Sallie Mae 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Student Loans (Continued)

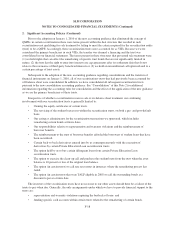

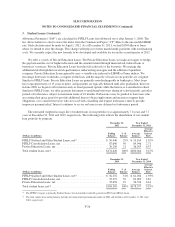

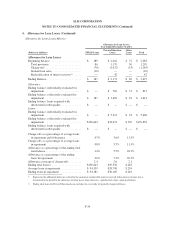

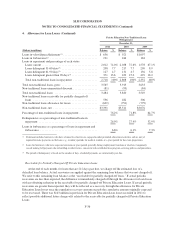

The following table shows the assets and liabilities that were acquired and consolidated on our balance sheet

at fair value on December 31, 2010.

(Dollars in millions)

Acquisition on

December 31, 2010

FFELP Stafford Loans ................................................. $11,121

FFELP Consolidation Loans ............................................ 14,262

Loan fair value discount ............................................... (494)

FFELP Loans ........................................................ 24,889

Restricted cash ....................................................... 749

Other assets ......................................................... 446

Total assets ......................................................... $26,084

Long-term borrowings — FFELP trusts ................................... $25,609

Long-term borrowings — acquisition financing ............................. 1,064

Long-term borrowings fair value discount ................................. (659)

Long-term borrowings ................................................. 26,014

Other liabilities ...................................................... 70

Total liabilities ....................................................... $26,084

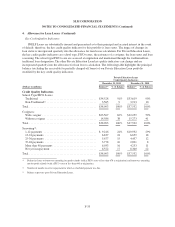

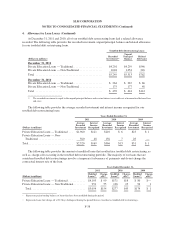

Certain Collection Tools

Forbearance involves granting the borrower a temporary cessation of payments (or temporary acceptance of

smaller than scheduled payments) for a specified period of time. Using forbearance extends the original term of

the loan. Forbearance does not grant any reduction in the total repayment obligation (principal or interest). While

in forbearance status, interest continues to accrue and is capitalized to principal when the loan re-enters

repayment status. Our forbearance policies include limits on the number of forbearance months granted

consecutively and the total number of forbearance months granted over the life of the loan. In some instances, we

require good-faith payments before granting forbearance. Exceptions to forbearance policies are permitted when

such exceptions are judged to increase the likelihood of collection of the loan. Forbearance as a collection tool is

used most effectively when applied based on a borrower’s unique situation, including historical information and

judgments. We leverage updated borrower information and other decision support tools to best determine who

will be granted forbearance based on our expectations as to a borrower’s ability and willingness to repay their

obligation. This strategy is aimed at mitigating the overall risk of the portfolio as well as encouraging cash

resolution of delinquent loans.

Forbearance may be granted to borrowers who are exiting their grace period to provide additional time to

obtain employment and income to support their obligations, or to current borrowers who are faced with a

hardship and request forbearance time to provide temporary payment relief. In these circumstances, a borrower’s

loan is placed into a forbearance status in limited monthly increments and is reflected in the forbearance status at

month-end during this time. At the end of the granted forbearance period, the borrower will enter repayment

status as current and is expected to begin making scheduled monthly payments on a go-forward basis.

Forbearance may also be granted to borrowers who are delinquent in their payments. In these circumstances,

the forbearance cures the delinquency and the borrower is returned to a current repayment status. In more limited

instances, delinquent borrowers will also be granted additional forbearance time.

F-28