Sallie Mae 2011 Annual Report Download - page 38

Download and view the complete annual report

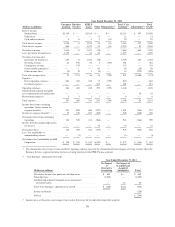

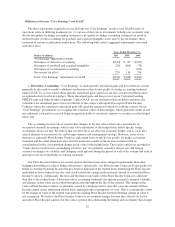

Please find page 38 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Gains on loans and investments, net, increased $41 million from the prior year primarily related to the

gains on sales of additional FFELP Loans to ED as part of ED’s Loan Purchase Commitment Program

(the “Purchase Program”). These gains will not occur in the future as the Purchase Program ended in

2010.

• Losses on derivatives and hedging activities, net, declined by $243 million in 2010 compared with 2009,

primarily due to interest rate and foreign currency fluctuations, which primarily affected the valuations of

our Floor Income Contracts, basis swaps and foreign currency hedges during the period. Valuations of

derivative instruments vary based upon many factors including changes in interest rates, credit risk,

foreign currency fluctuations and other market factors. As a result, net gains and losses on derivatives and

hedging activities may vary significantly in future periods.

• Servicing revenue decreased by $35 million primarily due to HCERA becoming effective as of July 1,

2010, thereby eliminating our ability to earn additional Guarantor issuance fees on new FFELP Loans, as

well as to a decline in outstanding FFELP Loans for which we were earning additional fees.

• Contingency revenue increased $36 million primarily from increased collections on defaulted FFELP

Loans.

• Gains on debt repurchases decreased $219 million year-over-year while the principal amount of debt

repurchased increased to $4.9 billion, as compared with the $3.4 billion repurchased in fiscal year 2009.

Debt repurchase activity will fluctuate based on market fundamentals and our liability management

strategy.

• Other income declined by $82 million primarily due to a $71 million decrease in foreign currency

translation gains. The foreign currency translation gains relate to a portion of our foreign currency

denominated debt that does not receive hedge accounting treatment. These gains were partially offset by

the “losses on derivative and hedging activities, net” line item on the income statement related to the

derivatives used to economically hedge these debt instruments.

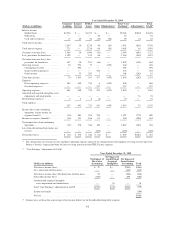

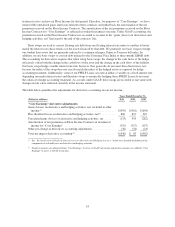

• Operating expenses, excluding restructuring-related asset impairments of $19 million in 2010, increased

$146 million year-over-year primarily due to an increase in legal contingency expense, costs related to the

ED Servicing Contract, higher collection and servicing costs from a higher number of loans in repayment

and in delinquent status, and higher marketing and technology enhancement costs related to Private

Education Loans.

• Goodwill and intangible asset impairment and amortization increased $623 million for the year ended

December 31, 2010, primarily due to the $660 million of impairment recognized as a result of the passage

of HCERA and its negative effects on the anticipated cash flows for certain of our reporting units and the

reduced market values of these units. The amortization of acquired intangibles for continuing operations

and for discontinued operations each remained relatively unchanged for the years ended December 31,

2010 and 2009, respectively. For additional discussion regarding the impairment of goodwill and

intangible assets see “Note 5 — Goodwill and Acquired Intangible Assets.”

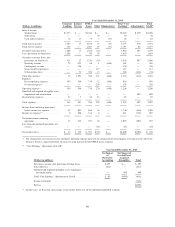

• Restructuring expenses increased $69 million in the year ended December 31, 2010, which is a result of a

$75 million increase in restructuring expenses in continuing operations partially offset by a $6 million

decrease in restructuring expenses attributable to discontinued operations. The following details our

ongoing restructuring efforts:

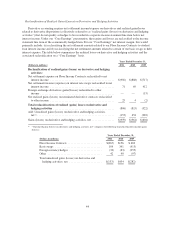

• On March 30, 2010, President Obama signed into law H.R. 4872, HCERA, which included the

SAFRA Act. Effective July 1, 2010, this legislation eliminated FFELP and requires all new federal

loans to be made through the DSLP. The new law did not alter or affect the terms and conditions of

existing FFELP Loans. We have and will continue to restructure our operations in response to this

change in law which has and will continue to result in a significant reduction of operating costs due

to the elimination of positions and facilities associated with the origination of FFELP Loans.

Restructuring expenses associated with continuing operations under this restructuring plan were $83

million for the year ended December 31, 2010. We expect to incur an estimated $10 million of

additional restructuring expenses.

36