Sallie Mae 2011 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

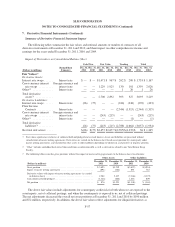

7. Derivative Financial Instruments (Continued)

Summary of Derivative Financial Statement Impact

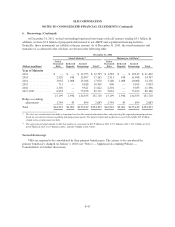

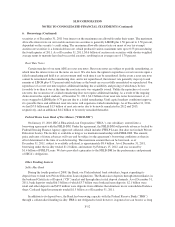

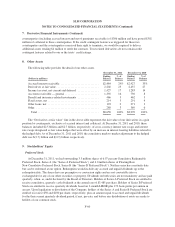

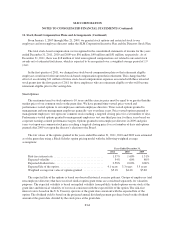

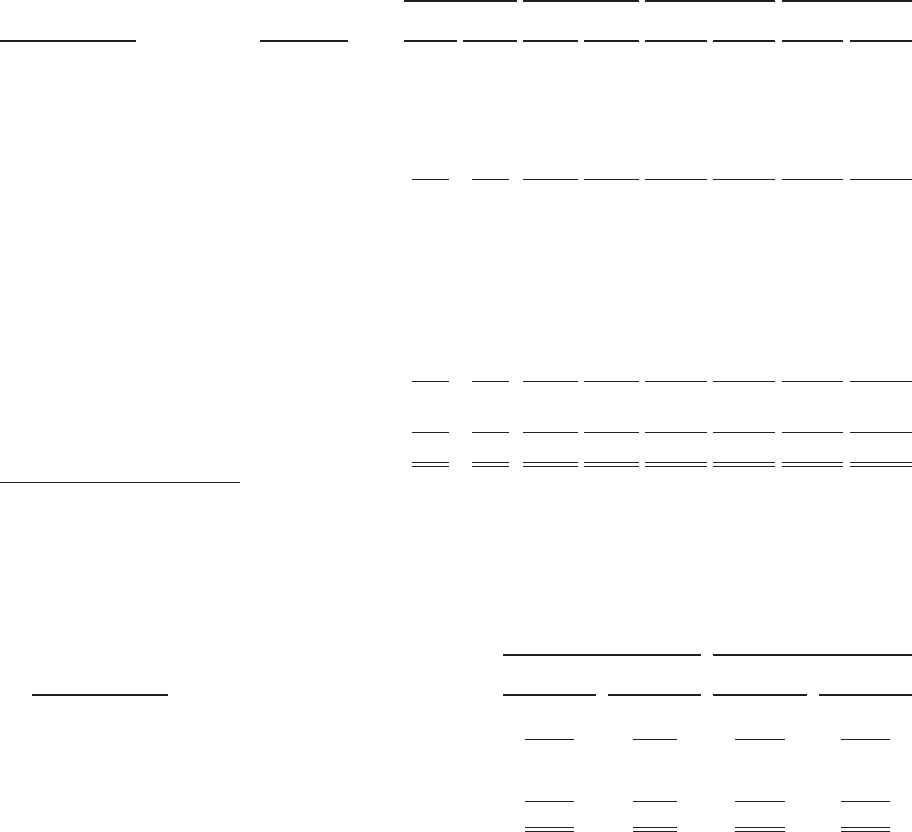

The following tables summarize the fair values and notional amounts or number of contracts of all

derivative instruments at December 31, 2011 and 2010, and their impact on other comprehensive income and

earnings for the years ended December 31, 2011, 2010 and 2009.

Impact of Derivatives on Consolidated Balance Sheet

Cash Flow Fair Value Trading Total

(Dollars in millions)

Hedged Risk

Exposure

Dec. 31,

2011

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2010

Fair Values(1)

Derivative Assets:

Interest rate swaps ...... Interest rate $ — $ — $1,471 $ 967 $ 262 $ 200 $ 1,733 $ 1,167

Cross currency interest

rate swaps ..........

Foreign currency and

interest rate — — 1,229 1,925 130 101 1,359 2,026

Other(2) .............. Interest rate — — — — 1 26 1 26

Total derivative

assets(3) ............ — — 2,700 2,892 393 327 3,093 3,219

Derivative Liabilities:

Interest rate swaps ...... Interest rate (26) (75) — — (244) (348) (270) (423)

Floor Income

Contracts ........... Interest rate — — — — (2,544) (1,315) (2,544) (1,315)

Cross currency interest

rate swaps ..........

Foreign currency and

interest rate — — (243) (215) — — (243) (215)

Other(2) .............. Interest rate — — — — — (1) — (1)

Total derivative

liabilities(3) .......... (26) (75) (243) (215) (2,788) (1,664) (3,057) (1,954)

Net total derivatives .... $(26) $(75) $2,457 $2,677 $(2,395)$(1,337)$ 36 $ 1,265

(1) Fair values reported are exclusive of collateral held and pledged and accrued interest. Assets and liabilities are presented without

consideration of master netting agreements. Derivatives are carried on the balance sheet based on net position by counterparty under

master netting agreements, and classified in other assets or other liabilities depending on whether in a net positive or negative position.

(2) “Other” includes embedded derivatives bifurcated from securitization debt as well as derivatives related to our Total Return Swap

Facility.

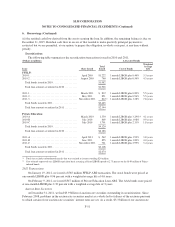

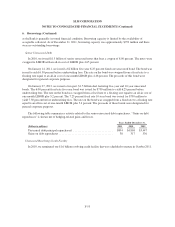

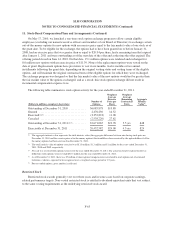

(3) The following table reconciles gross positions without the impact of master netting agreements to the balance sheet classification:

Other Assets Other Liabilities

(Dollars in millions)

December 31,

2011

December 31,

2010

December 31,

2011

December 31,

2010

Gross position ............................................. $3,093 $3,219 $(3,057) $(1,954)

Impact of master netting agreements ............................ (891) (782) 891 782

Derivative values with impact of master netting agreements (as carried

on balance sheet) ......................................... 2,202 2,437 (2,166) (1,172)

Cash collateral (held) pledged ................................. (1,326) (886) 1,018 809

Net position ............................................... $ 876 $1,551 $(1,148) $ (363)

The above fair values include adjustments for counterparty credit risk for both when we are exposed to the

counterparty, net of collateral postings, and when the counterparty is exposed to us, net of collateral postings.

The net adjustments decreased the overall net asset positions at December 31, 2011 and 2010 by $190 million

and $72 million, respectively. In addition, the above fair values reflect adjustments for illiquid derivatives as

F-57