Sallie Mae 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

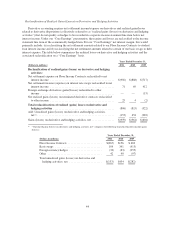

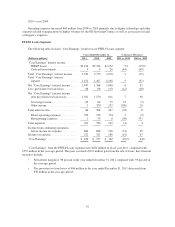

administration services for our various 529 college-savings plans. Assets under administration in our 529 college

savings plans totaled $37.5 billion as of December 31, 2011, a 9 percent increase from 2010. Campus Solutions

revenue is earned from our Campus Solutions business whose services include comprehensive transaction

processing solutions and associated technology that we provide to college financial aid offices and students to

streamline the financial aid process.

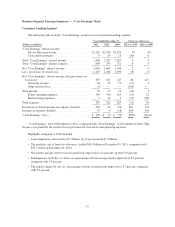

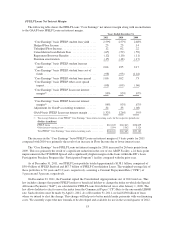

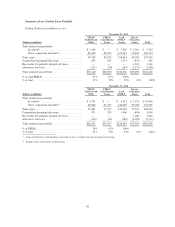

The following table presents the outstanding inventory of contingent collections receivables that our

Business Services segment will collect on behalf of others. We expect the inventory of contingent collections

receivables to decline over time as a result of the elimination of FFELP.

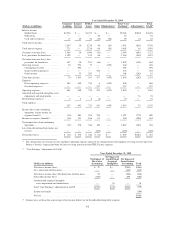

December 31,

(Dollars in millions) 2011 2010 2009

Contingency:

Student loans ................................. $11,553 $10,362 $ 8,762

Other ........................................ 2,017 1,730 1,262

Total .......................................... $13,570 $12,092 $10,024

Other Business Services revenue is primarily transaction fees that are earned in conjunction with our

rewards program from participating companies based on member purchase activity, either online or in stores,

depending on the contractual arrangement with the participating company. Typically, a percentage of the

purchase price of the consumer members’ eligible purchases with participating companies is set aside in an

account maintained by us on behalf of our members. In fourth quarter 2011, we terminated our credit card

affiliation program with a third-party bank and concurrently entered into an affiliation program with a new bank.

In terminating the old program we recognized a $25 million gain which primarily represented prior cash

advances we received that were previously recorded as deferred revenue.

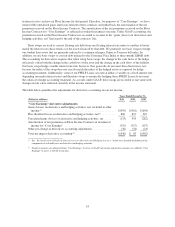

Revenues related to services performed on FFELP Loans accounted for 76 percent, 78 percent and 79

percent of total segment revenues for the years ended December 31, 2011, 2010 and 2009, respectively.

In 2011, we launched Sallie Mae Insurance Services, which offers directly to college students and higher

education institutions tuition, renters’ and student health insurance. We also include a Tuition Insurance Benefit

with our Smart Option Student Loan.

On September 1, 2011, we acquired SC Services & Associates, Inc., a provider of collections services to

local governments and courts. This acquisition enhances and complements our other contingency collection

businesses.

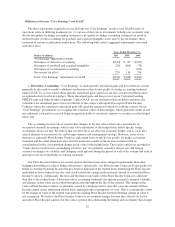

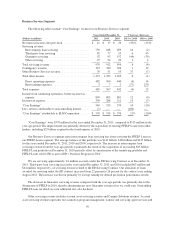

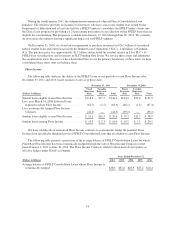

Operating Expenses — Business Services Segment

For the years ended December 31, 2011, 2010 and 2009, operating expenses for the Business Services

segment totaled $482 million, $500 million and $440 million, respectively.

2011 versus 2010

Operating expenses for 2011 decreased from 2010, primarily as a result of our cost cutting initiatives.

Included in operating expenses for the year ended December 31, 2011 is approximately $33 million in third-party

servicing costs associated with our acquisition of $25 billion of existing FFELP Loans at the end of 2010. During

third-quarter 2011, we began transitioning these loans to our own servicing platform and completed the transfer

in October 2011. With the portfolio fully transitioned, the servicing costs associated with these loans will be

significantly less in 2012.

51