Sallie Mae 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Audit Committee of our Board of Directors has oversight over the establishment of standards related to

our monitoring and control of regulatory and compliance risks and the qualification of employees overseeing

these risk management functions. The Audit Committee annually approves our Corporate Compliance Plan, has

responsibility for considering significant breaches of our Code of Business Conduct and receives regular reports

from executive management team members responsible for the regulatory and compliance risk management

functions.

Primary ownership and responsibility for regulatory and compliance risk is placed with the business

segments to manage their specific regulatory and compliance risks. Our Compliance group supports these

activities by providing extensive training, monitoring and testing of the processes, policies and procedures

utilized by our business segments, maintaining consumer lending regulatory and information security policies

and procedures, and working in close coordination with our Legal group. Our Corporate Compliance Committee

serves as a regular internal forum where key compliance issues and risks are discussed and business, compliance

and legal professional review testing of existing regulatory compliance procedures and approve new or revised

procedures.

Our Code of Business Conduct and the on-going training our employees receive in many compliance areas

provide a framework for our employees to conduct themselves with the highest integrity. We instill a risk-

conscious culture through communications, training, policies and procedures. We have strengthened the linkage

between the management performance process and individual compensation to encourage employees to work

toward corporate-wide compliance goals.

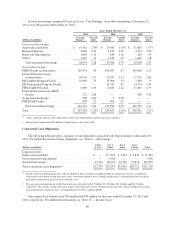

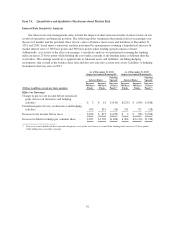

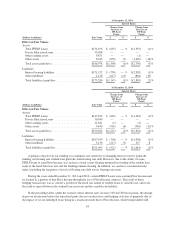

Common Stock

The following table summarizes our common share repurchases and issuances.

Years Ended December 31,

2011 2010 2009

Common stock repurchased ............................. 19,054,115 — —

Average purchase price per share ........................ $ 15.77 $ — $ —

Shares repurchased related to employee stock-based

compensation plans(1) ................................ 3,024,662 1,097,647 263,640

Average purchase price per share ........................ $ 15.71 $ 13.44 $ 20.29

Authority remaining at end of period for repurchases ......... — 38,841,923 38,841,923

Common shares issued ................................. 3,886,217 1,803,683 536,134

(1) Comprises shares withheld from stock option exercises and vesting of restricted stock for employees’ tax

withholding obligations and shares tendered by employees to satisfy option exercise costs.

The closing price of our common stock on December 31, 2011 was $13.40.

Our shareholders have authorized the issuance of 1.125 billion shares of common stock (par value of $.20).

At December 31, 2011, 509 million shares were issued and outstanding and 34.9 million shares were unissued

but encumbered for outstanding stock options for employee compensation and remaining authority for stock-

based compensation plans. The stock-based compensation plans are described in Note 11, “Stock-Based

Compensation Plans and Arrangements.”

In March 2011, we retired 70 million shares of common stock held in treasury. This retirement decreased

the balance in treasury stock by $1.9 billion, with corresponding decreases of $14 million in common stock and

$1.9 billion in additional paid-in capital. There was no impact to total equity from this transaction.

During 2009, we converted $339 million of our Series C Preferred Stock to common stock. As part of this

conversion, we delivered to the holders of the preferred stock: (1) approximately 17 million shares (the number

90