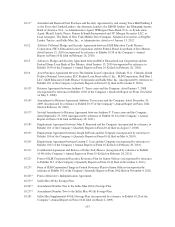

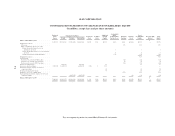

Supplemental information — assets and liabilities of consolidated variable interest entities:

December 31,

2011

December 31,

2010

FFELP Loans .......................................................................... $135,536 $145,750

Private Education Loans .................................................................. 24,962 24,355

Restricted cash and investments ............................................................ 5,609 5,983

Other assets ........................................................................... 2,638 3,706

Short-term borrowings ................................................................... 21,313 24,484

Long-term borrowings ................................................................... 134,533 142,244

Net assets of consolidated variable interest entities ............................................. $ 12,899 $ 13,066

See accompanying notes to consolidated financial statements.

F-3