Sallie Mae 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

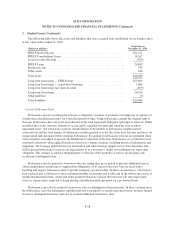

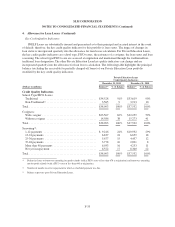

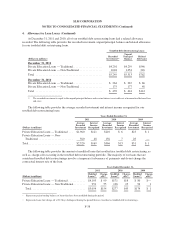

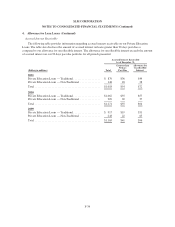

4. Allowance for Loan Losses (Continued)

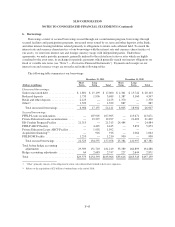

At December 31, 2011 and 2010, all of our troubled debt restructuring loans had a related allowance

recorded. The following table provides the recorded investment, unpaid principal balance and related allowance

for our troubled debt restructuring loans.

Troubled Debt Restructuring Loans

(Dollars in millions)

Recorded

Investment(1)

Unpaid

Principal

Balance

Related

Allowance

December 31, 2011

Private Education Loans — Traditional .................... $4,201 $4,259 $546

Private Education Loans — Non-Traditional ................ 1,048 1,054 216

Total ............................................... $5,249 $5,313 $762

December 31, 2010

Private Education Loans — Traditional .................... $ 264 $ 267 $ 66

Private Education Loans — Non-Traditional ................ 175 177 48

Total ............................................... $ 439 $ 444 $114

(1) The recorded investment is equal to the unpaid principal balance and accrued interest receivable net of unamortized deferred fees

and costs.

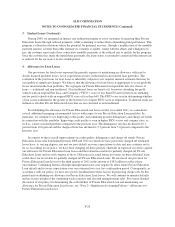

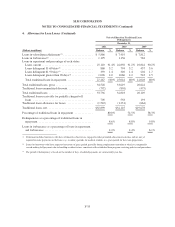

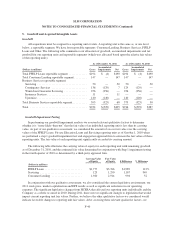

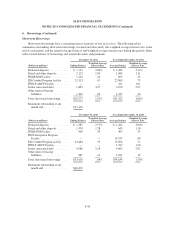

The following table provides the average recorded investment and interest income recognized for our

troubled debt restructuring loans.

Years Ended December 31,

2011 2010 2009

(Dollars in millions)

Average

Recorded

Investment

Interest

Income

Recognized

Average

Recorded

Investment

Interest

Income

Recognized

Average

Recorded

Investment

Interest

Income

Recognized

Private Education Loans — Traditional . . . $1,960 $121 $210 $ 6 $23 $ 1

Private Education Loans — Non-

Traditional ........................ 560 48 156 7 28 —

Total ............................... $2,520 $169 $366 $13 $51 $ 1

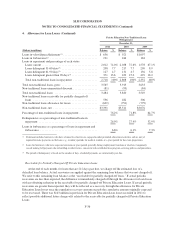

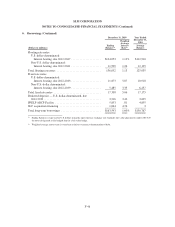

The following table provides the amount of modified loans that resulted in a troubled debt restructuring, as

well as, charge-offs occurring in the troubled debt restructuring portfolio. The majority of our loans that are

considered troubled debt restructurings involve a temporary forbearance of payments and do not change the

contractual interest rate of the loan.

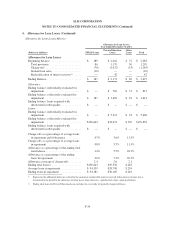

Years Ended December 31,

2011 2010 2009

(Dollars in millions)

Modified

Loans(1)

Charge-

offs(2)

Modified

Loans(1)

Charge-

offs(2)

Modified

Loans(1)

Charge-

offs(2)

Private Education Loans — Traditional ............ $4,103 $ 99 $171 $18 $ 80 $—

Private Education Loans — Non-Traditional ........ 951 55 106 25 94 1

Total ..................................... $5,054 $154 $277 $43 $174 $ 1

(1) Represents period ending balance of loans that have been modified during the period.

(2) Represents loans that charge off at 212 days delinquent during the period that are classified as troubled debt restructurings.

F-38