Sallie Mae 2011 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

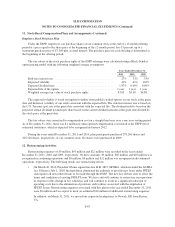

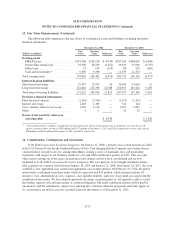

14. Commitments, Contingencies and Guarantees (Continued)

In view of the inherent difficulty of predicting the outcome of such litigation and regulatory matters, we

cannot predict what the eventual outcome of the pending matters will be, what the timing or the ultimate

resolution of these matters will be, or what the eventual loss, fines or penalties related to each pending matter

may be.

We are required to establish reserves for litigation and regulatory matters where those matters present loss

contingencies that are both probable and estimable. When loss contingencies are not both probable and

estimable, we do not establish reserves.

Based on current knowledge, reserves have been established for certain litigation or regulatory matters

where the loss is both probable and estimable. Based on current knowledge, management does not believe that

loss contingencies, if any, arising from pending investigations, litigation or regulatory matters will have a

material adverse effect on our consolidated financial position, liquidity, results of operations or cash flows.

We maintain forward contracts to purchase loans from our lending partners at contractual prices. These

contracts typically have a maximum amount we are committed to buy, but lack a fixed or determinable amount

as it ultimately is based on the lending partner’s origination activity. At December 31, 2011, there were $17

million of originated loans (Private Education Loans) in the pipeline that we are committed to purchase.

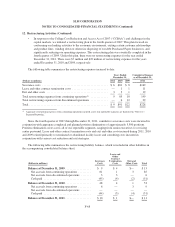

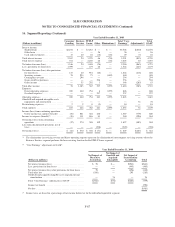

15. Income Taxes

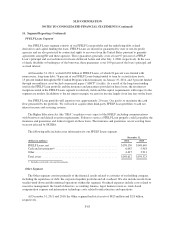

Reconciliations of the statutory U.S. federal income tax rates to our effective tax rate for continuing

operations follow:

Years Ended December 31,

2011 2010 2009

Statutory rate ................................................... 35.0% 35.0% 35.0%

State tax, net of federal benefit ..................................... .8 1.2 (1.3)

Non-deductible goodwill .......................................... — 9.2 —

Other, net ...................................................... (.5) (.2) (1.0)

Effective tax rate ................................................ 35.3% 45.2% 32.7%

The effective tax rates for discontinued operations for the years ended December 31, 2011, 2010 and 2009

are 38.0 percent, 26.7 percent, and 27.9 percent, respectively. The effective tax rate varies from the statutory U.S.

federal rate of 35 percent primarily due to the establishment of valuation allowances against capital loss

carryforwards for the years ended December 31, 2010 and 2009, and due to the impact of state taxes, net of

federal benefit, for the years ended December 31, 2011, 2010 and 2009.

F-77