Sallie Mae 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Step 3: Consider affordable Private Education Loans to fill the gap.

We offer Private Education Loan products to bridge the gap between family resources, federal loans, grants,

student aid and scholarships, and the cost of a college education. While we actively maintain our presence in

school marketing channels, we also continue to develop and evolve our marketing efforts through various other

direct and indirect marketing channels, such as direct mailings, internet channels and marketing alliances with

various banks and financial institutions.

We regularly review the terms of our Private Education Loan products to explore ways to minimize finance

charges and incorporate additional consumer protections. Today, the Smart Option Student Loan offers a choice

of payment options: 1) interest-only payments while the student is in school; 2) fixed monthly payments of $25

while the student is in school; and 3) no payment required while the student is in school. We believe these

repayment options encourage payments while in school and, when combined with shorter repayment terms

customized for each borrower, can result in far lower costs to borrowers over the life of their loans. Our Private

Education Loans are certified to us by higher education institutions to ensure borrowing does not exceed the cost

of attendance, and can include important protections for the family, including tuition insurance, and death and

disability loan forgiveness.

The Higher Education Opportunity Act of 2008 established a series of new disclosures that provide private

education loan customers clear, consistent, and easy-to-compare information about Private Education Loans

offered by different lenders. These disclosures inform borrowers of the potential life-of-loan costs and provide

multiple reminders of the availability of federal loans. When a customer is approved for the loan, we send a

disclosure that provides very specific information about the loan’s terms and that gives instructions on how to

accept the terms of the loan. When a customer accepts the terms of the loan, we send a disclosure that confirms

the loan information and also notifies the customer of a right-to-cancel period.

Additionally, we provide information to customers during the application process to allow them to compare

the full cost of different repayment plans. We also provide a 60-day loan cancellation period within which

borrowers have the ability to repay their loans after disbursement with no interest or fees should a borrower

change his or her mind.

Business Segments

We have three primary operating business segments — the Consumer Lending segment, the Business

Services segment and FFELP Loans segment. A fourth segment — Other, primarily consists of the financial

results of our holding company, including activities related to the repurchase of debt, the corporate liquidity

portfolio, all overhead and results from smaller wind-down and discontinued operations within this segment.

A summary of financial information for each of our business segments for each of the last three fiscal years

is included in “Note 16—Segment Reporting” to the consolidated financial statements.

Consumer Lending Segment

In this segment, we originate, acquire, finance and service Private Education Loans. The Private Education

Loans we make are largely to bridge the gap between the cost of higher education and the amount funded through

financial aid, federal loans or borrowers’ resources.

Private Education Loans bear the full credit risk of the borrower. We manage this risk by underwriting and

pricing according to credit risk based upon customized credit scoring criteria and the addition of qualified

cosigners. For the year ended December 31, 2011, our annual charge-off rate for Private Education Loans (as a

percentage of loans in repayment) was 3.7 percent, as compared with 5.0 percent for the prior year.

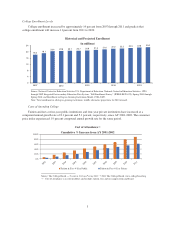

In 2011 we originated $2.7 billion of Private Education Loans, an increase of 19 percent from the prior year

even as borrowings under Private Education Loan programs contracted by approximately 12 percent. As of

December 31, 2011 and 2010, we had $36.3 billion and $35.7 billion of Private Education Loans outstanding,

respectively. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of

5