Sallie Mae 2011 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

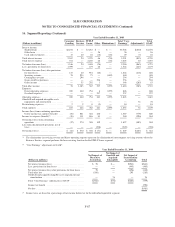

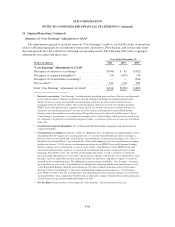

17. Discontinued Operations (Continued)

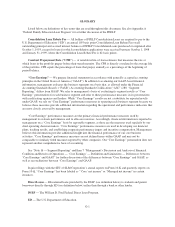

The following table summarizes the discontinued operations.

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

Operations:

Income (loss) from discontinued operations before income taxes . . $53 $(91) $(305)

Income tax expense (benefit) ............................... 20 (24) (85)

Income (loss) from discontinued operations, net of taxes ......... $33 $(67) $(220)

Disposal:

Loss on disposal before income taxes ........................ $— $— $(119)

Income tax benefit ....................................... — — (23)

Loss on disposal, net of taxes .............................. $— $— $ (96)

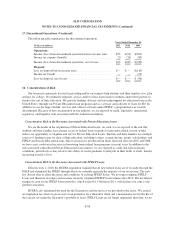

18. Concentrations of Risk

Our business is primarily focused in providing and/or servicing to help students and their families save, plan

and pay for college. We primarily originate, service and/or collect loans made to students and/or their parents to

finance the cost of their education. We provide funding, delivery and servicing support for education loans in the

United States, through our Private Education Loan programs and as a servicer and collector of loans for ED. In

addition we are the largest holder, servicer and collector of loans under FFELP, a program that was recently

discontinued. Because of this concentration in one industry, we are exposed to credit, legislative, operational,

regulatory, and liquidity risks associated with the student loan industry.

Concentration Risk in the Revenues Associated with Private Education Loans

We are the leader in the origination of Private Education Loans. As such, we are exposed to the risk that

students and their families have greater access to federal loans or grants for education which, in turn, would

reduce our opportunity to originate and service Private Education Loans. Students and their families use multiple

sources of funding to pay for their college education, including savings, current income, grants, scholarships, and

FFELP and Private Education Loans. Due to an increase in federal loan limits that took effect in 2007 and 2008,

we have seen a substantial increase in borrowing from federal loan programs in recent years. In addition to the

risk associated with reduced Private Education Loan volumes, we are exposed to credit risk from economic

conditions, particularly as they relate to the ability of recent graduates to find jobs in their fields of study, thereby

increasing our risk of loss.

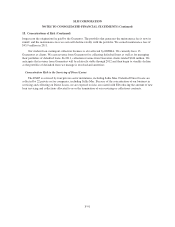

Concentration Risk in the Revenues Associated with FFELP Loans

Effective July 1, 2010, the HCERA legislation required that all new federal loans are to be made through the

DSLP and eliminated the FFELP through which we currently generate the majority of our net income. The new

law did not alter or affect the terms and conditions of existing FFELP Loans. We no longer originate FFELP

Loans and therefore no longer earn revenue on newly originated FFELP Loan volume after 2010. The net interest

margin we earn on our FFELP Loans portfolio, which totaled $1.9 billion in 2011, will decline over time as the

portfolio amortizes.

HCERA also eliminated the need for the Guarantors and the services we provided to the sector. We earned

an origination fee when we processed a loan guarantee for a Guarantor client and a maintenance fee for the life of

the loan for servicing the Guarantor’s portfolio of loans. FFELP Loans are no longer originated; therefore, we no

F-90