Sallie Mae 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

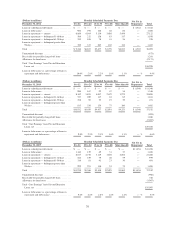

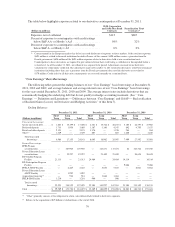

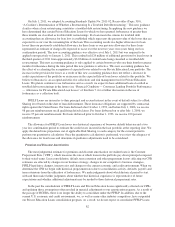

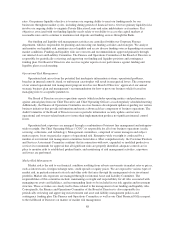

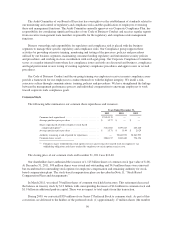

Secured borrowings comprised 87 percent of our “Core Earnings” basis debt outstanding at December 31,

2011 versus 86 percent at December 31, 2010.

Years Ended December 31,

2011 2010 2009

(Dollars in millions)

Average

Balance

Average

Rate

Average

Balance

Average

Rate

Average

Balance

Average

Rate

Unsecured borrowings:

Senior unsecured debt ............... $ 19,562 2.34% $ 24,480 1.70% $ 31,863 1.77%

Brokered deposits ................... 3,660 2.35 5,123 2.65 4,754 3.50

Retail and other deposits ............. 1,684 1.11 644 1.16 128 .59

Other(1) ........................... 1,187 .17 1,159 .19 1,263 .28

Total unsecured borrowings ......... 26,093 2.16 31,406 1.79 38,008 1.94

Secured borrowings:

FFELP Loans securitizations .......... 110,474 .93 100,967 .87 105,069 1.15

Private Education Loans

securitizations .................... 20,976 2.17 21,367 2.13 17,731 1.83

ED Conduit Program Facility ......... 22,869 .75 15,096 .70 7,340 .75

ED Participation Program Facility ...... — — 13,537 .81 14,174 1.43

FFELP ABCP Facility ............... 4,989 1.05 6,623 1.24 15,401 2.79

Private Education Loans ABCP

Facility ......................... 272 2.08 — — 838 5.56

Acquisition financing(2) .............. 998 4.81 3 5.28 — —

FHLB-DM Facility .................. 893 .25 403 .35 — —

Total secured borrowings ........... 161,471 1.09 157,996 1.03 160,553 1.41

Total ............................. $ 187,564 1.24% $ 189,402 1.16% $ 198,561 1.51%

(1) “Other” primarily consists of the obligation to return cash collateral held related to derivative exposure.

(2) Relates to the acquisition of $25 billion of student loans at the end of 2010.

