Sallie Mae 2011 Annual Report Download - page 39

Download and view the complete annual report

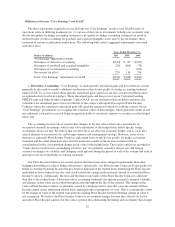

Please find page 39 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• In response to the College Cost Reduction and Access Act of 2007 (“CCRAA”) and challenges in

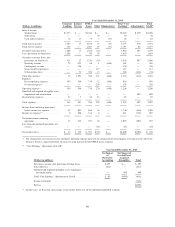

the capital markets, we also initiated a restructuring plan in the fourth quarter of 2007. Under this

ongoing plan, restructuring expenses associated with continuing operations of $2 million and

$10 million were recognized in the years ended December 31, 2010 and 2009, respectively. This

restructuring plan was essentially completed in the fourth quarter of 2009.

• Income tax expense from continuing operations increased $229 million for the year ended December 31,

2010 as compared with the prior year. The effective tax rates for fiscal years 2010 and 2009 were

45 percent and 33 percent, respectively. The change in the effective tax rate was primarily driven by the

impact of non-deductible goodwill impairments recorded in 2010 and state tax rate changes recorded in

both periods.

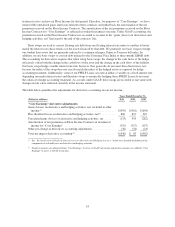

• Net loss from discontinued operations in the year ended December 31, 2010 was $67 million compared

with a net loss from discontinued operations of $220 million for the year ended December 31, 2009. In

the fourth quarter of 2009, we sold our Purchased Paper — Mortgage/Properties business for

$280 million which resulted in an after-tax loss of $95 million. As a result of this sale, the results of

operations of this business were presented in discontinued operations in the fourth quarter of 2009. In the

fourth quarter of 2010, we began actively marketing our Purchased Paper — Non Mortgage business for

sale and began presenting its results in discontinued operations. We recorded an after-tax loss of

$52 million from discontinued operations in the fourth quarter of 2010, primarily due to adjusting the

value of this business to its estimated fair value. We sold our Purchased Paper — Non-Mortgage business

in the third quarter of 2011. Our Purchased Paper businesses are presented in discontinued operations for

the current and prior periods. The additional losses for both years that are more than the losses discussed

above relate to ongoing impairment recorded as a result of the weakened economy’s effect on our ability

to collect the receivables.

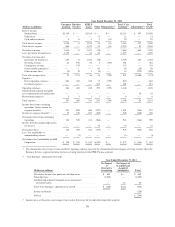

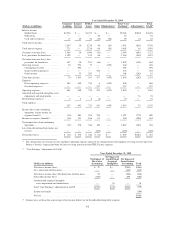

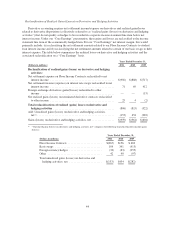

“Core Earnings” — Definition and Limitations

We prepare financial statements in accordance with GAAP. However, we also evaluate our business

segments on a basis that differs from GAAP. We refer to this different basis of presentation as “Core Earnings”.

We provide this “Core Earnings” basis of presentation on a consolidated basis for each business segment because

this is what we internally review when making management decisions regarding our performance and how we

allocate resources. We also refer to this information in our presentations with credit rating agencies, lenders and

investors. Because our “Core Earnings” basis of presentation corresponds to our segment financial presentations,

we are required by GAAP to provide “Core Earnings” disclosure in the notes to our consolidated financial

statements for our business segments. For additional information, see “Note 16 — Segment Reporting.”

“Core Earnings” are not a substitute for reported results under GAAP. We use “Core Earnings” to manage

each business segment because “Core Earnings” reflect adjustments to GAAP financial results for three items,

discussed below, that create significant volatility mostly due to timing factors generally beyond the control of

management. Accordingly, we believe that “Core Earnings” provide management with a useful basis from which

to better evaluate results from ongoing operations against the business plan or against results from prior periods.

Consequently, we disclose this information as we believe it provides investors with additional information

regarding the operational and performance indicators that are most closely assessed by management. The three

items adjusted for in our “Core Earnings” presentations are (1) our use of derivatives instruments to hedge our

economic risks that do not qualify for hedge accounting treatment or do qualify for hedge accounting treatment

but result in ineffectiveness (2) the accounting for goodwill and acquired intangible assets and (3) the off-balance

sheet treatment of certain securitization transactions.

37