Sallie Mae 2011 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

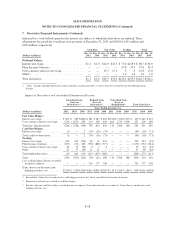

7. Derivative Financial Instruments (Continued)

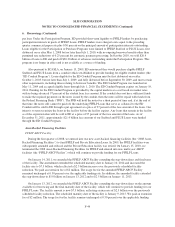

certain derivative transactions entered into as hedges, primarily Floor Income Contracts, basis swaps and

Eurodollar futures contracts, are economically effective; however, those transactions generally do not qualify for

hedge accounting under GAAP (as discussed below) and thus may adversely impact earnings.

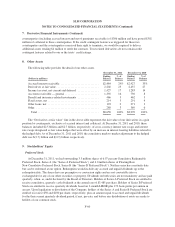

Although we use derivatives to offset (or minimize) the risk of interest rate and foreign currency changes,

the use of derivatives does expose us to both market and credit risk. Market risk is the chance of financial loss

resulting from changes in interest rates, foreign exchange rates and market liquidity. Credit risk is the risk that a

counterparty will not perform its obligations under a contract and it is limited to the loss of the fair value gain in

a derivative that the counterparty owes us. When the fair value of a derivative contract is negative, we owe the

counterparty and, therefore, have no credit risk exposure to the counterparty; however, the counterparty has

exposure to us. We minimize the credit risk in derivative instruments by entering into transactions with highly

rated counterparties that are reviewed regularly by our Credit Department. We also maintain a policy of requiring

that all derivative contracts be governed by an International Swaps and Derivative Association Master

Agreement. Depending on the nature of the derivative transaction, bilateral collateral arrangements generally are

required as well. When we have more than one outstanding derivative transaction with the counterparty, and

there exists legally enforceable netting provisions with the counterparty (i.e., a legal right to offset receivable and

payable derivative contracts), the “net” mark-to-market exposure, less collateral the counterparty has posted to

us, represents exposure with the counterparty. When there is a net negative exposure, we consider our exposure

to the counterparty to be zero. At December 31, 2011 and 2010, we had a net positive exposure (derivative gain

positions to us less collateral which has been posted by counterparties to us) related to SLM Corporation and the

Bank derivatives of $113 million and $296 million, respectively.

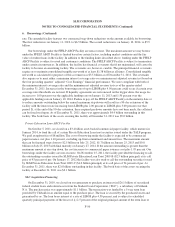

Our on-balance sheet securitization trusts have $13.6 billion of Euro and British Pound Sterling

denominated bonds outstanding as of December 31, 2011. To convert these non-U.S. dollar denominated bonds

into U.S dollar liabilities, the trusts have entered into foreign-currency swaps with highly–rated counterparties. In

addition, the trusts have entered into $13.8 billion of interest rates swaps which are primarily used to convert

Prime received on securitized student loans to LIBOR paid on the bonds. At December 31, 2011, the net positive

exposure on swaps in securitization trusts is $807 million. Current turmoil in the European markets has led to

increased disclosure of exposure in those markets. Of the total net exposure, $691 million of the net exposure is

related to financial institutions located in France. Of this amount, $498 million carries a guarantee from the

French government. $690 million of the $691 million exposure relates to derivatives held at our securitization

trusts. Counterparties to these derivatives are required to post collateral when their credit rating is withdrawn or

downgraded below a certain level. As of December 31, 2011, no collateral was required to be posted. As

discussed below, adjustments are made to our derivative valuations for counterparty credit risk based on market

credit default swap spreads. The adjustments made at December 31, 2011 related to derivatives with French

financial institutions (including those that carry a guarantee from the French government) decreased the

derivative asset value by $179 million. Credit risks for all derivative counterparties are assessed internally on a

continual basis.

Accounting for Derivative Instruments

Derivative instruments that are used as part of our interest rate and foreign currency risk management

strategy include interest rate swaps, basis swaps, cross-currency interest rate swaps, interest rate futures

contracts, and interest rate floor and cap contracts with indices that relate to the pricing of specific balance sheet

assets and liabilities. The accounting for derivative instruments requires that every derivative instrument,

including certain derivative instruments embedded in other contracts, be recorded on the balance sheet as either

an asset or liability measured at its fair value. As more fully described below, if certain criteria are met,

derivative instruments are classified and accounted for by us as either fair value or cash flow hedges. If these

criteria are not met, the derivative financial instruments are accounted for as trading.

F-55