Sallie Mae 2011 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

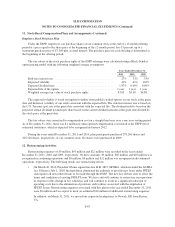

9. Stockholders’ Equity (Continued)

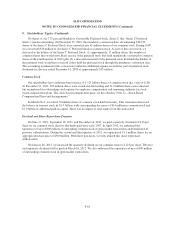

No shares of our 7.25 percent Mandatory Convertible Preferred Stock, Series C (the “Series C Preferred

Stock”) remain outstanding. On December 15, 2010, the mandatory conversion date, all remaining 810,370

shares of the Series C Preferred Stock were converted into 41 million shares of our common stock. During 2009,

we converted $339 million of our Series C Preferred Stock to common stock. As part of this conversion, we

delivered to the holders of the Series C Preferred Stock: (1) approximately 17 million shares (the number of

common shares they would most likely receive if the preferred stock they held mandatorily converted to common

shares in the fourth quarter of 2010) plus (2) a discounted amount of the preferred stock dividends the holders of

the preferred stock would have received if they held the preferred stock through the mandatory conversion date.

The accounting treatment for this conversion resulted in additional expense recorded as part of preferred stock

dividends for the year ended December 31, 2009 of approximately $53 million.

Common Stock

Our shareholders have authorized the issuance of 1.125 billion shares of common stock (par value of $.20).

At December 31, 2011, 509 million shares were issued and outstanding and 34.9 million shares were unissued

but encumbered for outstanding stock options for employee compensation and remaining authority for stock-

based compensation plans. The stock-based compensation plans are described in “Note 11—Stock-Based

Compensation Plans and Arrangements.”

In March 2011, we retired 70 million shares of common stock held in treasury. This retirement decreased

the balance in treasury stock by $1.9 billion, with corresponding decreases of $14 million in common stock and

$1.9 billion in additional paid-in capital. There was no impact to total equity from this transaction.

Dividend and Share Repurchase Program

On June 17, 2011, September 16, 2011, and December 16, 2011, we paid a quarterly dividend of $.10 per

share on our common stock, the first dividends paid since early 2007. In April 2011, we authorized the

repurchase of up to $300 million of outstanding common stock in open market transactions and terminated all

previous authorizations. During the second and third quarters of 2011, we repurchased 19.1 million shares for an

aggregate purchase price of $300 million. With these purchases, we fully utilized this share repurchase

authorization.

On January 26, 2012, we increased the quarterly dividend on our common stock to $.125 per share. The next

such quarterly dividend will be paid on March 16, 2012. We also authorized the repurchase of up to $500 million

of outstanding common stock in open market transactions.

F-61