Sallie Mae 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

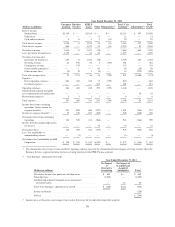

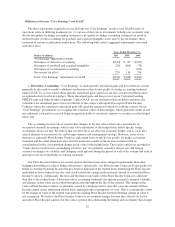

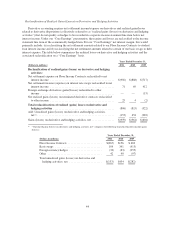

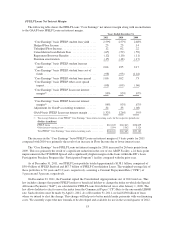

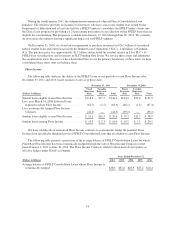

Reclassification of Realized Gains (Losses) on Derivative and Hedging Activities

Derivative accounting requires net settlement income/expense on derivatives and realized gains/losses

related to derivative dispositions (collectively referred to as “realized gains (losses) on derivative and hedging

activities”) that do not qualify as hedges to be recorded in a separate income statement line item below net

interest income. Under our “Core Earnings” presentation, these gains and losses are reclassified to the income

statement line item of the economically hedged item. For our “Core Earnings” net interest margin, this would

primarily include: (a) reclassifying the net settlement amounts related to our Floor Income Contracts to student

loan interest income and (b) reclassifying the net settlement amounts related to certain of our basis swaps to debt

interest expense. The table below summarizes the realized losses on derivative and hedging activities and the

associated reclassification on a “Core Earnings” basis.

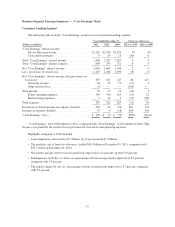

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

Reclassification of realized gains (losses) on derivative and hedging

activities:

Net settlement expense on Floor Income Contracts reclassified to net

interest income ............................................. $(902) $(888) $(717)

Net settlement income (expense) on interest rate swaps reclassified to net

interest income ............................................. 71 69 412

Foreign exchange derivatives gains/(losses) reclassified to other

income .................................................... — — (15)

Net realized gains (losses) on terminated derivative contracts reclassified

to other income ............................................. 25 4 (2)

Total reclassifications of realized (gains) losses on derivative and

hedging activities ........................................... (806) (815) (322)

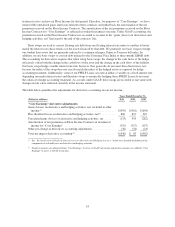

Add: Unrealized gains (losses) on derivative and hedging activities,

net(1) ...................................................... (153) 454 (282)

Gains (losses) on derivative and hedging activities, net ................ $(959) $(361) $(604)

(1) “Unrealized gains (losses) on derivative and hedging activities, net” comprises the following unrealized mark-to-market gains

(losses):

Years Ended December 31,

(Dollars in millions) 2011 2010 2009

Floor Income Contracts ........................ $(267) $156 $ 483

Basis swaps ................................. 104 341 (413)

Foreign currency hedges ....................... (32) (83) (255)

Other ...................................... 42 40 (97)

Total unrealized gains (losses) on derivative and

hedging activities, net ....................... $(153) $454 $(282)

44