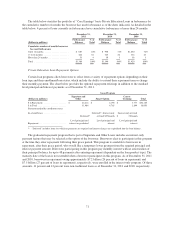

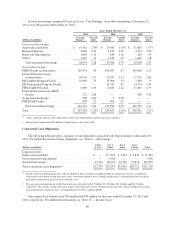

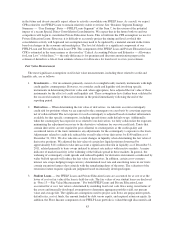

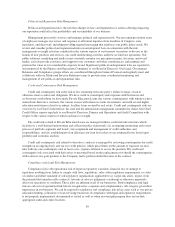

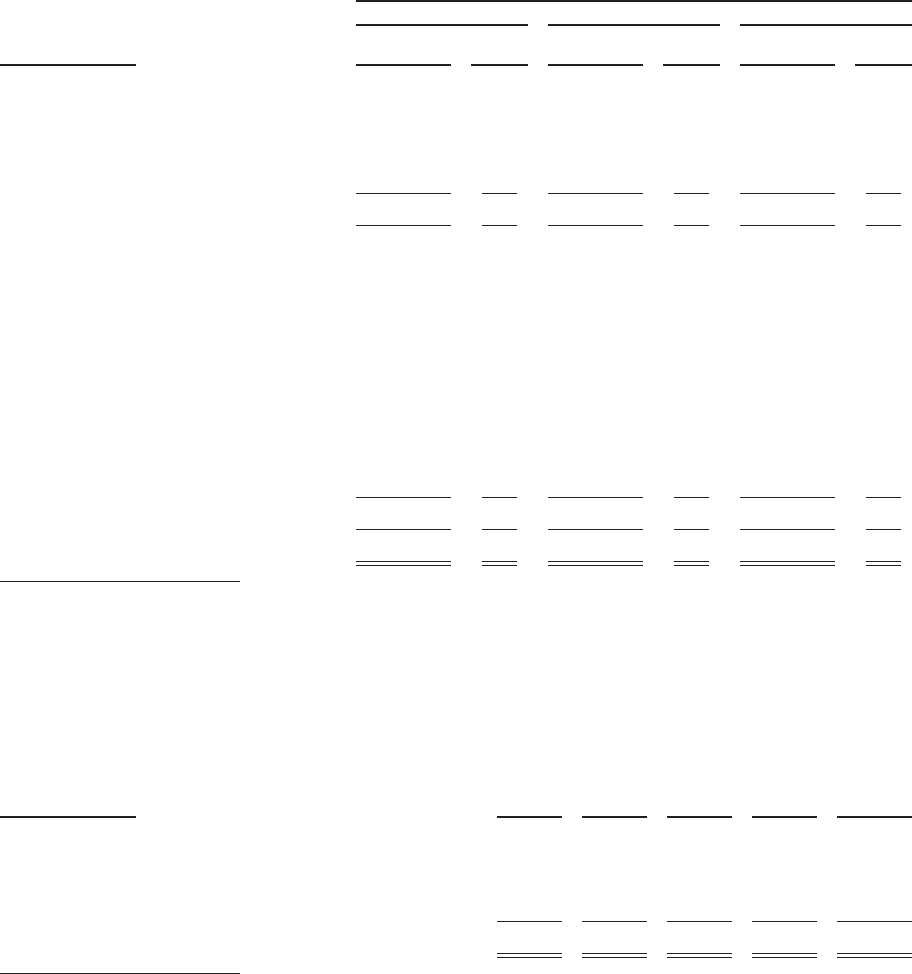

Contractual Cash Obligations

The following table provides a summary of our obligations associated with long-term notes at December 31,

2011. For further discussion of these obligations, see “Note 6 — Borrowings.”

(Dollars in millions)

1 Year

or Less

2to3

Years

4to5

Years

Over

5 Years Total

Long-term notes:

Senior unsecured debt ............................. $ — $ 5,354 $ 3,012 $ 6,833 $ 15,199

Unsecured term bank deposits ....................... — 1,956 — — 1,956

Secured borrowings(1) .............................. 12,795 26,933 18,949 75,878 134,555

Total contractual cash obligations(2) ................... $12,795 $34,243 $21,961 $82,711 $151,710

(1) Includes long-term beneficial interests of $127.2 billion of notes issued by consolidated VIEs in conjunction with our securitization

transactions and included in long-term notes in the consolidated balance sheet. Timing of obligations is estimated based on our current

projection of prepayment speeds of the securitized assets.

(2) The aggregate principal amount of debt that matures in each period is $12.9 billion, $34.5 billion, $22.1 billion and $83.3 billion,

respectively. Specifically excludes derivative market value adjustments of $2.7 billion for long-term notes. Interest obligations on notes

are predominantly variable in nature, resetting quarterly based on 3-month LIBOR.

Unrecognized tax benefits were $40 million and $39 million for the years ended December 31, 2011 and

2010, respectively. For additional information, see “Note 15 — Income Taxes.”

80