Sallie Mae 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

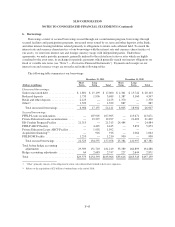

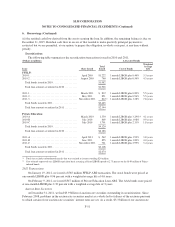

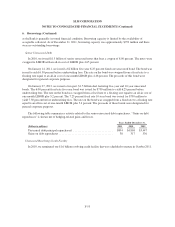

6. Borrowings

Borrowings consist of secured borrowings issued through our securitization program, borrowings through

secured facilities and participation programs, unsecured notes issued by us, term and other deposits at the Bank,

and other interest-bearing liabilities related primarily to obligations to return cash collateral held. To match the

interest rate and currency characteristics of our borrowings with the interest rate and currency characteristics of

our assets, we enter into interest rate and foreign currency swaps with independent parties. Under these

agreements, we make periodic payments, generally indexed to the related asset rates or rates which are highly

correlated to the asset rates, in exchange for periodic payments which generally match our interest obligations on

fixed or variable rate notes (see “Note 7 — Derivative Financial Instruments”). Payments and receipts on our

interest rate and currency swaps are not reflected in the following tables.

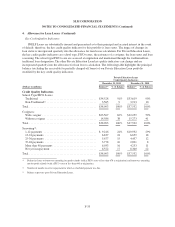

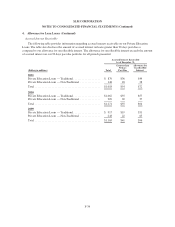

The following table summarizes our borrowings.

December 31, 2011 December 31, 2010

(Dollars in millions)

Short

Term

Long

Term Total

Short

Term

Long

Term Total

Unsecured borrowings:

Senior unsecured debt .................. $ 1,801 $ 15,199 $ 17,000 $ 4,361 $ 15,742 $ 20,103

Brokered deposits ..................... 1,733 1,956 3,689 1,387 3,160 4,547

Retail and other deposits ................ 2,123 — 2,123 1,370 — 1,370

Other(1) .............................. 1,329 — 1,329 887 — 887

Total unsecured borrowings ........... 6,986 17,155 24,141 8,005 18,902 26,907

Secured borrowings:

FFELP Loans securitizations ............ — 107,905 107,905 — 113,671 113,671

Private Education Loans securitizations .... — 19,297 19,297 — 21,409 21,409

ED Conduit Program Facility ............ 21,313 — 21,313 24,484 — 24,484

FFELP ABCP Facility .................. — 4,445 4,445 — 5,853 5,853

Private Education Loans ABCP Facility .... — 1,992 1,992 — — —

Acquisition financing(2) ................. — 916 916 — 1,064 1,064

FHLB-DM Facility .................... 1,210 — 1,210 900 — 900

Total secured borrowings ............. 22,523 134,555 157,078 25,384 141,997 167,381

Total before hedge accounting

adjustments ........................ 29,509 151,710 181,219 33,389 160,899 194,288

Hedge accounting adjustments ........... 64 2,683 2,747 227 2,644 2,871

Total ............................... $29,573 $154,393 $183,966 $33,616 $163,543 $197,159

(1) “Other” primarily consists of the obligation to return cash collateral held related to derivative exposures.

(2) Relates to the acquisition of $25 billion of student loans at the end of 2010.

F-43