Sallie Mae 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Political and Reputation Risk Management

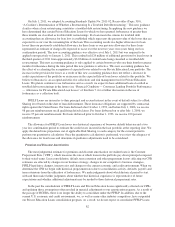

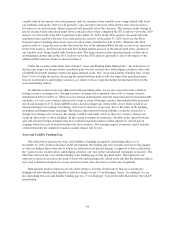

Political and reputation risk is the risk that changes in laws and regulations or actions affecting impacting

our reputation could affect the profitability and sustainability of our business.

Management proactively assesses and manages political and reputation risk. Our government relations team

of employees manages our review and response to all formal inquiries from members of Congress, state

legislators, and their staff, including providing targeted messaging that reinforces our public policy goals. We

review and consider political and reputational risks on an integrated basis in connection with the risk

management oversight activities conducted in the various aspects of our business on matters as diverse as the

launch of new products and services, our credit underwriting activities and how we fund our operations. Our

public relations, marketing and media teams constantly monitor our perception in print, electronic and social

media; actively provide assistance and support to our customers and other constituencies and maintain and

promote the value of our considerable corporate brand. Significant political and reputation risks are reported to

and monitored by the Finance and Operations Committee of our Board of Directors. Our Legal, Government

Relations and Compliance groups efforts are coordinated through our General Counsel and regularly meet and

collaborate with our Media and Investor Relations teams to provide more coordinated monitoring and

management of our political and reputational risks.

Credit and Counterparty Risk Management

Credit and counterparty risk is the risk of loss stemming from one party’s failure to repay a loan or

otherwise meet a contractual obligation. We have credit or counterparty risk exposure with borrowers and

co-borrowers with whom we have made Private Education Loans, the various counterparties with whom we have

entered into derivative contracts, the various issuers with whom we make investments, and with several higher

education institutions related to academic facilities loans secured by real estate. Credit and counterparty risks are

overseen by our Chief Credit Officer, his staff and the internal risk management committee he chairs. Our Chief

Credit Officer reports regularly to our Board of Directors, Finance and Operations and Audit Committees with

respect to the various matters of which each have oversight.

The credit risk related to Private Education Loans are managed within a credit risk infrastructure which

includes (i) a well-defined underwriting and collection policy framework; (ii) an ongoing monitoring and review

process of portfolio segments and trends; (iii) assignment and management of credit authorities and

responsibilities; and (iv) establishment of an allowance for loan losses that covers estimated losses based upon

portfolio and economic analysis.

Credit and counterparty risk related to derivative contracts is managed by reviewing counterparties for credit

strength on an ongoing basis and via our credit policies, which place limits on the amount of exposure we may

take with any one counterparty and, in most cases, require collateral to secure the position. The credit and

counterparty risk associated with derivatives is measured based on the replacement cost should the counterparties

with contracts in a gain position to the Company fail to perform under the terms of the contract.

Compliance and Legal Risk Management

Compliance risk is the operational risk of legal or regulatory sanctions, financial loss or damage to

reputation resulting from failure to comply with laws, regulations, rules, other regulatory requirements, or codes

of conduct and other standards of self-regulatory organizations applicable to us. Legal risk arises, in part, from

the potential that unenforceable contracts, lawsuits or adverse judgments can disrupt or otherwise negatively

affect our operations or condition. These risks are inherent in all of our businesses. Both compliance and legal

risk are sub-sets of operational risk but are recognized as a separate and complementary risk category given their

importance in our business. We can be exposed to regulatory and compliance risk in key areas such as our private

education lending, collections or loan servicing businesses if compliance with legal and regulatory requirements

is not properly implemented, documented or tested, as well as when an oversight program does not include

appropriate audit and control features.

89