Sallie Mae 2011 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

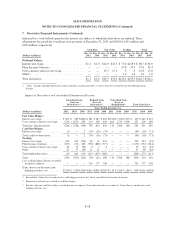

7. Derivative Financial Instruments (Continued)

counterparties (including accrued interest and net of premiums receivable) of $306 million and have posted $302

million of collateral to these counterparties. If the credit contingent feature was triggered for these two

counterparties and the counterparties exercised their right to terminate, we would be required to deliver

additional assets totaling $4 million to settle the contracts. Trust related derivatives do not contain credit

contingent features related to our or the trusts’ credit ratings.

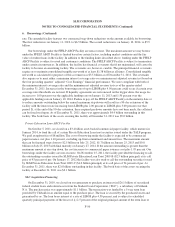

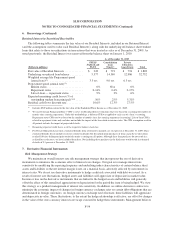

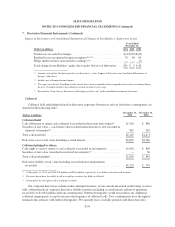

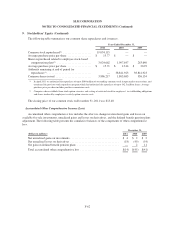

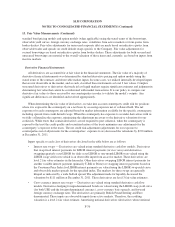

8. Other Assets

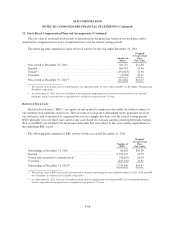

The following table provides the detail of our other assets.

December 31, 2011 December 31, 2010

(Dollars in millions)

Ending

Balance

%of

Balance

Ending

Balance

%of

Balance

Accrued interest receivable ........................... $2,484 29% $2,927 33%

Derivatives at fair value .............................. 2,202 25 2,437 27

Income tax asset, net current and deferred ............... 1,427 17 1,283 14

Accounts receivable — general ........................ 1,392 16 730 8

Benefit and insurance-related investments ............... 466 5 462 5

Fixed assets, net .................................... 214 3 291 4

Other loans, net .................................... 193 2 271 3

Other ............................................ 280 3 569 6

Total ........................................... $8,658 100% $8,970 100%

The “Derivatives at fair value” line in the above table represents the fair value of our derivatives in a gain

position by counterparty, exclusive of accrued interest and collateral. At December 31, 2011 and 2010, these

balances included $2.5 billion and $2.7 billion, respectively, of cross-currency interest rate swaps and interest

rate swaps designated as fair value hedges that were offset by an increase in interest-bearing liabilities related to

the hedged debt. As of December 31, 2011 and 2010, the cumulative mark-to-market adjustment to the hedged

debt was $(2.7) billion and $(2.9) billion, respectively.

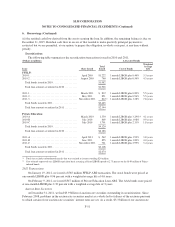

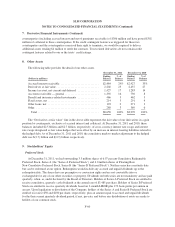

9. Stockholders’ Equity

Preferred Stock

At December 31, 2011, we had outstanding 3.3 million shares of 6.97 percent Cumulative Redeemable

Preferred Stock, Series A (the “Series A Preferred Stock”) and 4.0 million shares of Floating-Rate

Non-Cumulative Preferred Stock, Series B (the “Series B Preferred Stock”). Neither series has a maturity date

but can be redeemed at our option. Redemption would include any accrued and unpaid dividends up to the

redemption date. The shares have no preemptive or conversion rights and are not convertible into or

exchangeable for any of our other securities or property. Dividends on both series are not mandatory and are paid

quarterly, when, as, and if declared by the Board of Directors. Holders of Series A Preferred Stock are entitled to

receive cumulative, quarterly cash dividends at the annual rate of $3.485 per share. Holders of Series B Preferred

Stock are entitled to receive quarterly dividends based on 3-month LIBOR plus 170 basis points per annum in

arrears. Upon liquidation or dissolution of the Company, holders of the Series A and Series B Preferred Stock are

entitled to receive $50 and $100 per share, respectively, plus an amount equal to accrued and unpaid dividends

for the then current quarterly dividend period, if any, pro rata, and before any distribution of assets are made to

holders of our common stock.

F-60