Sallie Mae 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

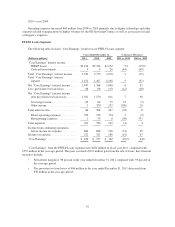

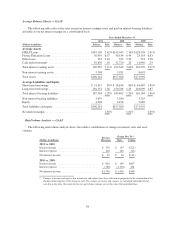

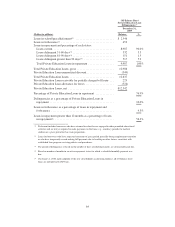

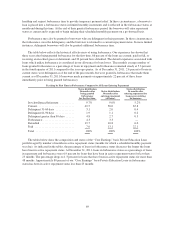

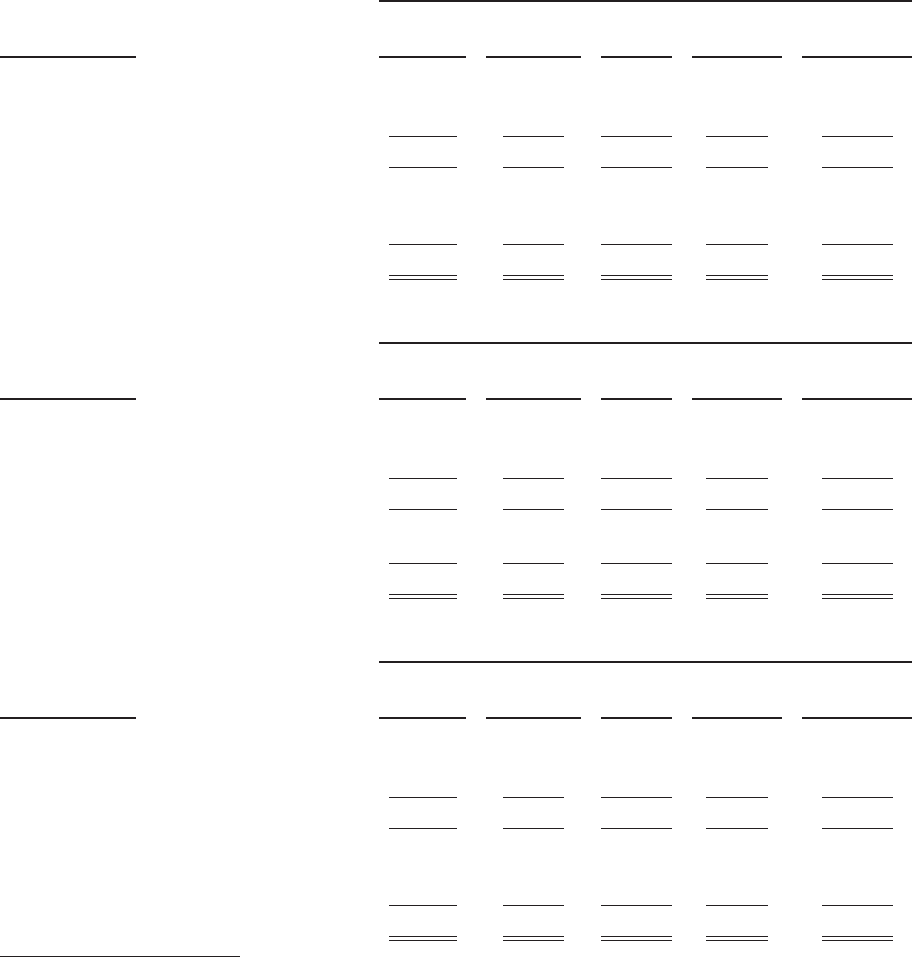

GAAP-Basis

Year Ended December 31, 2009

(Dollars in millions)

FFELP

Stafford and

Other

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total On-

Balance Sheet

Portfolio

Beginning balance ...................... $52,476 $71,744 $124,220 $20,582 $144,802

Consolidations to third parties ......... (1,113) (518) (1,631) (8) (1,639)

Acquisitions and originations(1) ........ 25,677 1,150 26,827 4,343 31,170

Net acquisitions and originations ........... 24,564 632 25,196 4,335 29,531

Securitization-related(2) ................... 645 — 645 — 645

Sales ................................. (19,300) — (19,300) — (19,300)

Repayments/defaults/resales/other .......... (5,710) (3,997) (9,707) (2,164) (11,871)

Ending balance ......................... $52,675 $68,379 $121,054 $22,753 $143,807

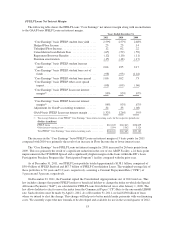

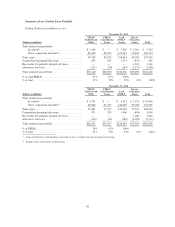

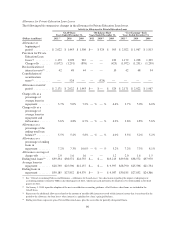

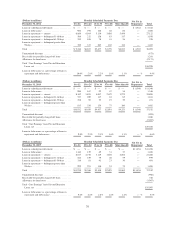

Off-Balance Sheet

Year Ended December 31, 2009

(Dollars in millions)

FFELP

Stafford and

Other

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total Off-

Balance Sheet

Portfolio

Beginning balance ...................... $ 7,143 $15,531 $ 22,674 $12,917 $ 35,591

Consolidations to third parties ......... (413) (138) (551) (18) (569)

Acquisitions and originations(1) ........ 135 208 343 498 841

Net acquisitions and originations ........... (278) 70 (208) 480 272

Securitization-related(2) ................... (645) — (645) — (645)

Repayments/defaults/resales/other .......... (720) (804) (1,524) (1,056) (2,580)

Ending balance ......................... $ 5,500 $14,797 $ 20,297 $12,341 $ 32,638

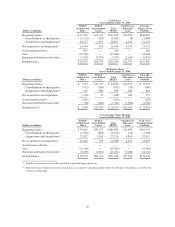

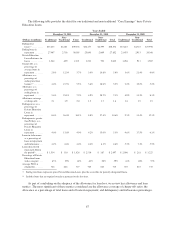

“Core Earnings” Basis Portfolio

Year Ended December 31, 2009

(Dollars in millions)

FFELP

Stafford and

Other

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total “Core

Earnings” Basis

Portfolio

Beginning balance ...................... $59,619 $87,275 $146,894 $33,499 $180,393

Consolidations to third parties ......... (1,526) (656) (2,182) (26) (2,208)

Acquisitions and originations(1) ........ 25,812 1,358 27,170 4,841 32,011

Net acquisitions and originations ........... 24,286 702 24,988 4,815 29,803

Securitization-related(2) ................... — — — — —

Sales ................................. (19,300) — (19,300) — (19,300)

Repayments/defaults/resales/other .......... (6,430) (4,801) (11,231) (3,220) (14,451)

Ending balance ......................... $58,175 $83,176 $141,351 $35,094 $176,445

(1) Includes accrued interest receivable capitalized to principal during the period.

(2) Represents loans within securitization trusts that we are required to consolidate under GAAP once the trusts’ loan balances are below the

clean-up call threshold.

62