Sallie Mae 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Significant Accounting Policies (Continued)

January 1, 2010. The historical cost basis is the basis that would exist if these securitization trusts had remained

on-balance sheet since they settled. The new guidance did not change the accounting of any other VIEs in which

we had a variable interest as of January 1, 2010.

After the adoption of the new accounting guidance, our results of operations no longer reflect securitization,

servicing and Residual Interest revenue related to these securitization trusts, but instead report interest income,

provisions for loan losses associated with the securitized assets and interest expense associated with the debt

issued from the securitization trusts to third parties, consistent with our accounting treatment of prior on-balance

sheet securitization trusts.

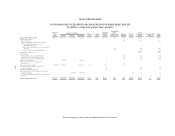

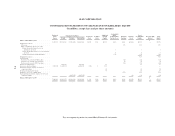

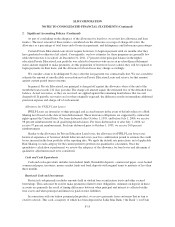

The following table summarizes the change in the consolidated balance sheet resulting from the

consolidation of the off-balance sheet securitization trusts upon the adoption of the new consolidation accounting

guidance.

(Dollars in millions)

At January 1,

2010

FFELP Stafford Loans (net of allowance of $15) ............................... $ 5,500

FFELP Consolidation Loans (net of allowance of $10) ........................... 14,797

Private Education Loans (net of allowance of $524) ............................. 12,341

Total student loans ..................................................... 32,638

Restricted cash and investments ............................................. 1,041

Other assets ............................................................. 1,370

Total assets consolidated ................................................ 35,049

Long-term borrowings .................................................... 34,403

Other liabilities .......................................................... 6

Total liabilities consolidated ............................................. 34,409

Net assets consolidated on balance sheet ...................................... 640

Less: Residual Interest removed from balance sheet ............................. 1,828

Cumulative effect of accounting change before taxes ............................ (1,188)

Tax effect .............................................................. 434

Cumulative effect of accounting change after taxes recorded to retained earnings ...... $ (754)

Fair Value Measurement

We use estimates of fair value in applying various accounting standards for our financial statements. Fair

value measurements are used in one of four ways:

• In the consolidated balance sheet with changes in fair value recorded in the consolidated statement of

income;

• In the consolidated balance sheet with changes in fair value recorded in the accumulated other

comprehensive income section of the consolidated statement of changes in stockholders’ equity;

• In the consolidated balance sheet for instruments carried at lower of cost or fair value with impairment

charges recorded in the consolidated statement of income; and

• In the notes to the financial statements.

F-10