Sallie Mae 2011 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

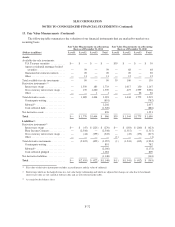

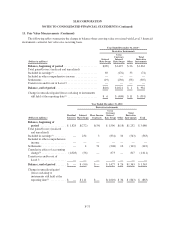

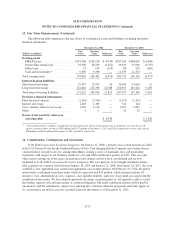

13. Fair Value Measurements (Continued)

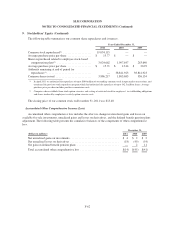

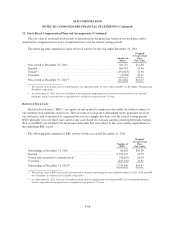

The following table summarizes the valuation of our financial instruments that are marked-to-market on a

recurring basis.

Fair Value Measurements on a Recurring

Basis as of December 31, 2011

Fair Value Measurements on a Recurring

Basis as of December 31, 2010

(Dollars in millions) Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Assets

Available-for-sale investments:

U.S. Treasury securities ........... $— $ — $ — $ — $39 $ — $ — $ 39

Agency residential mortgage backed

securities ..................... — 59 — 59 — 68 — 68

Guaranteed investment contracts .... — 20 — 20 — 20 — 20

Other .......................... — 11 — 11 — 12 — 12

Total available-for-sale investments .... — 90 — 90 39 100 — 139

Derivative instruments:(1)

Interest rate swaps ................ — 1,550 183 1,733 — 1,017 150 1,167

Cross currency interest rate swaps . . . — 139 1,220 1,359 — 427 1,599 2,026

Other .......................... — — 1 1 — — 26 26

Total derivative assets ............... — 1,689 1,404 3,093 — 1,444 1,775 3,219

Counterparty netting .............. (891) (782)

Subtotal(3) ...................... 2,202 2,437

Cash collateral held ............... (1,326) (886)

Net derivative assets ................ 876 1,551

Total ............................ $— $1,779 $1,404 $ 966 $39 $ 1,544 $1,775 $ 1,690

Liabilities(2)

Derivative instruments(1)

Interest rate swaps ................ $— $ (47) $ (223) $ (270) $— $ (183) $ (240) $ (423)

Floor Income Contracts ............ — (2,544) — (2,544) — (1,315) — (1,315)

Cross currency interest rate swaps . . . — (44) (199) (243) — (43) (172) (215)

Other .......................... — — — — (1) — — (1)

Total derivative instruments .......... — (2,635) (422) (3,057) (1) (1,541) (412) (1,954)

Counterparty netting .............. 891 782

Subtotal(3) ...................... (2,166) (1,172)

Cash collateral pledged ............ 1,018 809

Net derivative liabilities ............. (1,148) (363)

Total ............................ $— $(2,635) $ (422) $(1,148) $ (1) $(1,541) $ (412) $ (363)

(1) Fair value of derivative instruments excludes accrued interest and the value of collateral.

(2) Borrowings which are the hedged items in a fair value hedge relationship and which are adjusted for changes in value due to benchmark

interest rates only are not carried at full fair value and are not reflected in this table.

(3) As carried on the balance sheet.

F-72