Sallie Mae 2011 Annual Report Download - page 118

Download and view the complete annual report

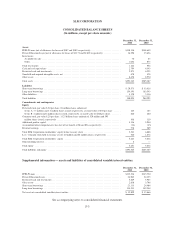

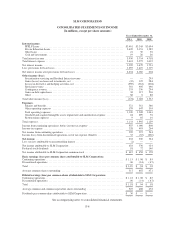

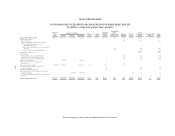

Please find page 118 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Business

SLM Corporation (“we”, “us”, “our”, or the “Company”) is a holding company that operates through a number

of subsidiaries. We were formed in 1972 as the Student Loan Marketing Association, a federally chartered

government-sponsored enterprise (the “GSE”), with the goal of furthering access to higher education by acting as a

secondary market for federal student loans. In 2004, we completed our transformation to a private company through

our wind-down of the GSE. The GSE’s outstanding obligations were placed into a Master Defeasance

Trust Agreement as of December 29, 2004, which was fully collateralized by direct, noncallable obligations of the

United States.

We provide Private Education Loans that help students and their families bridge the gap between family

resources, federal loans, grants, student aid, scholarships and the cost of a college education. We also provide

savings products to help save for a college education. In addition we provide servicing and collection services on

federal loans. We also offer servicing, collection and transaction support directly to colleges and universities in

addition to the saving for college industry. Finally, we are the largest private owner of Federal Family Education

Loan Program (“FFELP”) Loans.

On March 30, 2010, President Obama signed into law H.R. 4872, the Health Care and Education

Reconciliation Act of 2010 (“HCERA”), which included the SAFRA Act. Effective July 1, 2010, legislation

eliminated the authority to originate new loans under FFELP and required that all new federal loans be made

through the Direct Student Loan Program (“DSLP”). Consequently, we no longer originate FFELP Loans. Net

interest income from our FFELP Loan portfolio and fees associated with servicing FFELP Loans and collecting

on delinquent and defaulted FFELP Loans on behalf of Guarantors has been our largest source of income. The

law does not alter or affect the terms and conditions of existing FFELP Loans.

2. Significant Accounting Policies

Use of Estimates

Our financial reporting and accounting policies conform to generally accepted accounting principles in the

United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Actual results could differ from those estimates. Key

accounting policies that include significant judgments and estimates include the allowance for loan losses, the

effective interest rate method (amortization of student loan and debt premiums and discounts), fair value

measurements, goodwill and acquired intangible asset impairment assessments, and derivative accounting.

Consolidation

The consolidated financial statements include the accounts of SLM Corporation and its majority-owned and

controlled subsidiaries and those Variable Interest Entities (“VIEs”) for which we are the primary beneficiary,

after eliminating the effects of intercompany accounts and transactions.

On January 1, 2010, we adopted the new consolidation accounting guidance. Under the new consolidation

accounting guidance, if an entity has a variable interest in a VIE and that entity is determined to be the primary

beneficiary of the VIE then that entity will consolidate the VIE. The primary beneficiary is the entity which has

both: (1) the power to direct the activities of the VIE that most significantly impact the VIE’s economic

performance and (2) the obligation to absorb losses or receive benefits of the entity that could potentially be

significant to the VIE. As it relates to our securitized assets, we are the servicer of the securitized assets and own

the Residual Interest of the securitization trusts. As a result, we are the primary beneficiary of our securitization

trusts and consolidated those trusts that were previously off-balance sheet at their historical cost basis on

F-9