Sallie Mae 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4. Appendices

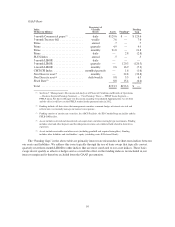

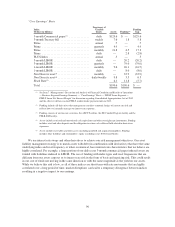

Appendix A — Federal Family Education Loan Program

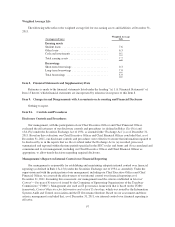

(b) Exhibits

3.1 Restated Certificate of Incorporation of the Company (incorporated by reference to Exhibit 4.1 to the

Company’s Registration Statement on Form S-8 (File No. 333-159447) filed on May 22, 2009).

3.2 Certificate of Designation of 7.25% Mandatory Convertible Preferred Stock (incorporated by reference

to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on January 3, 2008).

3.3 By-Laws of the Company (incorporated by reference to Exhibit 3.2 to the Company’s Current Report

on Form 8-K filed on November 21, 2011).

4.1 Indenture, dated as of October 1, 2000, between the Company and The Bank of New York Mellon, as

successor to J.P. Morgan Chase Bank, National Association, formerly Chase Manhattan Bank

(incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K (File No. 1-

13251) filed on October 5, 2000).

4.2 Fourth Supplemental Indenture, dated as of January 16, 2003, between the registrant and Deutsche

Bank Trust Company Americas (incorporated by reference to Exhibit 4.1 to the Company’s Current

Report on Form 8-K (File No. 1-13251) filed on January 17, 2003).

4.3 Amended Fourth Supplemental Indenture, dated as of December 17, 2004, between the Company and

Deutsche Bank Trust Company Americas (incorporated by reference to Exhibit 4.1 to the Company’s

Current Report on Form 8-K (File No. 1-13251) filed on December 17, 2004).

4.4 Second Amended Fourth Supplemental Indenture, dated as of July 22, 2008, between the Company

and Deutsche Bank Trust Company Americas (incorporated by reference to Exhibit 4.1 to the

Company’s Current Report on Form 8-K (File No. 1-13251) filed on July 25, 2008).

4.5 Sixth Supplemental Indenture, dated as of October 15, 2008, between the Company and The Bank of

New York Mellon (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form

8-K (File No. 1-13251) filed on October 15, 2008).

4.6 Medium Term Note Master Note, Series A (incorporated by reference to Exhibit 4.1.1 to the

Company’s Current Report on Form 8-K (File No. 1-13251) filed on November 7, 2001).

4.7 Medium Term Note Master Note, Series B (incorporated by reference to Exhibit 4.2 to the Company’s

Current Report on Form 8-K (File No. 1-13251) filed on January 28, 2003).

10.1 Note Purchase and Security Agreement between Bluemont Funding 1; the Conduit Lenders; the

Alternate Lenders; the LIBOR lenders; the Managing Agents; Bank of America, N.A.; JPMorgan

Chase Bank, N.A.; Banc of America Securities LLC; J.P. Morgan Securities Inc.; The Bank of New

York Mellon Trust Company, “National Association; and Sallie Mae, Inc., dated January 15, 2010

(incorporated by reference to Exhibit 10.40 of the Company’s Annual Report on Form 10-K filed on

February 26, 2010).

10.2 Schedule of Contracts Substantially Identical to Exhibit 10.10 in all Material Respects: between Town

Center Funding 1 LLC and Town Hall Funding I LLC (incorporated by reference to Exhibit 10.41 of

the Company’s Annual Report on Form 10-K filed on February 26, 2010).

10.3* Amendment No. 1 to Note Purchase and Security Agreement by and among Bluemont Funding I, as

the Trust; Sallie Mae, Inc., as Administrator; The Bank of New York Mellon Trust Company, National

Association, as Eligible Lender Trustee; J.P. Morgan Securities LLC and Merrill Lynch, Pierce Fenner

Smith Incorporated, as Lead Arrangers; the Conduit Lenders, the Alternate Lenders and the LIBOR

Lenders party thereto; JPMorgan Chase Bank, N.A., Bank of America, N.A., Barclays Bank PLC, The

Royal Bank of Scotland PLC, Deutsche Bank AG, New York Branch, Alpine Securitization

Corporation and Royal Bank of Canada, as Managing Agents; JPMorgan Chase Bank, N.A., as

Syndication Agent; and Bank of America, N.A., as Administrative Agent, dated as of January 14,

2011.

101