Sallie Mae 2011 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2011 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

17. Discontinued Operations

Our Purchased Paper businesses are presented in discontinued operations for the current and prior periods.

In the fourth quarter of 2009, we sold our Purchased Paper — Mortgage/Properties business for $280 million

which resulted in an after-tax loss of $95 million. As a result of this sale, the results of operations of this business

were required to be presented in discontinued operations beginning in the fourth quarter of 2009.

In the fourth quarter of 2010, we began actively marketing for sale our Purchased Paper — Non-Mortgage

business and concluded it was probable this business would be sold within one year at which time we would exit

the business. The Purchased Paper — Non-Mortgage business comprises operations and cash flows that can be

clearly distinguished operationally and for financial reporting purposes from the rest of the Company. As a result,

we have classified the business as held-for-sale, and, as such, the results of operations of this business were

required to be presented in discontinued operations beginning in the fourth quarter of 2010. In connection with

this classification, we were required to carry this business at the lower of fair value or historical cost basis. This

resulted in us recording an after-tax loss of $52 million from discontinued operations in the fourth quarter of

2010, primarily due to adjusting the value of this business to its estimated fair value. We sold the Purchased

Paper — Non-Mortgage business in the third quarter of 2011 which resulted in a $23 million after-tax gain.

The Purchased Paper — Mortgage/Properties business and the Purchased Paper — Non-Mortgage business

comprise operations and cash flows that can be clearly distinguished operationally and for financial reporting

purposes, from the rest of the Company. Accordingly, this Component is presented as discontinued operations as

(1) the operations and cash flows of the Component have been eliminated from our ongoing operations as of

December 31, 2010, and (2) we will have no continuing involvement in the operations of this Component

subsequent to the sale of the Purchased Paper-Non Mortgage business.

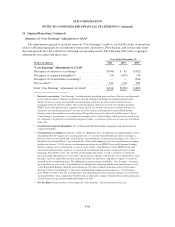

The following table summarizes the discontinued assets and liabilities at December 31, 2011 and 2010.

At December 31,

(Dollars in millions) 2011 2010

Assets:

Cash and equivalents .................................................... $ 3 $ 4

Other assets ........................................................... 14 177

Assets of discontinued operations .......................................... $17 $181

Liabilities:

Liabilities of discontinued operations ....................................... $ 7 $ 6

At December 31, 2011, other assets of our discontinued operations consist primarily of restricted cash and a

deferred tax asset for wind down accruals. Liabilities of our discontinued operations consist primarily of sale

related liabilities and restructuring liabilities related to severance and contract termination costs.

At December 31, 2010, other assets of our discontinued operations consist primarily of the Purchased

Paper — Non-Mortgage loan portfolio and a deferred tax asset for intangibles that will be realized when the tax

loss for the sale of our Purchased Paper — Non-Mortgage business is utilized on our consolidated income tax

return. Liabilities of our discontinued operations consist primarily of restructuring liabilities related to severance

and contract termination costs.

F-89