Sallie Mae 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

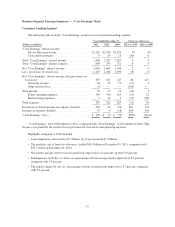

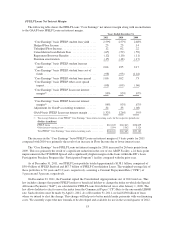

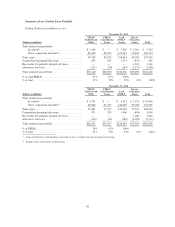

FFELP Loans Provision for Loan Losses and Charge-Offs

The following table summarizes the total FFELP Loan provision for loan losses and charge-offs on both a

GAAP-basis and a “Core Earnings” basis.

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

FFELP Loan provision for loan losses, GAAP ................. $86 $98 $106

FFELP Loan provision for loan losses, “Core Earnings” basis ..... $86 $98 $119

FFELP Loan charge-offs, GAAP ........................... $78 $87 $ 79

FFELP Loan charge-offs, “Core Earnings” basis ............... $78 $87 $ 94

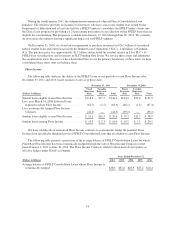

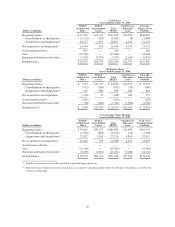

Servicing Revenue and Other Income — FFELP Loans Segment

The following table summarizes the components of “Core Earnings” other income for our FFELP Loans

segment.

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

Servicing revenue ....................................... $ 85 $ 68 $ 75

Gains on loans and investments, net ......................... — 325 284

Other ................................................. 1 (5) 8

Total other income, net ................................... $ 86 $388 $367

Servicing revenue for our FFELP Loans segment primarily consists of borrower late fees.

The gains on loans and investments in 2010 and 2009 related primarily to the sale of $20.4 billion and

$18.5 billion loans, respectively, of FFELP Loans to ED as part of the ED Purchase Program.

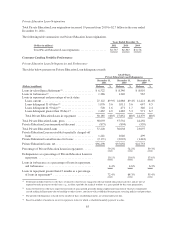

Operating Expenses — FFELP Loans Segment

Operating expenses for our FFELP Loans segment primarily include the contractual rates we pay to service

loans in term asset-backed securitization trusts or a similar rate if a loan is not in a term financing facility (which

is presented as an intercompany charge from the Business Services segment who services the loans), the fees we

pay for third-party loan servicing and costs incurred to acquire loans. The intercompany revenue charged from

the Business Services segment and included in those amounts was $739 million, $648 million and $659 million

for the years ended December 31, 2011, 2010 and 2009, respectively. These amounts exceed the actual cost of

servicing the loans.

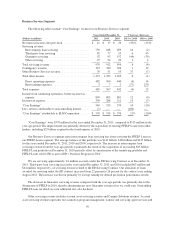

2011 versus 2010

The increase in operating expenses from the prior year was primarily the result of the increase in servicing

costs related to the $25 billion loan portfolio acquisition on December 31, 2010. Operating expenses, excluding

restructuring-related asset impairments, were 53 basis points and 51 basis points of average FFELP Loans in the

years ended December 31, 2011 and 2010, respectively.

2010 versus 2009

Operating expenses decreased $18 million from the prior year, primarily due to the effect of our cost cutting

initiative in connection with the passage of HCERA. This was partially offset by a one-time fee paid to acquire

55